Up to date on February twenty third, 2023 by Nikolaos Sismanis

To put money into nice companies, it’s a must to discover them first. That’s the place Warren Buffett is available in…

Berkshire Hathaway (BRK.B) has an fairness funding portfolio value greater than $300 billion, as of the top of the 2022 second quarter.

Berkshire Hathaway’s portfolio is full of high quality shares. You may ‘cheat’ from Warren Buffett shares to seek out picks on your portfolio. That’s as a result of Buffett (and different institutional traders) are required to periodically present their holdings in a 13F Submitting.

You may see all of Warren Buffett’s inventory holdings (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Notes: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

This text analyzes Warren Buffett’s prime 20 shares primarily based on data disclosed in his This fall 2022 13F submitting.

Desk of Contents

You may skip to a particular part with the desk of contents beneath. Shares are listed by share of the overall portfolio, from highest to lowest.

How To Use Warren Buffett Shares To Discover Funding Concepts

Having a database of Warren Buffett shares is extra highly effective when you’ve got the power to filter it primarily based on necessary investing metrics.

That’s why this text’s Excel obtain is so helpful…

It means that you can search Warren Buffett shares to seek out dividend funding concepts that match your particular portfolio.

For these of you unfamiliar with Excel, this part will present you how you can filter Warren Buffett shares for 2 necessary investing metrics – price-to-earnings ratio and dividend yield.

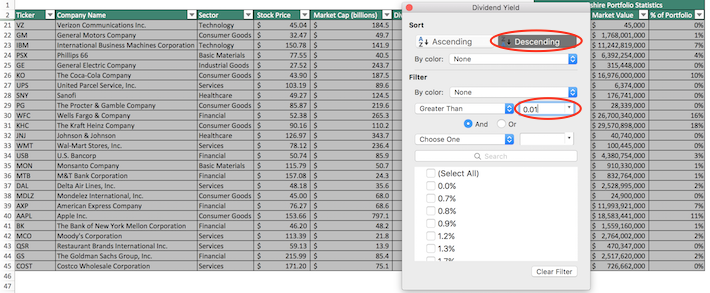

Step 1: Click on on the filter icon within the column for dividend yield or price-to-earnings ratio.

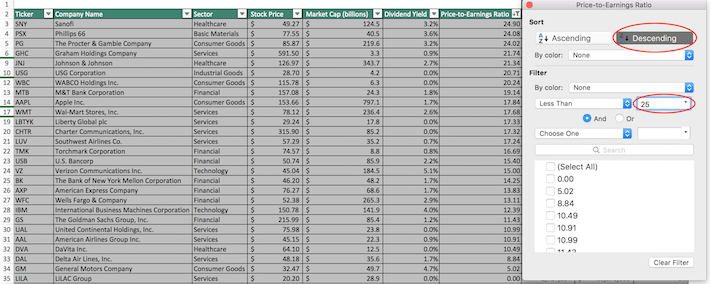

Step 2: Filter every metric to seek out high-quality shares. Two examples are offered beneath.

Instance 1: To search out shares with dividend yields above 1% and checklist them in descending order, click on the ‘Dividend Yield’ filter and do the next:

Instance 2: To search out shares with price-to-earnings ratios beneath 25 and checklist them in descending order, click on the ‘Value-to-Earnings Ratio’ filter and do the next:

Warren Buffett & Dividend Shares

Buffett has grown his wealth by investing in and buying companies with sturdy aggressive benefits buying and selling at truthful or higher costs.

Most traders know Warren Buffett appears to be like for high quality, however few know the diploma to which he invests in dividend shares:

Over half of Warren Buffett’s prime 10 shares pay dividends

His prime 5 holdings have a mean dividend yield of two.2% (and make up 77% of his portfolio)

A lot of his dividend shares have paid rising dividends over a long time

Warren Buffett prefers to put money into shareholder-friendly companies with lengthy observe data of success.

Maintain studying this text to see Warren Buffett’s 20 highest conviction inventory alternatives analyzed. These are the 20 shares with the best worth (most weight) in Berkshire Hathaway’s portfolio.

#1: Apple, Inc. (AAPL)

Dividend Yield: 0.6percent% of Warren Buffett’s Portfolio: 41.7%

As of its fourth-quarter 13F submitting, Berkshire held simply over 894 million shares of Apple, value greater than $122 billion. Apple is Berkshire’s largest place by far, due largely to Apple’s wonderful rally over the previous few years.

Apple revolutionized private know-how with the introduction of the Macintosh in 1984. In the present day the know-how firm designs, manufactures and sells merchandise corresponding to iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a providers enterprise that sells music, apps, and subscriptions.

Apple revolutionized private know-how with the introduction of the Macintosh in 1984. In the present day the know-how firm designs, manufactures and sells merchandise corresponding to iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a providers enterprise that sells music, apps, and subscriptions.

Apple is the #1 holding of Berkshire Hathaway (BRK.B), making the know-how big one of many prime Warren Buffett shares.

On February 2nd, 2023, Apple reported Q1 fiscal 12 months 2023 outcomes for the interval ending December thirty first, 2022 (Apple’s fiscal 12 months ends the final Saturday in September). For the quarter, Apple generated income of $117.154 billion, a -5.5% decline in comparison with Q1 2022.

Product gross sales had been down -7.7%, pushed by an -8.2% decline in iPhones (56% of whole gross sales). Service gross sales elevated 6.4% to $20.8 billion and made up 17.7% of all gross sales within the quarter. Web earnings equaled $29.998 billion or $1.88 per share in comparison with $34.630 billion or $2.10 per share in Q1 2022.

Click on right here to obtain our most up-to-date Certain Evaluation report on AAPL (preview of web page 1 of three proven beneath):

#2: Financial institution of America Company (BAC)

Dividend Yield: 2.4percent% of Warren Buffett’s Portfolio: 10.9%

Berkshire Hathaway owns simply over 1 billion shares of Financial institution of America inventory, value $31 billion as of the newest 13F submitting.

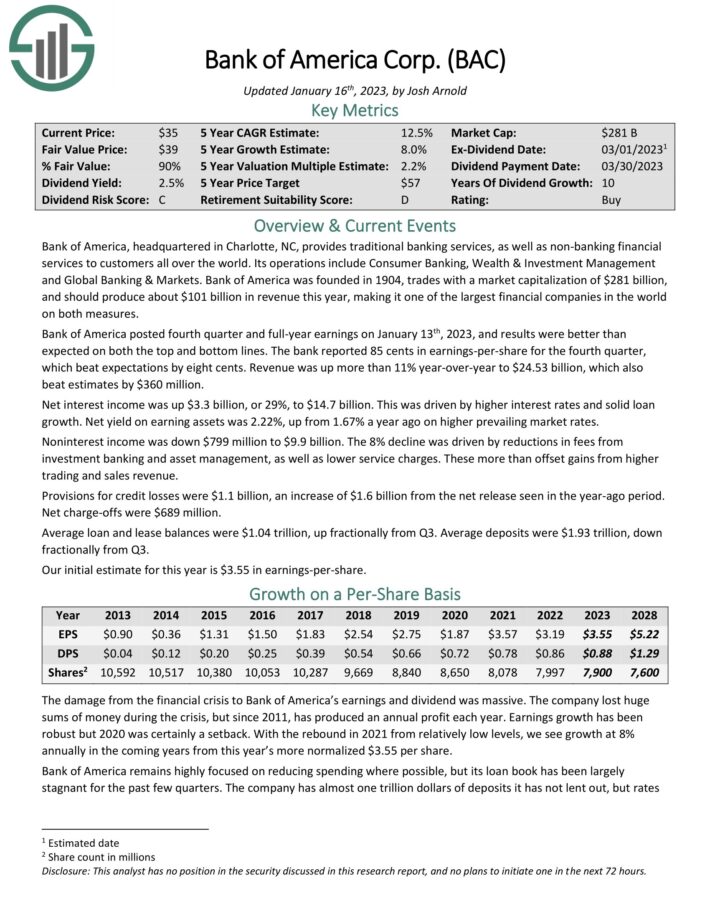

Financial institution of America, headquartered in Charlotte, NC, supplies conventional banking providers, in addition to non–banking monetary providers to clients throughout the world. Its operations embrace Shopper Banking, Wealth & Funding Administration and World Banking & Markets.

