Mongkol Onnuan

Incomes dividends is nice! Incomes dividends EVERY month hits a bit in a different way.

You are able to do this a number of alternative ways:

You should buy ETFs that pay a month-to-month dividend like (JEPI) or (JEPQ) You should buy a month-to-month paying dividend inventory like (O) or (STAG) Or you possibly can stagger quarterly paying dividend shares that pay their dividends on completely different months from the opposite

For instance, you possibly can have Inventory A pay you in January, Inventory B pay in February, and Inventory C pay you in March earlier than restarting the method once more. Three completely different shares, dividend revenue EVERY month.

That’s precisely what we’re going to take a look at immediately, three high-quality blue-chip dividend shares which might be buying and selling at intriguing valuations and would have you ever incomes a dividend paycheck EVERY month.

3 Dividend Shares To Earn A Dividend EVERY Month

Dividend Inventory #1 – JPMorgan Chase (JPM)

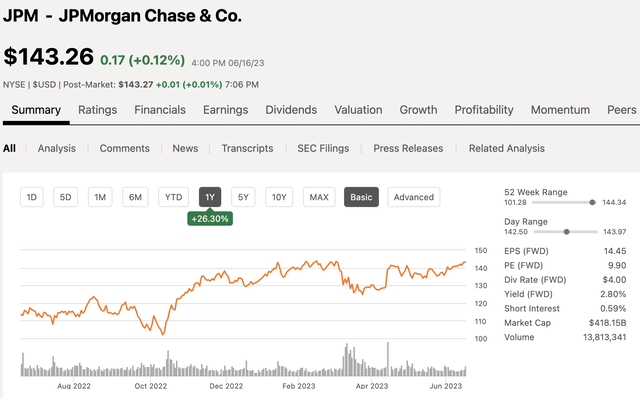

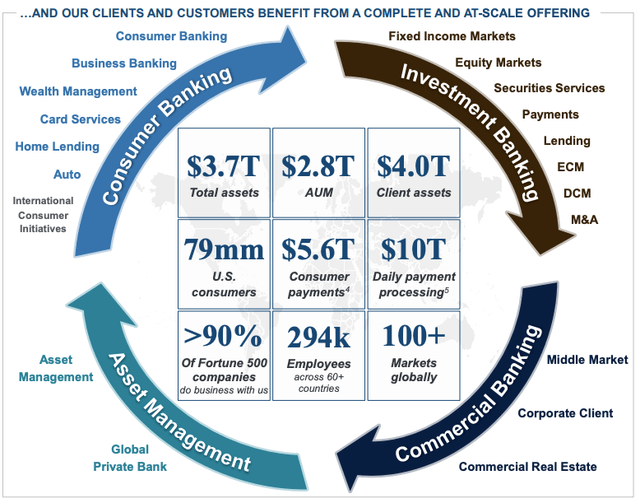

JPMorgan chase is the biggest US financial institution, having $3.7 Trillion in whole belongings. The corporate at the moment has a market cap of $418 billion and over the previous yr, shares of JPM have climbed 26%, as soon as once more buying and selling at ranges final seen previous to the mini banking disaster we went by.

Looking for Alpha

JPM shouldn’t be solely the biggest US financial institution, however they’ve additionally been top-of-the-line performing banks over the previous 12 months, up 22% over that interval. There was a variety of turmoil within the banking sector, particularly the regional banking sector, in 2023 as now we have now seen three financial institution failures of some fairly substantial regional banks.

A type of banks that went underneath was First Republic, to which JPM scooped up their belongings for a really favorable quantity, reserving a $2.6 billion one-time acquire from the transaction.

The financial institution operates inside 4 main segments:

Client Banking Funding Banking Industrial Banking Asset Administration

JPM Investor Presentation

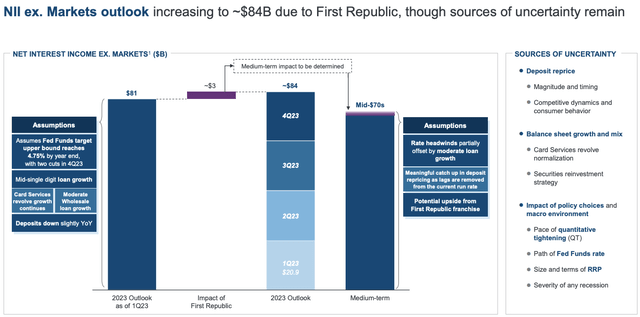

Though the rise in rates of interest over the previous 12+ months has put a pressure on some areas of the economic system, what it does for banks is enhance what’s name NII or Web Curiosity Earnings.

NII is actually the distinction between the curiosity the financial institution EARNS from loans and what they pay in curiosity for one thing like a financial savings account. The mortgage charges have elevated far sooner than the financial savings account charges.

