zhaojiankang/iStock through Getty Photographs

After a data-filled week (US CPI, FOMC), we will now take inventory on the technical image of the markets. Total, regardless of trying just a little prolonged, the uptrends in a number of sectors proceed to look wholesome.

Rising markets and commodities organising for transfer larger

I’m intrigued by the energy in rising markets (together with China) and commodities. The USD concluded the week on a weak word; that is key because the USD traditionally has had a unfavorable correlation towards rising markets and commodities (weaker USD = stronger EM, stronger commodities).

From the day by day chart of the Greenback Index beneath, we will see that the USD is now buying and selling beneath its key transferring averages (10, 20, 50, 200 day). It seems heading in the right direction to check the 100–101 helps, and if these break, the USD might start its subsequent leg decrease.

Every day Chart: Greenback Index

Tradingview

Threat-on currencies are additionally trying constructive towards the USD, which offer a wholesome backdrop for rising markets and commodities to advance. Right here is the Australian Greenback, which has damaged out larger from a multi-month base towards the USD. The Australian Greenback has constructive correlations with copper costs, iron ore costs, and China shares.

Every day Chart: AUD/USD

Tradingview

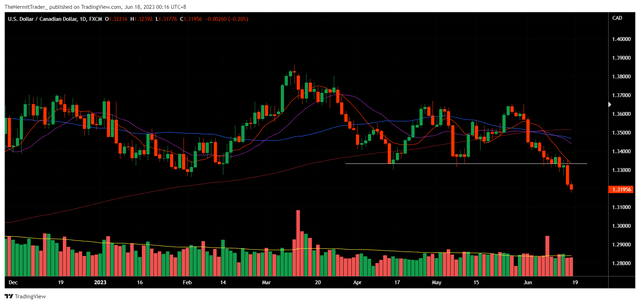

The Canadian Greenback, which has a excessive constructive correlation with oil costs, provided that Canada is a big oil exporter, has damaged out towards the USD.

Every day Chart: USD/CAD

Tradingview

Throughout the commodity fairness house, I’m watching copper miners (COPX) carefully. I believe copper miners look higher than their commodity friends – metal miners (SLX), in addition to oil & gasoline shares (XOP) (XLE) (XOP) (OIH) (FCG). I like that copper miners have been constructing a base for two years, and value has risen above the important thing weekly transferring averages.

Weekly Chart: COPX

Tradingview

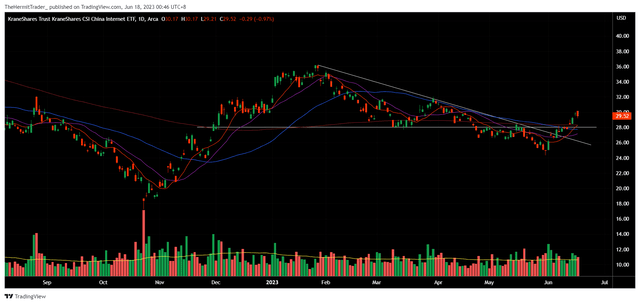

China expertise (KWEB) has damaged out above downtrend resistance that has contained costs since January. I’m watching to see how the sector holds up throughout its subsequent pullback.

Every day Chart: KWEB

Tradingview

Pinduoduo (PDD) is without doubt one of the shares I maintain on this house. The inventory broke out larger from a mini base after beating earnings. I went lengthy at 76.91 (inexperienced line), with a cease at 70.90 (pink line), and have since trimmed a 3rd of my place.

Every day Chart: PDD

Tradingview

Right here is NetEase (NTES), one other chief inside the China expertise sector. The inventory has damaged out larger from a multi-month base.

Every day Chart: NTES

Tradingview

Li Auto (LI) shouldn’t be a expertise inventory, however is one other chief inside the China house. It broke out from a multi-month base after its current earnings beat again in Might. Since then, the inventory has been trending larger, and has benefited from one other catalyst this week, which confirmed new highs on its weekly gross sales numbers. I went lengthy at 29.41 (inexperienced line), and have since moved my cease to breakeven. I’ve decreased my place by 1 / 4.

Every day Chart: LI

Tradingview

Vipshop (VIPS) is one other chief inside the China expertise house. Discover how the inventory was going sideways when the sector was promoting off, after which breaking out larger from this vary forward of its friends. I took a protracted place at 17.99 (inexperienced line), after Powell’s speech this week.

Every day Chart: VIPS

Tradingview

Away from China, different rising markets are additionally seeing robust momentum. Argentina (ARGT) (shock, shock…) has been a powerful outperformer this yr, and not too long ago broke out from a big base.

Every day Chart: ARGT

Tradingview

Latin America (ILF) has damaged out from a big multi-month base.

Every day Chart: ILF

Tradingview

Total, this week’s huge financial occasions have led to a pullback within the USD, which is now weak to a different 1.5% drop earlier than it meets with helps.

Whereas the market’s consideration has been on the resurgence in AI, semiconductor, and expertise shares, the current weakening within the USD has coincided with energy in commodity and rising market shares. Arguably, this has gone beneath the radar.

Commodity shares have gone sideways for months, and China shares are on the cusp of popping out from one in every of its most painful bear markets. I imagine that if the USD breaks beneath its helps, it could pave the best way for its subsequent leg decrease. Concurrently, commodity and rising markets might transition into highly effective uptrends.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.