Financial institution of America was based in 1904, and may produce about $89 billion in income this year. Financial institution of America is one of many largest monetary shares on the earth.

Financial institution of America posted fourth quarter and full-year earnings on January thirteenth, 2023, and outcomes had been higher than anticipated on each the highest and backside strains. The financial institution reported 85 cents in earnings-per-share for the fourth quarter, which beat expectations by eight cents. Income was up greater than 11% year-over-year to $24.53 billion, which additionally beat estimates by $360 million.

Web curiosity earnings was up $3.3 billion, or 29%, to $14.7 billion. This was pushed by increased rates of interest and stable mortgage progress. Web yield on incomes property was 2.22%, up from 1.67% a 12 months in the past on increased prevailing market charges. Noninterest earnings was down $799 million to $9.9 billion. The 8% decline was pushed by reductions in charges from funding banking and asset administration, in addition to decrease service fees. These greater than offset good points from increased buying and selling and gross sales income.

Provisions for credit score losses had been $1.1 billion, a rise of $1.6 billion from the online launch seen within the year-ago interval. Web charge-offs had been $689 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on Financial institution of America (preview of web page 1 of three proven beneath):

#3: Chevron Company (CVX)

Dividend Yield: 3.5percent% of Warren Buffett’s Portfolio: 8.5%

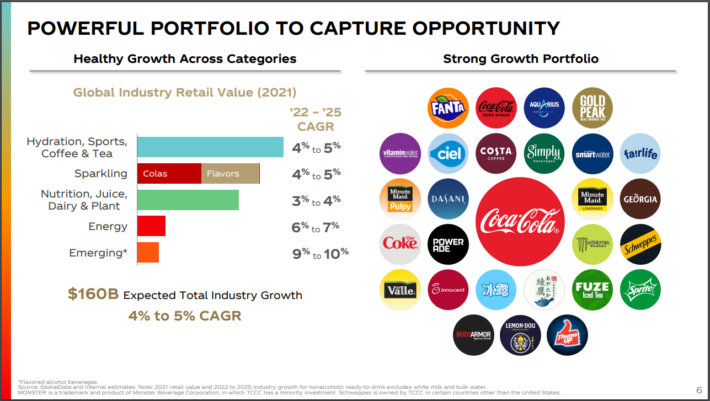

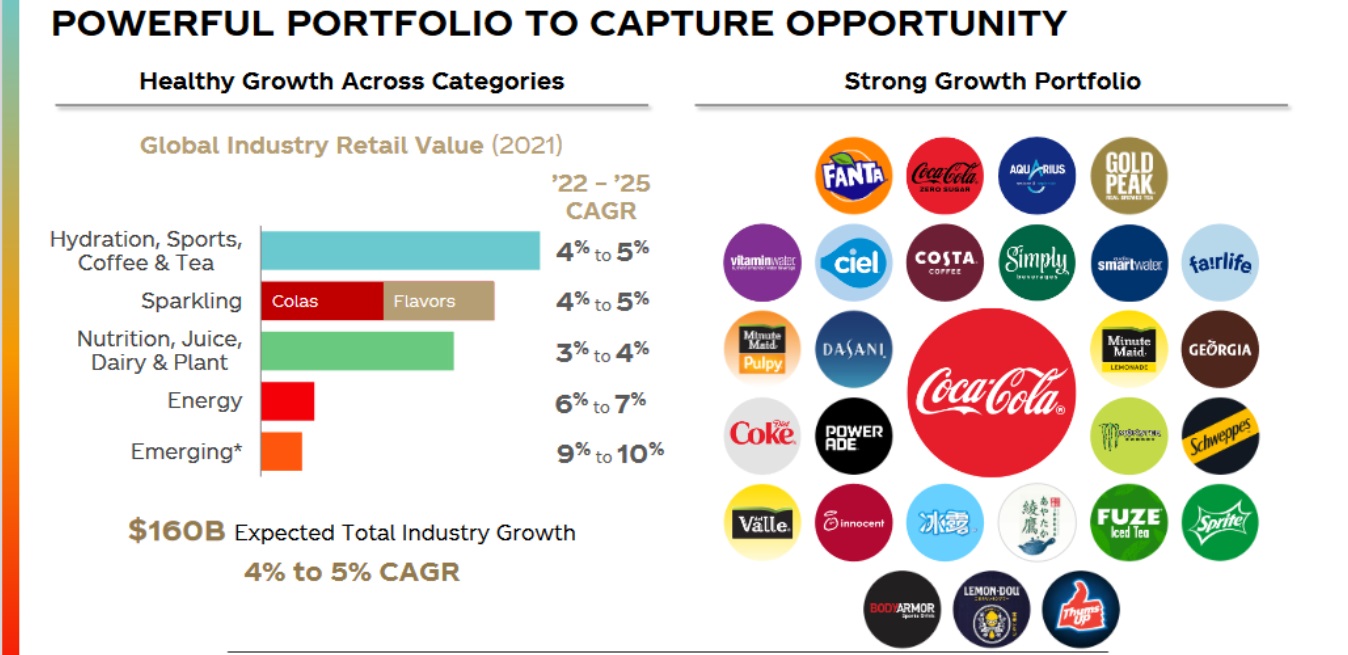

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non-alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 nations worldwide. Its manufacturers account for about 2 billion servings of drinks worldwide every single day, producing over $42 billion in annual income.

Supply: Investor Presentation

Coca-Cola reported third quarter earnings on October twenty fifth, 2022, and outcomes had been higher than anticipated on each the highest and backside strains. Earnings-per-share on an adjusted foundation got here to 69 cents, which was a nickel higher than anticipated. Income was up 11% year-over-year to $11.1 billion, which was additionally $600 million higher than estimates. Additional, the corporate guided for 14% to fifteen% in natural income progress this 12 months.

World unit case quantity was up 4% in Q3. Natural gross sales had been up 16%, which was virtually double the anticipated 9.8% achieve. The Europe, Center East & Africa area noticed a 20% natural gross sales achieve, Latin America was up 18%, and North America was up 14%.

