Lisa Maree Williams/Getty Photographs Leisure

I reiterated my Purchase ranking on EPR Properties (NYSE:EPR) in November 2022, even because the macroeconomic situations have been extremely unsure again then. Bloomberg Economics even issued a “doom-and-gloom” name, highlighting that its “newest recession chance fashions forecast the next recession chance throughout all timeframes.” Notably, it harassed the “12-month estimate of a downturn by October 2023 hitting 100%.”

By the way, Bloomberg’s name was issued in mid-October 2022, simply because the S&P 500 (SPX) (SPY) shaped its backside, probably beautiful bearish buyers who shorted these lows into submission.

As such, I imagine it is essential for buyers to be cautious about over-relying on macroeconomic forecasts for his or her inventory evaluation. And if somebody’s mannequin tells you there’s a 100% likelihood of a recession, you have to assume much more fastidiously. 9 months after Bloomberg’s bearish prognostication, we’re wanting more and more probably towards a comfortable touchdown than a tough one.

As a reminder, Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett highlighted beforehand that he does not “pay any consideration to what economists say, frankly.” Oaktree Capital Administration Co-Chairman Howard Marks additionally articulated: “My readers know I don’t assume constantly worthwhile market calls will be manufactured out of macroeconomic forecasts.”

Based mostly on how EPR and SPX have recovered from their late 2022 lows, I imagine Buffett and Marks have made their level succinctly.

Notably, EPR has even outperformed SPX (in complete return phrases) since my final replace in November 2022. Accordingly, EPR delivered a complete return of 23%, beating S&P 500’s 18.4%. CEO Greg Silvers articulated in a June convention that, regardless of EPR “being the most effective performing triple web REIT of the 12 months,” it was nonetheless buying and selling at a “important low cost to [its average] valuation.”

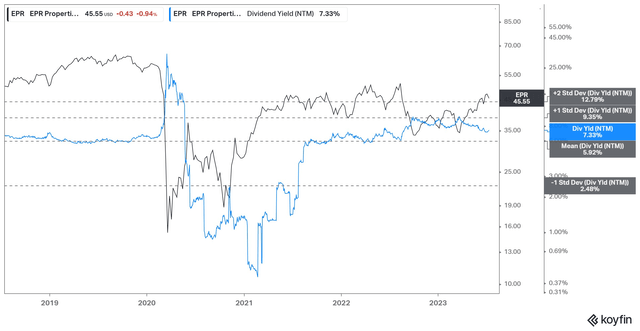

EPR ahead dividend yields development (koyfin)

Accordingly, EPR final traded at a ahead dividend yield of seven.33%, markedly above its 10Y common of 6.07%. As well as, its AFFO per share a number of of 9.19x can also be properly under its 10Y common of 12.93x.

Due to this fact, regardless of the outperformance since my earlier replace, EPR’s valuation does not appear aggressive. Nevertheless, they’re additionally not as engaging in comparison with the degrees in late 2022.

Furthermore, administration emphasised that its experiential properties are well-configured to navigate a recession or arduous touchdown. Due to this fact, if we transfer away from a tough landing-esque market state of affairs, EPR’s working efficiency needs to be higher ready than its non-experiential friends to recuperate additional.

The corporate’s latest restructuring of its lease settlement with Regal Cinemas ought to present some respite into its outlook. Accordingly, EPR’s “new grasp lease will cowl 41 out of the 57 properties presently leased to Regal Cinemas.” The corporate may also function 5 out of the 16 theaters beforehand leased to Regal, with 11 earmarked to be offered. The corporate intends to recycle the capital from the asset gross sales into non-cinema properties.

The corporate expects to recuperate almost “96% of the combination pre-bankruptcy Regal hire for the 57 properties.” Furthermore, with the anticipated asset gross sales in its modeling, the corporate expects to realize “100% or higher hire protection,” assuring buyers that the restructuring is probably going accretive and gives visibility to its earnings profile.

Importantly, EPR embedded a proportion hire element into its grasp lease with Regal, permitting “EPR Properties to take part extra totally within the restoration of the theatrical exhibition trade, with important upside potential.”

As such, I assessed that buyers are anticipated to maneuver on from the Regal headwinds. However, primarily based on EPR’s exceptional restoration from its 2022 lows, they’ve probably anticipated a constructive end result from certainly one of EPR’s main cinema operators.

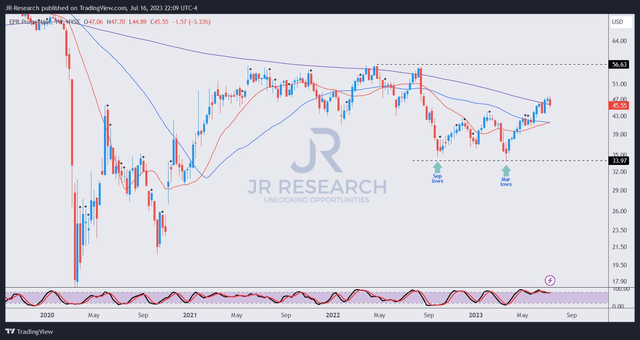

EPR value chart (weekly) (TradingView)

As seen above, EPR was robustly supported alongside the $34 ranges as dip patrons purchased aggressively into its steep selloff in September 2022 and March 2023. With EPR breaking above the $44 resistance zone decisively, EPR’s momentum has returned to patrons.

Furthermore, with EPR staying above its 50-week transferring common (blue line) over the previous two months, it seems to be near recovering its upward bias. The improved shopping for sentiments might additionally spur elevated upside potential from momentum buyers wanting so as to add additional to an actual property inventory main the sector restoration from its malaise.

With EPR’s valuation nonetheless favorable, I assessed the danger/reward profile stays constructive. Revenue buyers ought to proceed to help its comparatively engaging ahead dividend yield, which is predicted to be properly lined (estimated 66% payout ratio) by its FY23 estimated AFFO per share of $5.03.

Score: Keep Purchase.

Necessary observe: Buyers are reminded to do their very own due diligence and never depend on the knowledge supplied as monetary recommendation. The ranking can also be not supposed to time a particular entry/exit on the level of writing until in any other case specified.

We Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a essential hole in our view? Noticed one thing essential that we didn’t? Agree or disagree? Remark under with the intention of serving to everybody in the neighborhood to study higher!