shih-wei

Buyers closely uncovered to equities will just like the cooler June 2023 shopper worth index (“CPI”) report. Buyers on the sideline holding trillions of {dollars} in cash market funds will worry lacking additional beneficial properties. Bearish buyers will grumble in regards to the slowing inflation, ready for markets to show.

Which group is correct? Inventory markets are proverbially a voting machine within the quick time period. Merchants are inventory voters who will parse each knowledge level from the CPI report. In the long term, markets are weighing machines. The latter group will deal with the report as one knowledge level amongst many knowledge factors.

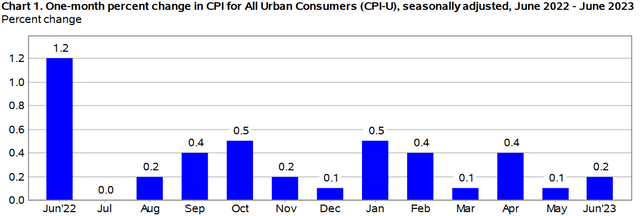

June 2023 CPI Rises By Simply 0.2%

In June, the shopper worth index rose by 0.2% and by 3.0% over the past 12 months. Shelter, which notably has an impression on most, accounted for 70% of the rise. The index for meals at dwelling didn’t change within the month. Because of this, readers could watch these meals shares. As well as, meals costs elevated by 0.1% in June and are up 5.7% within the final 12 months.

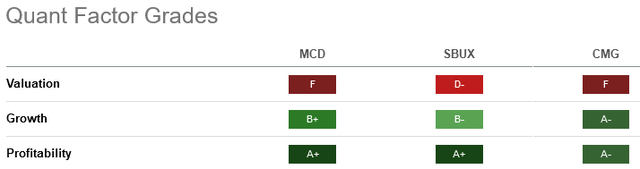

Meals away from dwelling elevated by 0.4% and by 7.7% within the 12-month interval, albeit not seasonally adjusted. Per Wikipedia, FAFH covers meals and snacks equipped by business meals service institutions and by consuming services in non-commercial establishments. Readers wouldn’t have actionable investments from the FAFH knowledge. For instance, Chipotle Mexican Grill (CMG) is buying and selling in a holding sample between $2,034 to $2,100. McDonald’s (MCD) shares are on the verge of breaking out. Starbucks (SBUX) is deservedly off its $115.48 excessive. SBUX inventory scores a D- on valuation, as proven beneath.

seekingalpha premium

The three restaurant shares commerce at a premium since they’ve robust profitability of A+ and nice development grades.

Vitality

The CPI report didn’t profit from falling power costs in comparison with the Could report. The power index gained 0.6% in June, in comparison with -3.6% in Could. Deal with the power inflation pattern as a lagging indicator. OPEC+ aggressively lower output. Within the subsequent six months, crude oil costs will strengthen. Yesterday, power topped the S&P sector leaderboard by gaining 2.2%. The U.S. Vitality Data Administration (“EIA”) expects world oil markets will tighten this 12 months. This would possibly strain future CPI at persistently excessive ranges. It will validate expectations of the Fed elevating rates of interest this month and once more someday in H2/2023.

Merchants could infer that after the inventory market’s 1.0% rally, fee tightening may have little to no impression. Even a particular rebalancing of the Nasdaq 100 amid Magnificent Seven domination ought to harm neither these shares nor the index. The Magnificent Seven are Amazon (AMZN), Apple (AAPL), Netflix (NFLX), Microsoft (MSFT), Alphabet (GOOG), Nvidia (NVDA), and Meta Platforms (META).

These corporations earned their weighting. For instance, Meta is encroaching on Twitter with Threads. Netflix cracked down on password sharing and raised subscription charges. It efficiently protected its moat. Regardless of disturbingly weak graphics card gross sales within the PC market, Nvidia will depend on surging H100 gross sales for the AI market this quarter.

The potential power inflation after the provision lower in H2 could not trigger markets to reverse their bullish sentiment. The power index fell by 16.7% previously 12 months. WTI crude costs would want to commerce effectively previous $100 per barrel within the close to time period to fret buyers, if in any respect.

Cumulative Inflation Concerns

Buyers ought to examine the June CPI to final 12 months’s inflation improve. In 2022, the CPI of 1.2% shook inventory market confidence.

bls.gov

Markets are ignoring the impression of the 2021-2023 or two-year inflation fee. Actual earnings worsens with persistent inflation. Administration points apart, firms like CVS Well being (CVS), Advance Auto Elements (AAP), Walgreens (WBA), and Greenback Normal (DG) are grappling with shrinkage (together with theft charges) and weaker demand. Conversely, buyers anticipate Costco (COST), Walmart (WMT), and Amazon to navigate decrease gross sales with none main points.

Different Dangers

The three.0% inflation is above the two.0% goal fee. It will justify the Fed elevating rates of interest at its subsequent coverage assembly. The upper for longer charges, nonetheless, introduce rising dangers for the credit score market. Look out for weak business actual property markets hurting regional banks and large banks. JPMorgan Chase (JPM) could provide perception about CRE markets when it studies outcomes on Friday.

Within the automotive sector, tighter credit score necessities are hurting used automobile and truck demand and their costs. The credit score crunch would possibly result in a rise in auto repossession charges.

Your Takeaway

Presently buying and selling at practically double the relative quantity, the S&P 500 could proceed its climb towards 4,500. Totally invested readers have few causes to take earnings. Impartial buyers gathering curiosity earnings haven’t any incentive to chase the 2023 index rally. Bears who’re hurting essentially the most could watch for the following credit score disaster to unfold. The Fed’s larger rates of interest ought to push CPI decrease. This provides dangers to sectors depending on lending and leverage.