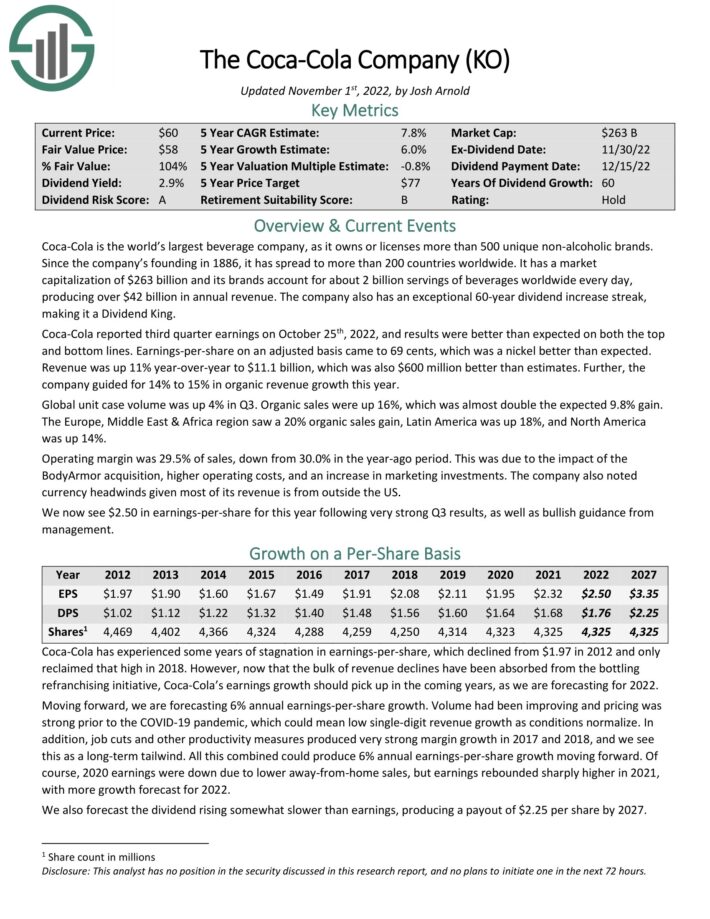

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

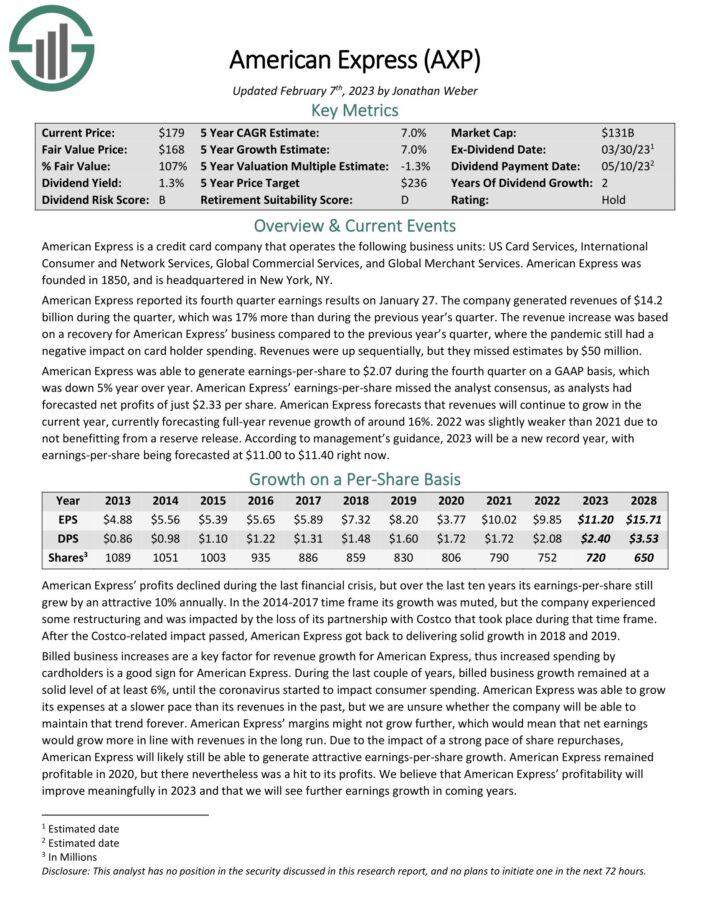

#4: American Specific Firm (AXP)

Dividend Yield: 1.2percent% of Warren Buffett’s Portfolio: 8.3%

American Specific is one in all Berkshire’s longest-held shares. American Specific is a bank card firm that operates the next enterprise items: US Card Companies, Worldwide Shopper and Community Companies, World Industrial Companies, and World Service provider Companies. American Specific was based in 1850.

American Specific reported its fourth quarter earnings outcomes on January 27. The corporate generated revenues of $14.2 billion in the course of the quarter, which was 17% greater than in the course of the earlier 12 months’s quarter. The income enhance was primarily based on a restoration for American Specific’ enterprise in comparison with the earlier 12 months’s quarter, the place the pandemic nonetheless had a unfavorable affect on card holder spending. Revenues had been up sequentially, however they missed estimates by $50 million.

American Specific was in a position to generate earnings-per-share to $2.07 in the course of the fourth quarter on a GAAP foundation, which was down 5% 12 months over 12 months. American Specific’ earnings-per-share missed the analyst consensus, as analysts had forecast internet income of simply $2.33 per share.

American Specific forecasts that revenues will proceed to develop within the present 12 months, at the moment forecasting full-year income progress of round 16%. 2022 was barely weaker than 2021 attributable to not benefiting from a reserve launch.

Based on administration’s steerage, 2023 will likely be a brand new document 12 months, with earnings-per-share being forecast at $11.00 to $11.40.

Click on right here to obtain our most up-to-date Certain Evaluation report on American Specific (preview of web page 1 of three proven beneath):

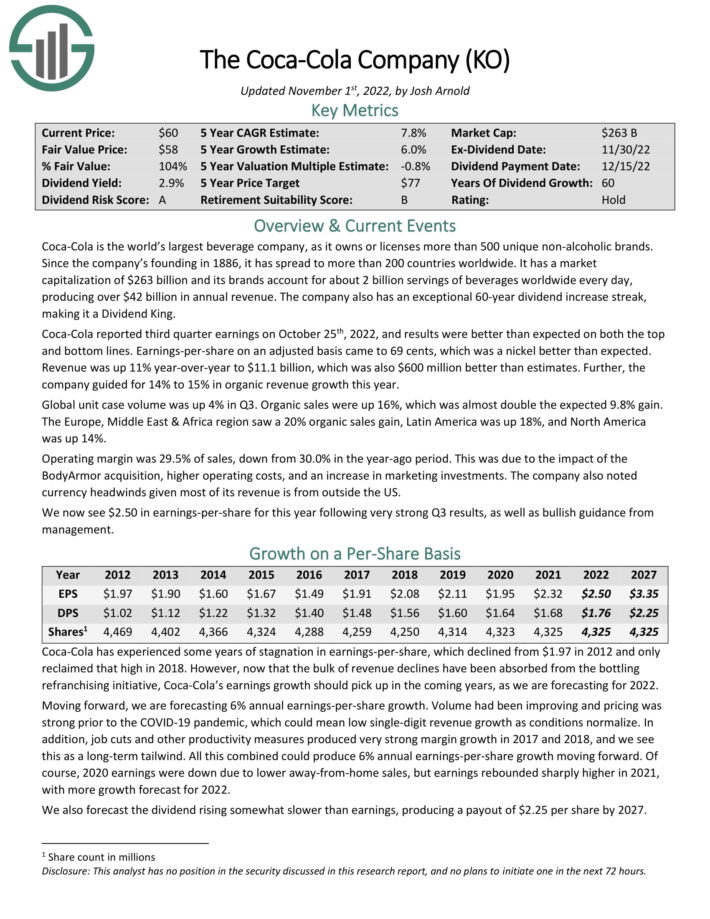

#5: The Coca-Cola Firm (KO)

Dividend Yield: 2.9percent% of Warren Buffett’s Portfolio: 7.2%

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

Supply: Investor Presentation

The corporate additionally has an distinctive 59-year dividend enhance streak.

Coca-Cola reported third quarter earnings on October twenty fifth, 2022, and outcomes had been higher than anticipated on each the highest and backside strains. Earnings-per-share on an adjusted foundation got here to 69 cents, which was a nickel higher than anticipated.

Income was up 11% year-over-year to $11.1 billion, which was additionally $600 million higher than estimates. Additional, the corporate guided for 14% to fifteen% in natural income progress this 12 months.