JPM is searching for NII of $81 billion in 2023, which was earlier than the First Republic acquisition, which is meant to be accretive by $3 billion in the course of the yr.

JPM Investor Presentation

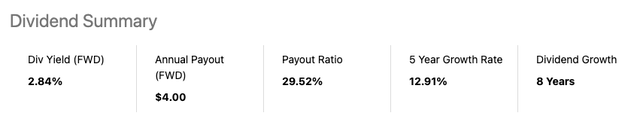

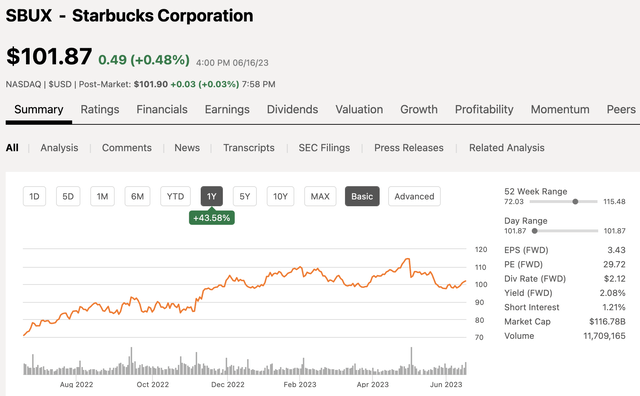

When it comes to the dividend, JPM pays an annual dividend of $4 per share, which equates to a dividend yield of two.8%. The financial institution has a low payout ratio barely beneath 30% and over the previous 5 years, traders have loved an annual dividend progress price close to 13%, making them additionally a dividend progress inventory.

Looking for Alpha

As you possibly can see on this chart, JPM pays out their dividend on a quarterly foundation each January, April, July and October.

Looking for Alpha

Now let’s take a look at valuation to see if the inventory is worthy of a purchase, in any case, we by no means need to make investments primarily based on yield alone and positively not primarily based on the month they pay a dividend.

Quick Graphs

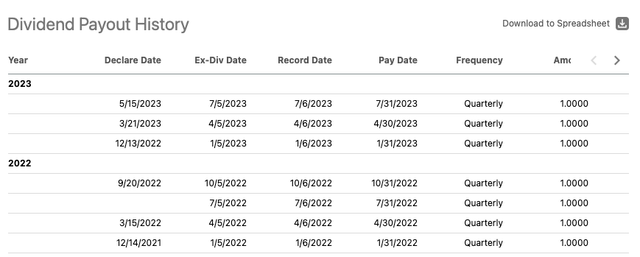

JPM is anticipated to generate EPS of $14.50 in 2023, which equates to an earnings a number of of solely 9.8x, which is sort of low for a inventory that has traded at a mean a number of of 11.7x over the previous 5 years and 12.4x over the previous decade.

Dividend Inventory #2 – Starbucks Company (SBUX)

Starbucks has constructed an especially sturdy model through the years, increasing from only a espresso store to extra of a standing image, it feels as of late. Carrying round that SBUX cup simply makes some folks really feel good. The corporate has constructed a really sturdy and dependable buyer base, on par with the likes of Apple (AAPL).

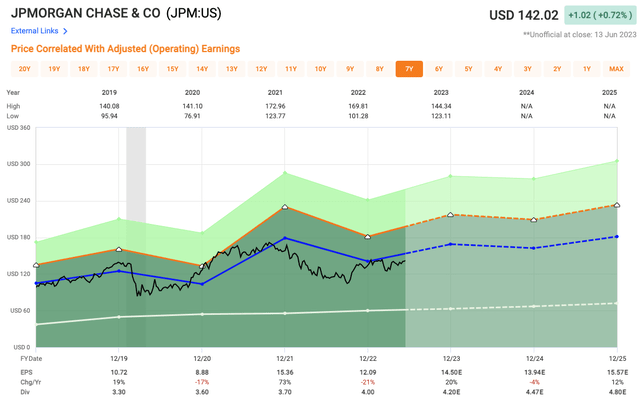

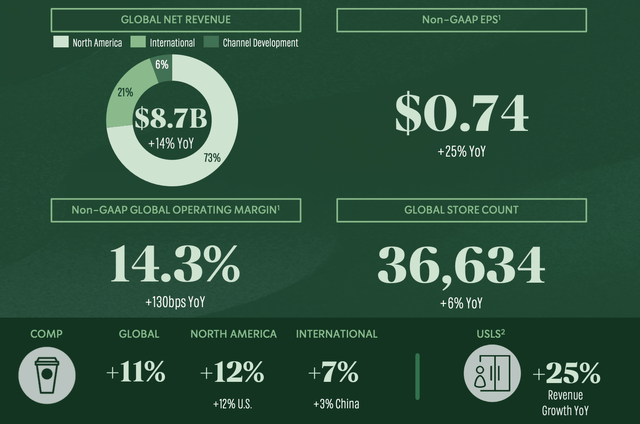

SBUX at the moment has a Market cap of $117 Billion and over the previous 12 months, shares are up over 40%. Nonetheless, in 2023, shares have stalled out as they’re roughly flat to date on the yr after falling 7% prior to now month.