World unit case quantity was up 4% in Q3. Natural gross sales had been up 16%, which was virtually double the anticipated 9.8% achieve. The Europe, Center East & Africa area noticed a 20% natural gross sales achieve, Latin America was up 18%, and North America was up 14%.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

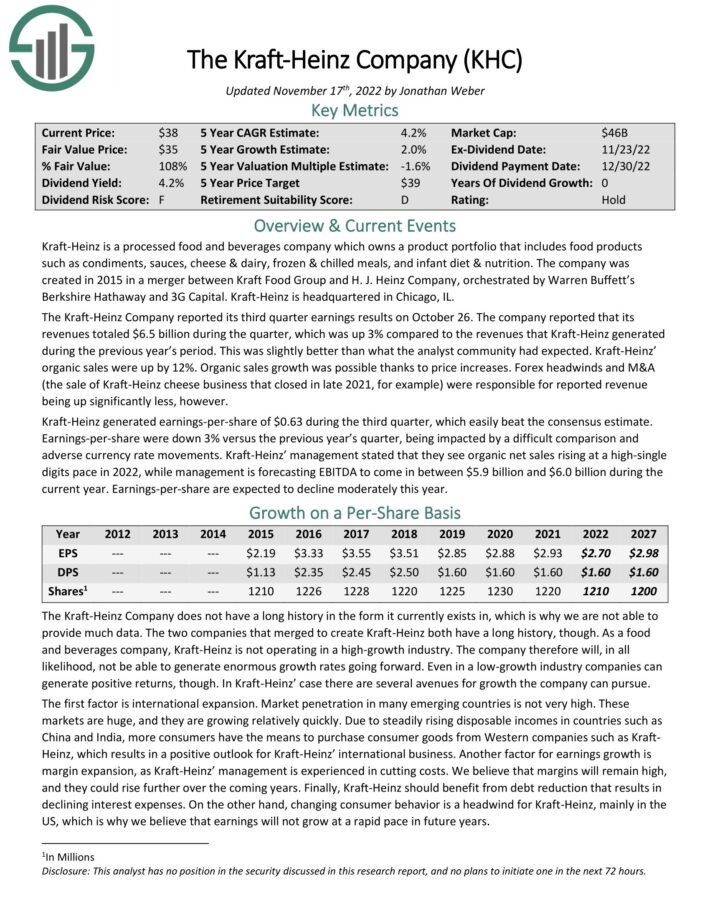

#6: The Kraft-Heinz Firm (KHC)

Dividend Yield: 3.9percent% of Warren Buffett’s Portfolio: 3.9%

Kraft–Heinz is a processed meals and drinks firm which owns a product portfolio that consists of meals merchandise corresponding to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler weight loss plan & nutrition. The corporate was created in 2015 in a merger between Kraft Meals Group and H. J. Heinz Firm, orchestrated by Berkshire Hathaway and 3G Capital.

The Kraft-Heinz Firm reported its third quarter earnings outcomes on October 26. The corporate reported that its revenues totaled $6.5 billion in the course of the quarter, which was up 3% in comparison with the revenues that Kraft-Heinz generated in the course of the earlier 12 months’s interval. This was barely higher than what the analyst group had anticipated. Kraft-Heinz’ natural gross sales had been up by 12%. Natural gross sales progress was attainable thanks to cost will increase.

Kraft-Heinz generated earnings-per-share of $0.63 in the course of the third quarter, which simply beat the consensus estimate. Earnings-per-share had been down 3% versus the earlier 12 months’s quarter, being impacted by a tough comparability and hostile forex charge actions. Kraft-Heinz’ administration said that they see natural internet gross sales rising at a high-single digits tempo in 2022, whereas administration is forecasting EBITDA to return in between $5.9 billion and $6.0 billion in the course of the present 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Kraft-Heinz (preview of web page 1 of three proven beneath):

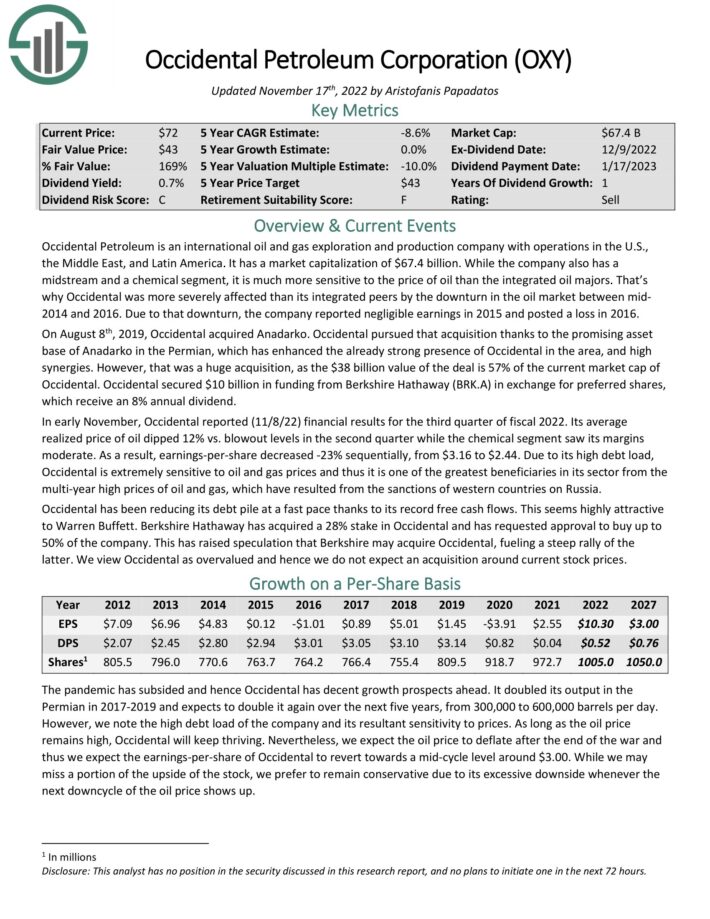

#7: Occidental Petroleum (OXY)

Dividend Yield: 0.6percent% of Warren Buffett’s Portfolio: 3.9%

Occidental Petroleum is a world oil and fuel exploration and manufacturing firm with operations within the U.S., the Center East, and Latin America. It has a market capitalization of $60 billion. Whereas the corporate additionally has a midstream and a chemical phase, it’s way more delicate to the value of oil than the built-in oil majors.

In early November, Occidental reported (11/8/22) monetary outcomes for the third quarter of fiscal 2022. Its common realized worth of oil dipped 12% vs. blowout ranges within the second quarter whereas the chemical phase noticed its margins reasonable. In consequence, earnings-per-share decreased -23% sequentially, from $3.16 to $2.44. Attributable to its excessive debt load, Occidental is extraordinarily delicate to grease and fuel costs and thus it is without doubt one of the best beneficiaries in its sector from the multi-year excessive costs of oil and fuel, which have resulted from the sanctions of western nations on Russia.

Occidental has been decreasing its debt pile at a quick tempo because of its document free money flows. This appears extremely enticing to Warren Buffett. Berkshire Hathaway has acquired a 28% stake in Occidental and has requested approval to purchase as much as 50% of the corporate.

Click on right here to obtain our most up-to-date Certain Evaluation report on OXY (preview of web page 1 of three proven beneath):

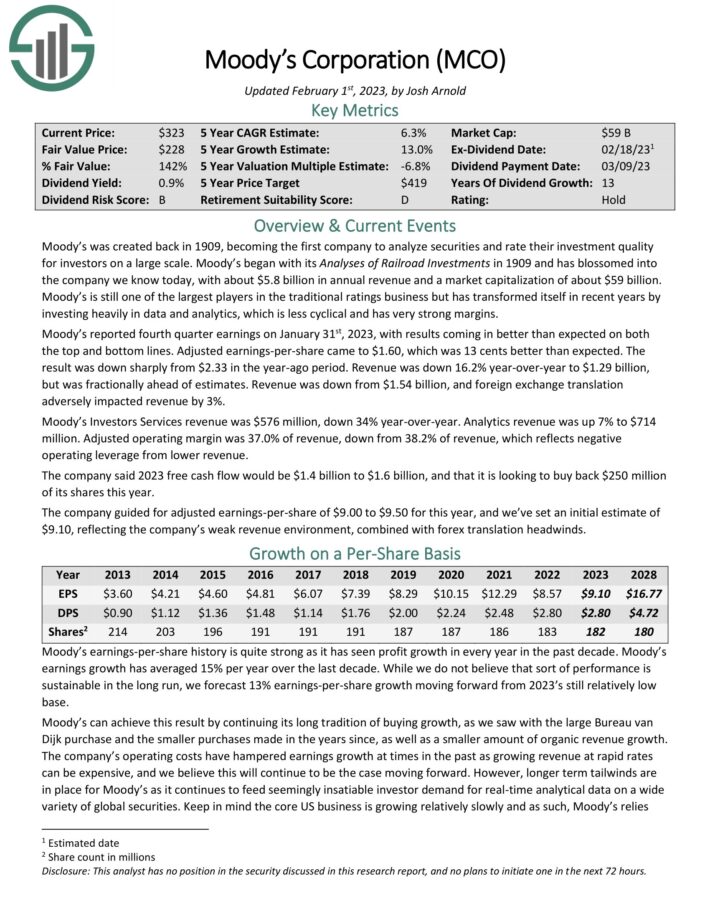

#8: Moody’s Company (MCO)

Dividend Yield: 0.9percent% of Warren Buffett’s Portfolio: 2.3%

Moody’s was created again in 1909, changing into the primary firm to research securities and charge their funding high quality for traders on a big scale. Moody’s started with its Analyses of Railroad Investments in 1909 and has blossomed into the corporate we all know in the present day, with over $6 billion in annual income.

Moody’s reported fourth quarter earnings on January thirty first, 2023, with outcomes coming in higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $1.60, which was 13 cents higher than anticipated. The consequence was down sharply from $2.33 within the year-ago interval. Income was down 16.2% year-over-year to $1.29 billion, however was fractionally forward of estimates. Income was down from $1.54 billion, and overseas change translation adversely impacted income by 3%.

Moody’s Traders Companies income was $576 million, down 34% year-over-year. Analytics income was up 7% to $714 million. Adjusted working margin was 37.0% of income, down from 38.2% of income, which displays unfavorable working leverage from decrease income.

The corporate stated 2023 free money circulation can be $1.4 billion to $1.6 billion, and that it’s seeking to purchase again $250 million of its shares this 12 months. The corporate guided for adjusted earnings-per-share of $9.00 to $9.50 for this 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Moody’s (preview of web page 1 of three proven beneath):

#9: Activision Blizzard (ATVI)

Dividend Yield: 0.6percent% of Warren Buffett’s Portfolio: 1.2%

Berkshire owns simply over 68 million shares of ATVI inventory. The stake is value roughly $4.45 billion.

Activision Blizzard is a online game producer. It operates by means of three segments: Activision, Blizzard, and King. It develops and distributes content material and providers on online game consoles, private computer systems, and cell units.

Activision Blizzard is about to be acquired by Microsoft (MSFT) in an almost $70 billion deal.

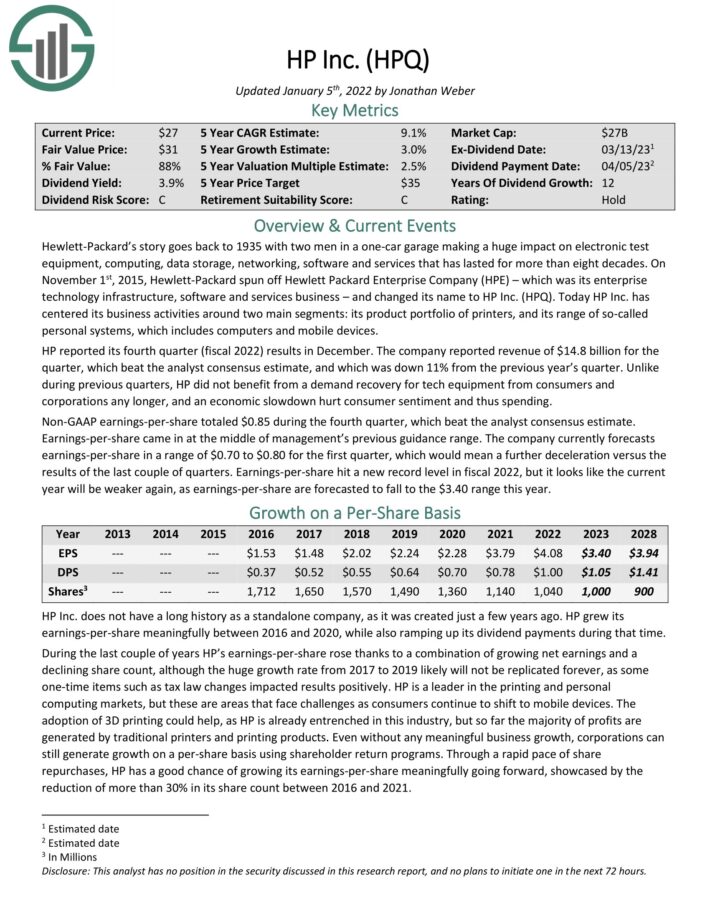

#10: HP Inc. (HPQ)

Dividend Yield: 3.3percent% of Warren Buffett’s Portfolio: 1.0%

On the finish of the second quarter, Berkshire held simply over 104 million shares of HPQ, for a market worth of roughly $3.17 billion.

HP Inc. has centered its enterprise actions round two primary segments: its product portfolio of printers, and its vary of so-called private methods, which incorporates computer systems and cell units.

HP reported its fourth quarter (fiscal 2022) leads to December. The corporate reported income of $14.8 billion for the quarter, which beat the analyst consensus estimate, and which was down 11% from the earlier 12 months’s quarter. Not like throughout earlier quarters, HP didn’t profit from a requirement restoration for tech gear from shoppers and companies any longer, and an financial slowdown damage client sentiment and thus spending.

Non-GAAP earnings-per-share totaled $0.85 in the course of the fourth quarter, which beat the analyst consensus estimate. Earnings-per-share got here in on the center of administration’s earlier steerage vary. The corporate at the moment forecasts earnings-per-share in a variety of $0.70 to $0.80 for the primary quarter, which might imply an additional deceleration versus the outcomes of the final couple of quarters.

Click on right here to obtain our most up-to-date Certain Evaluation report on HPQ (preview of web page 1 of three proven beneath):

#11: DaVita Inc. (DVA)

Dividend Yield: N/A (DaVita doesn’t at the moment pay a quarterly dividend)% of Warren Buffett’s Portfolio: 0.9%

Berkshire’s funding portfolio incorporates simply over 36 million shares of DaVita, Inc., equating to a complete funding of $2.60 billion on the time of the final 13F submitting. DaVita is lower than 1% of Berkshire’s general funding portfolio.

DaVita supplies kidney dialysis providers for sufferers affected by continual kidney failure or finish stage renal illness. The corporate operates kidney dialysis facilities and supplies associated lab providers in outpatient dialysis facilities.