Looking for Alpha

Why are the shares underneath stress of late, you may ask?

The US is the corporate’s largest area, however that’s adopted by China, which is a area the corporate could be very centered on rising the following few years.

In Q2, the corporate not too long ago reported US similar retailer gross sales progress comps of 12%, however China solely grew by 3%. Because the starting of the yr, China did away with their pandemic restrictions, which many had hoped would drive the inventory increased on account of increased anticipated financial progress within the area. That has did not take form throughout quite a few sectors within the area, which resulted in a mini sell-off in corporations linked to the area.

SBUX Investor

The inventory worth baked a variety of this progress in because the share worth climbed to $115 after sitting round $70 in June of final yr.

As soon as the corporate reported their Q2 earnings, which confirmed slower than anticipated progress in China and different corporations and financial information additionally confirmed slower than anticipated progress, the share worth plummeted and now sits round $100.

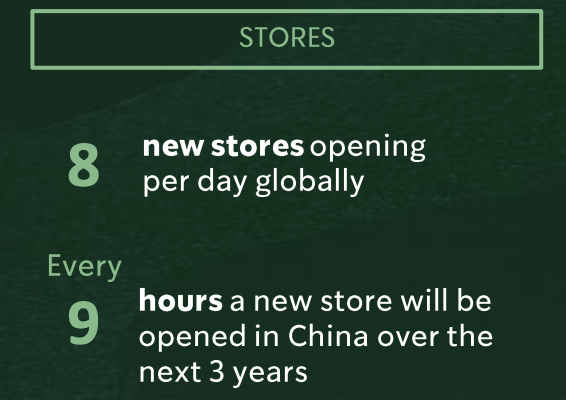

The corporate is so centered on China progress that they’ve dedicated to opening a brand new retailer each 9 hours within the area, over the course of the following three years.

SBUX Investor

SBUX has lengthy been an organization identified for producing giant quantities of free money stream, which has helped them enhance their dividend through the years at a quick tempo.

Shares of SBUX at the moment yield a dividend of two.15% with a 5yr DGR of 12.5%, which is slower than in years previous as they’ve handled some slower progress years after the pandemic hit. Administration has elevated the dividend for 12 consecutive years.

Looking for Alpha

Starbucks pays their dividend on a quarterly foundation in the course of the months of February, Might, August, and November.

So JPM paid us a dividend in January, and now Starbucks paid us a dividend in February, now we have acquired dividend funds each months from completely different corporations.

Now for valuation, are SBUX shares a purchase, promote or Maintain?

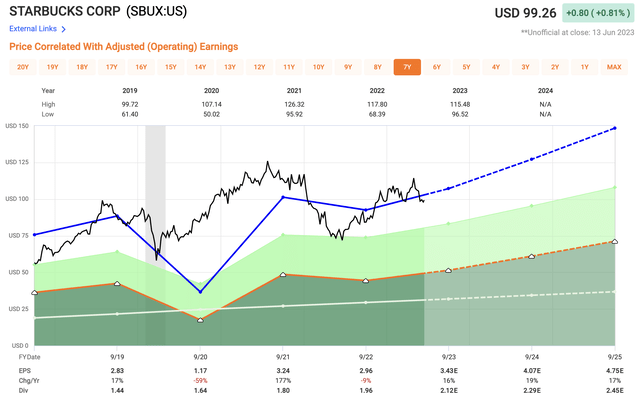

Analysts are searching for FY23 EPS of $3.43 per share, which equates to an earnings a number of of 28.9x. Over the previous 5 years, SBUX shares have traded at an avg of 31x and 30x over the previous decade.

Quick Graphs

Development is anticipated to return to the corporate with 16% progress anticipated in FY 2023 adopted by 19% progress in FY 2024 and 17% in FY 2025.

In the present day’s valuation does look intriguing, however with the expansion anticipated the next years, the valuation appears even cheaper

Dividend Inventory #3 – Pfizer (PFE)

Pfizer is an organization that has been talked about lots over the previous three years as they had been on the forefront of the pandemic primarily based on their developed vaccine.