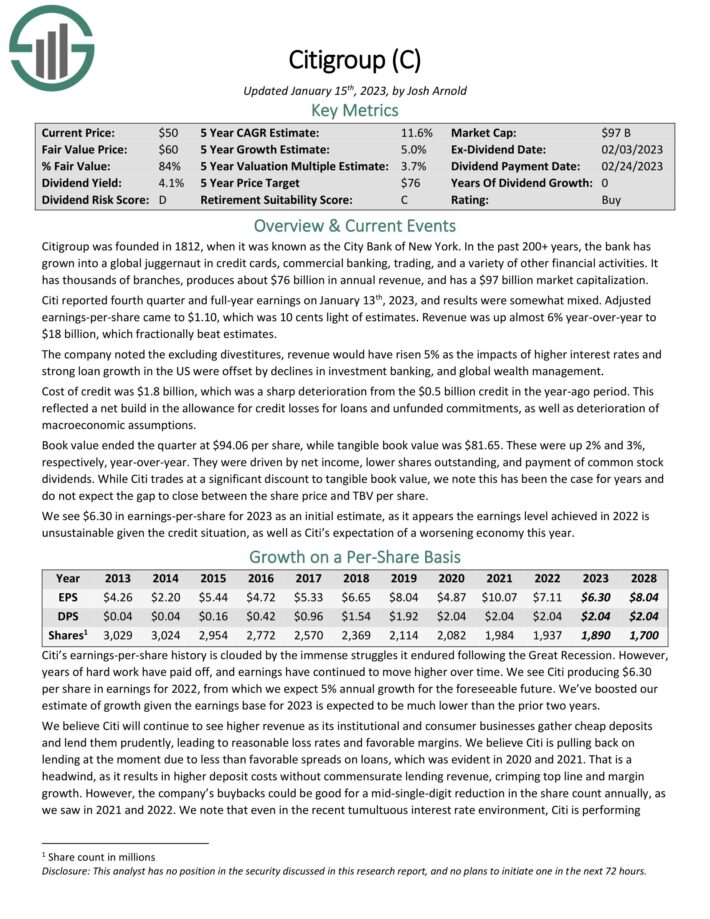

#12: Citigroup Inc. (C)

Dividend Yield: 3.9percent% of Warren Buffett’s Portfolio: 0.9%

Citigroup is a worldwide juggernaut in bank cards, business banking, buying and selling, and quite a lot of different monetary actions. It has 1000’s of branches and produces about $75 billion in annual income.

Citi reported fourth quarter and full-year earnings on January thirteenth, 2023, and outcomes had been considerably combined. Adjusted earnings-per-share got here to $1.10, which was 10 cents gentle of estimates. Income was up virtually 6% year-over-year to $18 billion, which fractionally beat estimates.

The corporate famous the excluding divestitures, income would have risen 5% because the impacts of upper rates of interest and powerful mortgage progress within the US had been offset by declines in funding banking, and world wealth administration.

Price of credit score was $1.8 billion, which was a pointy deterioration from the $0.5 billion credit score within the year-ago interval. This mirrored a internet construct within the allowance for credit score losses for loans and unfunded commitments, in addition to deterioration of macroeconomic assumptions.

Guide worth ended the quarter at $94.06 per share, whereas tangible ebook worth was $81.65. These had been up 2% and three%, respectively, year-over-year. They had been pushed by internet earnings, decrease shares excellent, and fee of widespread inventory dividends.

Click on right here to obtain our most up-to-date Certain Evaluation report on Citigroup (preview of web page 1 of three proven beneath):

#13: VeriSign, Inc. (VRSN)

Dividend Yield: N/APercent of Warren Buffett’s Portfolio: 0.8%

Buffett’s Berkshire Hathaway funding portfolio holds 12.8 million shares of VeriSign, Inc with a market worth of $2.7 billion.

VeriSign is a globally diversified supplier of area title registry providers and Web safety software program. The corporate operates in a single phase, and has a major worldwide presence.

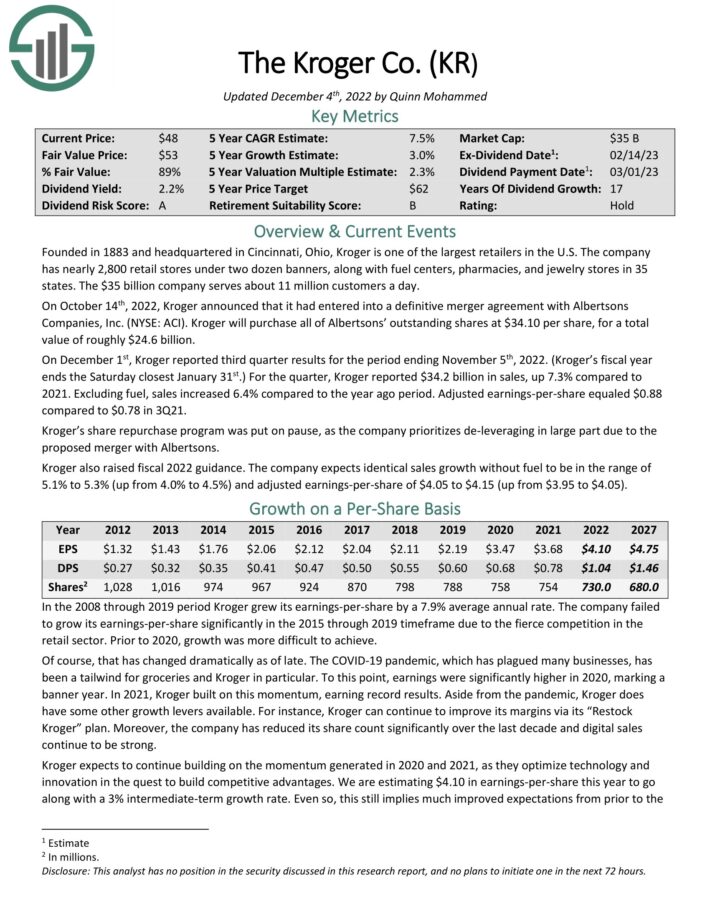

#14: The Kroger Co. (KR)

Dividend Yield: 2.2percent% of Warren Buffett’s Portfolio: 0.7%

Based in 1883 and headquartered in Cincinnati, Ohio, Kroger is one of many largest retailers within the U.S. The corporate has practically 2,800 retail shops beneath two dozen banners, together with gas facilities, pharmacies and jewellery shops in 35 states. The firm serves practically 11 million clients a day.

On December 1st, Kroger reported third quarter outcomes for the interval ending November fifth, 2022. (Kroger’s fiscal 12 months ends the Saturday closest January thirty first.) For the quarter, Kroger reported $34.2 billion in gross sales, up 7.3% in comparison with 2021. Excluding gas, gross sales elevated 6.4% in comparison with the 12 months in the past interval.

Adjusted earnings-per-share equaled $0.88 in comparison with $0.78 in 3Q21. Kroger’s share repurchase program was placed on pause, as the corporate prioritizes de-leveraging largely as a result of proposed merger with Albertsons.

Kroger additionally raised fiscal 2022 steerage. The corporate expects similar gross sales progress with out gas to be within the vary of 5.1% to five.3% (up from 4.0% to 4.5%) and adjusted earnings-per-share of $4.05 to $4.15 (up from $3.95 to $4.05).

Click on right here to obtain our most up-to-date Certain Evaluation report on Kroger (preview of web page 1 of three proven beneath):

#15: Normal Motors Firm (GM)

Dividend Yield: 0.4percent% of Warren Buffett’s Portfolio: 0.6%

Berkshire Hathaway’s funding portfolio owns 50 million shares of GM, for a market worth of just below $2 billion.

Normal Motors Firm designs, builds, and sells automobiles, vans, crossovers, and car elements world wide. Its prime automobile manufacturers embrace Buick, Cadillac, Chevrolet, GMC, Holden, Baojun, and Wuling.

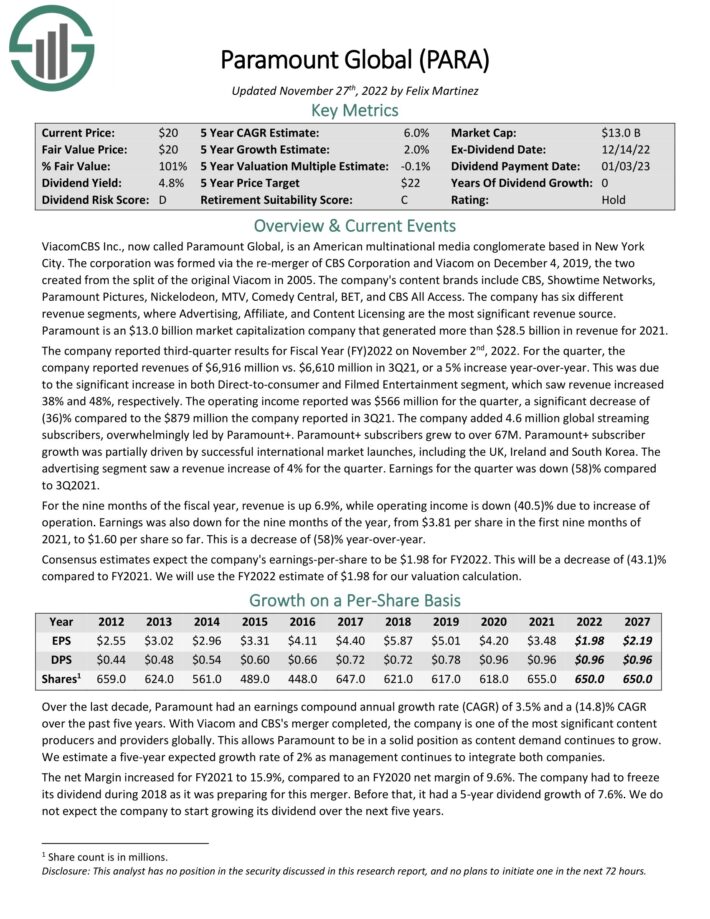

#16: Paramount World (PARA)

Dividend Yield: 4.0percent% of Warren Buffett’s Portfolio: 0.6%

ViacomCBS Inc., now referred to as Paramount World, is an American multinational media conglomerate primarily based in New York Metropolis. The company was fashioned by way of the re-merger of CBS Company and Viacom on December 4, 2019, the 2 created from the break up of the unique Viacom in 2005.

The corporate’s content material manufacturers embrace CBS, Showtime Networks, Paramount Photos, Nickelodeon, MTV, Comedy Central, BET, and CBS All Entry. The corporate has six totally different income segments, the place Promoting, Affiliate, and Content material Licensing are probably the most important income supply.

The corporate reported third-quarter outcomes for Fiscal Yr (FY)2022 on November 2nd, 2022. For the quarter, the corporate reported revenues of $6,916 million vs. $6,610 million in 3Q21, or a 5% enhance year-over-year. This was as a result of important enhance in each Direct-to-consumer and Filmed Leisure phase, which noticed income elevated 38% and 48%, respectively. The working earnings reported was $566 million for the quarter, a major lower of (36)% in comparison with the $879 million the corporate reported in 3Q21.

The corporate added 4.6 million world streaming subscribers, overwhelmingly led by Paramount+. Paramount+ subscribers grew to over 67M. Paramount+ subscriber progress was partially pushed by profitable worldwide market launches, together with the UK, Eire and South Korea. The promoting phase noticed a income enhance of 4% for the quarter.

Earnings for the quarter was down (58)% in comparison with 3Q2021. For the 9 months of the fiscal 12 months, income is up 6.9%, whereas working earnings is down (40.5)% attributable to enhance of operation. Earnings was additionally down for the 9 months of the 12 months, from $3.81 per share within the first 9 months of 2021, to $1.60 per share up to now. It is a lower of (58)% year-over-year.

Consensus estimates count on the corporate’s earnings-per-share to be $1.98 for FY2022. This will likely be a lower of (43.1)% in comparison with FY2021.

Click on right here to obtain our most up-to-date Certain Evaluation report on PARA (preview of web page 1 of three proven beneath):

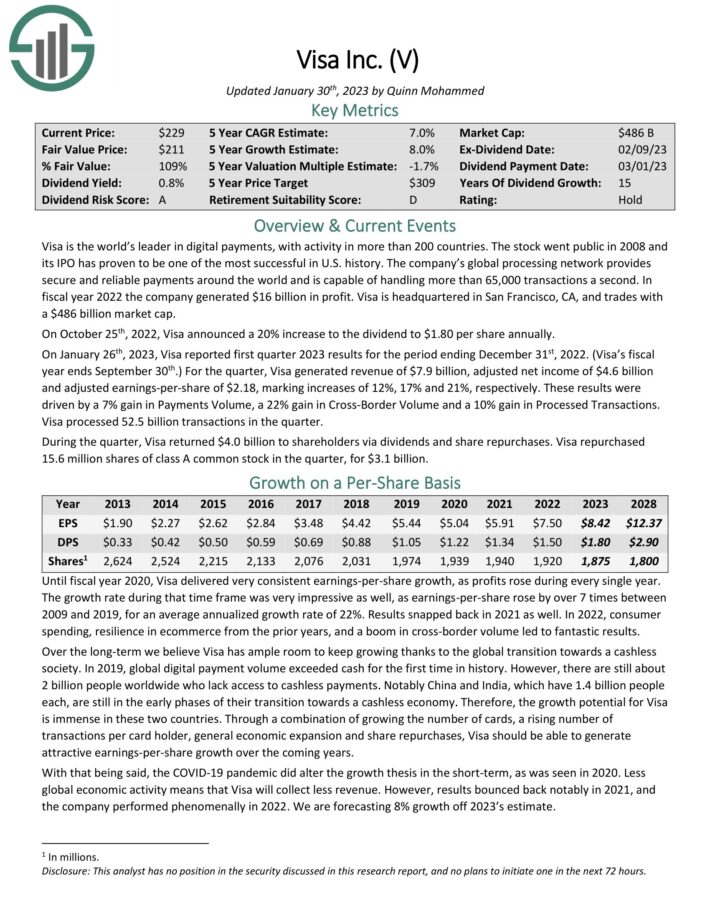

#17: Visa Inc. (V)

Dividend Yield: 0.7percent% of Warren Buffett’s Portfolio: 0.6%

Warren Buffett’s funding portfolio holds practically 8.3 million shares of Visa with a quarter-end market worth of $1.9 billion.

Visa is the world’s chief in digital funds, with exercise in additional than 200 nations. The corporate’s world processing community supplies safe and reliable funds world wide and is able to dealing with greater than 65,000 transactions a second.

On January twenty sixth, 2023, Visa reported first quarter 2023 outcomes for the interval ending December thirty first, 2022. (Visa’s fiscal 12 months ends September thirtieth.) For the quarter, Visa generated income of $7.9 billion, adjusted internet earnings of $4.6 billion and adjusted earnings-per-share of $2.18, marking will increase of 12%, 17% and 21%, respectively.

These outcomes had been pushed by a 7% achieve in Funds Quantity, a 22% achieve in Cross-Border Quantity and a ten% achieve in Processed Transactions. Visa processed 52.5 billion transactions within the quarter.

In the course of the quarter, Visa returned $4.0 billion to shareholders by way of dividends and share repurchases. Visa repurchased 15.6 million shares of sophistication A typical inventory within the quarter, for $3.1 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on Visa (preview of web page 1 of three proven beneath):

#18: Constitution Communications (CHTR)

Dividend Yield: N/APercent of Warren Buffett’s Portfolio: 0.5%

Warren Buffett’s funding portfolio holds 3.8 million shares of Constitution with a quarter-end market worth of $1.5 billion.

Constitution Communications, Inc. operates as a broadband connectivity and cable operator firm serving residential and business clients in the USA. The corporate provides subscription-based web, video, and cell and voice providers; a set of broadband connectivity providers, together with fastened web, WiFi, and cell.