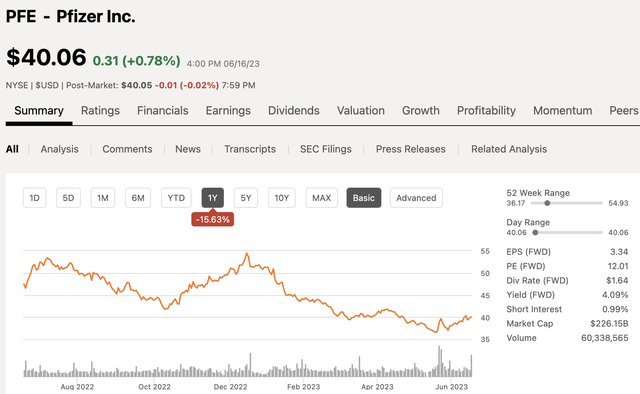

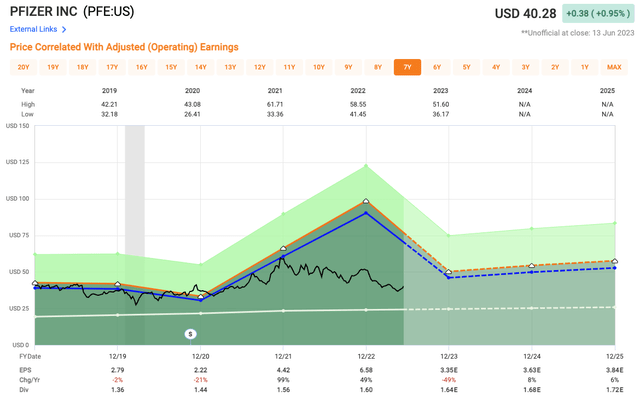

Pfizer has a market cap of $226 Billion and over the previous 12-months, shares of PFE have fallen greater than 15%, with all of that coming in 2023. YTD the inventory has been underneath intense stress, falling greater than 20%.

Looking for Alpha

One motive for the decline has been the decline in gross sales and internet earnings the corporate has seen of late, which primarily has been associated to slowing pandemic associated revenues, which is to be anticipated.

As well as, the corporate is going through a patent cliff for a lot of of its prime pharmaceutical merchandise, one thing similar to what AbbVie (ABBV) goes by and plenty of throughout the pharmaceutical house.

Though the pandemic revenues are down, the corporate does count on these to rebound in 2025 when they’re anticipated to roll out a combo vaccine for the Flu and COVID.

Nonetheless, the corporate additionally has a pipeline of latest merchandise which might be set to roll out in 2024 that can assist offset the loss in income. A type of new medication that’s rolling out is targeted on RSV, which has been a sizzling matter throughout the media. The corporate not too long ago acquired FDA approval for older adults.

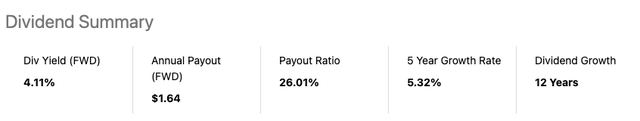

Regardless, the corporate continues to generate sturdy quantities of FCF to completely help their dividend. Pfizer’s dividend yield is the best dividend on immediately’s checklist as Pfizer has a dividend yield of 4.1% proper now with a low payout ratio beneath 30%. The five-year dividend progress price is 5.3% and the corporate has elevated the dividend for 12 consecutive years.

Looking for Alpha

Pfizer pays out their quarterly dividend within the months of March, June September and December.

So now we obtain dividend revenue as follows:

January – Dividend from JPM February – Dividend from SBUX March – Dividend from PFE April – Dividend from JPM Might – Dividend from SBUX June – Dividend from PFE July – Dividend from JPM August – Dividend from SBUX September – Dividend from PFE October – Dividend from JPM November – Dividend from SBUX December – Dividend from PFE

When it comes to valuation, analysts are searching for Pfizer to generate 2023 EPS of $3.35, half of what they did final yr largely because of the lack of the pandemic associated revenues, which equates to a 2023 earnings a number of of 12x. Over the previous 5 years, shares have traded at an avg a number of of 13.7x, which is in keeping with the place the inventory has traded over the previous decade as nicely.

Quick Graphs

Investor Takeaway

Incomes month-to-month dividends is nice, each for retired dwelling, or it lets you put the cash again to work regularly. Nonetheless, a inventory shouldn’t be purchased primarily based on the month they pay a dividend or primarily based on the dividend yield.

All three of those dividend shares are high-quality and buying and selling at affordable valuations to have in your watchlist.

Within the COMMENT part, let me know when you earn dividends each month.

Disclosure: This text is meant to supply data to events. I’ve no data of your particular person targets as an investor, and I ask that you simply full your individual due diligence earlier than buying any shares talked about or beneficial.