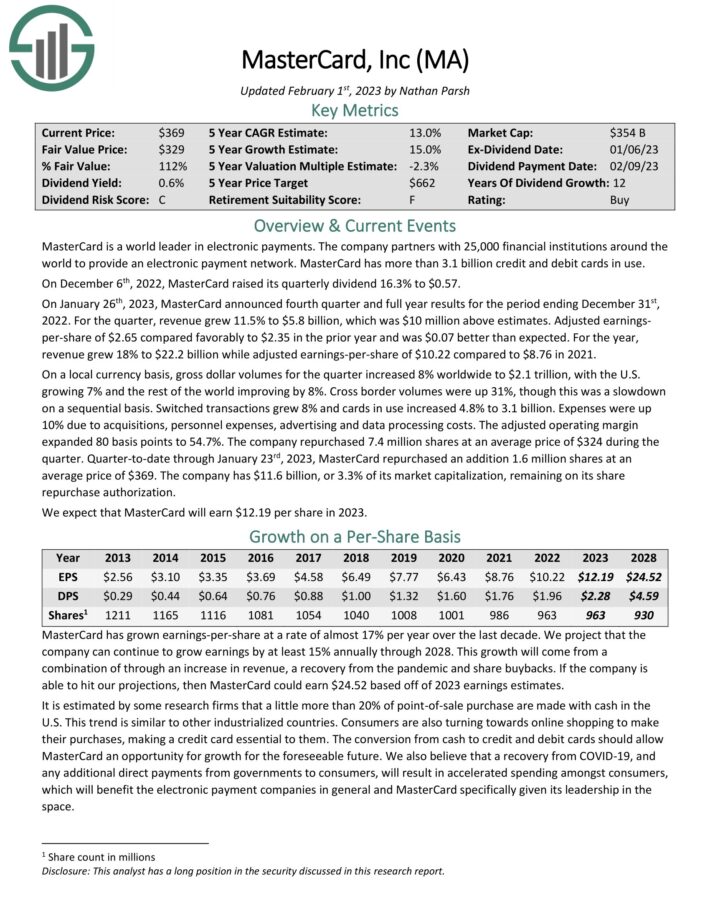

#19: Mastercard Inc. (MA)

Dividend Yield: 0.6percent% of Warren Buffett’s Portfolio: 0.4%

Warren Buffett’s funding portfolio holds practically 4 million shares of Mastercard with a quarter-end market worth of $1.47 billion.

MasterCard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments world wide to supply an digital fee community. MasterCard has greater than 3.1 billion credit score and debit playing cards in use.

On December sixth, 2022, MasterCard raised its quarterly dividend 16.3% to $0.57. On January twenty sixth, 2023, MasterCard introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2022. For the quarter, income grew 11.5% to $5.8 billion, which was $10 million above estimates.

Adjusted earnings-per-share of $2.65 in contrast favorably to $2.35 within the prior 12 months and was $0.07 higher than anticipated. For the 12 months, income grew 18% to $22.2 billion whereas adjusted earnings-per-share of $10.22 in comparison with $8.76 in 2021.

On a neighborhood forex foundation, gross greenback volumes for the quarter elevated 8% worldwide to $2.1 trillion, with the U.S. rising 7% and the remainder of the world enhancing by 8%. Cross border volumes had been up 31%, although this was a slowdown on a sequential foundation. Switched transactions grew 8% and playing cards in use elevated 4.8% to three.1 billion. Bills had been up 10% attributable to acquisitions, personnel bills, promoting and information processing prices. The adjusted working margin expanded 80 foundation factors to 54.7%.

The corporate repurchased 7.4 million shares at a mean worth of $324 in the course of the quarter. Quarter-to-date by means of January twenty third, 2023, MasterCard repurchased an addition 1.6 million shares at a mean worth of $369. The corporate has $11.6 billion, or 3.3% of its market capitalization, remaining on its share repurchase authorization.

Click on right here to obtain our most up-to-date Certain Evaluation report on Mastercard (preview of web page 1 of three proven beneath):

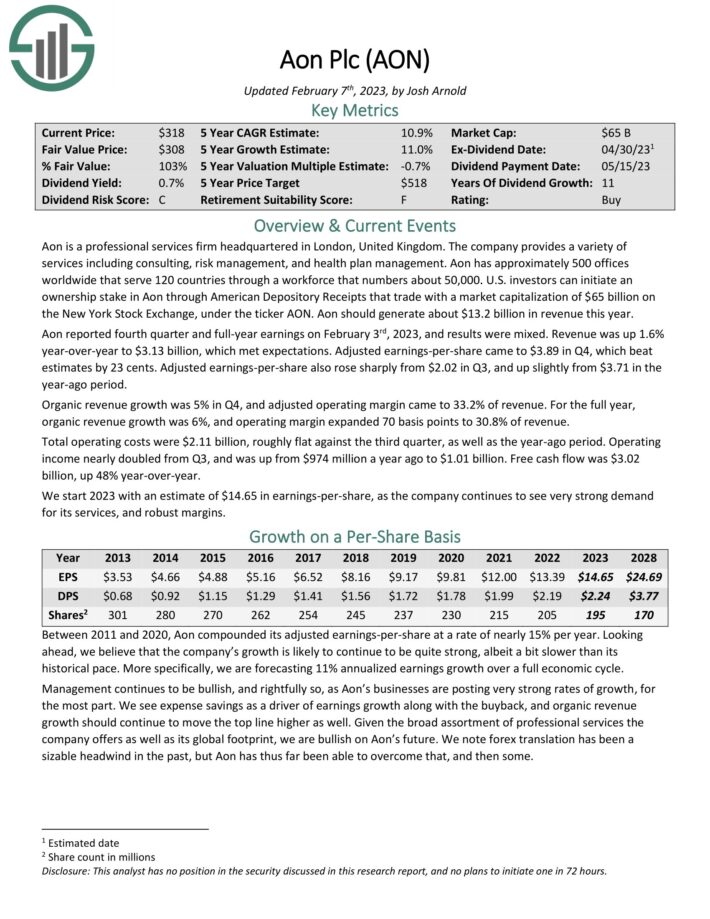

#20: Aon plc (AON)

Dividend Yield: 0.7percent% of Warren Buffett’s Portfolio: 0.4%

Aon is an expert providers agency headquartered in London, United Kingdom. The corporate supplies quite a lot of providers together with consulting, threat administration, and well being plan administration. Aon has roughly 500 places of work worldwide that serve 120 nations by means of a workforce that numbers about 50,000. Aon ought to generate about $13.2 billion in income this 12 months.

Aon reported fourth quarter and full-year earnings on February third, 2023, and outcomes had been combined. Income was up 1.6% year-over-year to $3.13 billion, which met expectations. Adjusted earnings-per-share got here to $3.89 in This fall, which beat estimates by 23 cents. Adjusted earnings-per-share additionally rose sharply from $2.02 in Q3, and up barely from $3.71 within the year-ago interval. Natural income progress was 5% in This fall, and adjusted working margin got here to 33.2% of income. For the complete 12 months, natural income progress was 6%, and working margin expanded 70 foundation factors to 30.8% of income.

Complete working prices had been $2.11 billion, roughly flat in opposition to the third quarter, in addition to the year-ago interval. Working earnings practically doubled from Q3, and was up from $974 million a 12 months in the past to $1.01 billion. Free money circulation was $3.02 billion, up 48% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on Aon (preview of web page 1 of three proven beneath):

Ultimate Ideas

You may see the next extra articles concerning Warren Buffett:

Warren Buffett shares characterize most of the strongest, most long-lived companies round. You may see extra high-quality dividend shares within the following Certain Dividend databases:

Alternatively, one other excellent place to search for high-quality enterprise is contained in the portfolios of different extremely profitable traders.

To that finish, Certain Dividend has created the next inventory databases:

You may additionally be seeking to create a extremely personalized dividend earnings stream to pay for all times’s bills.

The next two lists present helpful data on excessive dividend shares and shares that pay month-to-month dividends:

You may see Buffett’s prime dividend shares analyzed in video format as effectively beneath.

Lastly, you’ll be able to see the articles beneath for evaluation on different main funding companies/asset managers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].