Revealed on Could twenty ninth, 2023 by Nikolaos Sismanis

Based in 2003, Scion Asset Administration, LLC is a non-public funding agency led by investing guru Dr. Michael J. Burry.

Scion Asset Administration has change into more and more standard because of Dr. Burry’s potential to determine undervalued funding alternatives all over the world. The fund solely has 4 purchasers. It costs an asset-based administration price that may be as excessive as 2% per 12 months, whereas it could additionally take as much as 20% of the worth of the appreciation from every consumer’s account.

The fund has round $237.9 million in belongings underneath administration (AUM), $106.9 million of which is allotted to the agency’s public fairness portfolio. Scion Asset Administration is headquartered in Saratoga, California.

Traders following the corporate’s 13F filings during the last 3 years (from mid-Could 2020 via mid-Could 2023) would have generated annualized whole returns of 56.0%. For comparability, the S&P 500 ETF (SPY) generated annualized whole returns of 11.9% over the identical time interval.

Word: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

You’ll be able to obtain an Excel spreadsheet with metrics that matter of Scion Asset Administration’s present 13F fairness holdings under:

Preserve studying this text to study extra about Scion Asset Administration.

Desk Of Contents

Scion Asset Administration’s Fund Supervisor, Michael Burry

Michael J. Burry is understood by most because the “Large Quick” investor because of the eponymous film revolving round himself and his story in the course of the days of the Nice Monetary Disaster, a job performed by Christian Bale. Nevertheless, Dr. Burry has a wider monitor document within the investing world.

After attending medical faculty, Dr. Burry left to start out his personal hedge fund in 2000. He had already constructed a status as an investor on the time by exhibiting success in worth investing. Particularly, his picks had been printed on message boards on the inventory dialogue website Silicon Investor again in 1996, with their returns being excellent! The truth is, Dr. Burry had showcased such nice stock-picking expertise that he drew the curiosity of corporations akin to Vanguard, White Mountains Insurance coverage Group, and famend buyers akin to Joel Greenblatt.

However, it’s Dr. Burry’s legendary performs previous to the Nice Monetary Disaster, and the huge returns that adopted that pushed his title into the worldwide highlight. Significantly, in 2005, Dr. Burry began to focus on the subprime market. Primarily based on his evaluation of mortgage lending practices utilized in 2003 and 2004, he precisely forecasted that the true property bubble would come tumbling by 2007.

His evaluation resulted in him shorting the market by convincing Goldman Sachs and different funding companies to promote him credit score default swaps in opposition to subprime offers he noticed as weak. Curiously sufficient, when Dr. Burry needed to pay for the credit score default swaps, he skilled an investor revolt, as some buyers in his fund feared his prophecy was inaccurate, requesting to withdraw their funds. In the end, Burry’s evaluation proved proper. Not solely did he make a private revenue of $100 million, however his remaining buyers earned greater than $700 million.

As an instance how profitable Dr. Burry’s picks had been from the origins of Scion Asset Administration to the Nice Monetary Disaster, the hedge fund recorded returns of 489.34% (web of charges and bills) between its inception in November 2000 to June 2008. Compared, the S&P 500 returned just below 3%, together with dividends, over the identical interval.

Michael Burry’s Funding Philosophy & Technique

The idea of “Worth Investing can sum up Michael Burry’s entire funding philosophy”. He has acknowledged greater than as soon as that his funding fashion relies on Benjamin Graham and David Dodd’s 1934 ebook Safety Evaluation. In his phrases: “All my inventory choosing is 100% based mostly on the idea of a margin of security.”

Dr. Burry doesn’t differentiate between small-caps, mid-caps, tech shares, or non-tech shares. He solely appears to be like for his or her undervalued parts, no matter their sector and sophistication. Exactly as a result of he doesn’t deal with a particular business and since the essence of monetary metrics shifts by business and every firm’s place within the financial cycle, Dr. Burry makes use of the ratio of enterprise worth (EV) to EBITDA when researching funding concepts.

Accordingly, he disregards price-to-earnings ratios to dodge being deceived by an organization’s acknowledged metrics. Firm metrics from anybody time interval might be deceptive based mostly on the underlying state of the financial system and macros which will profit or hurt the corporate at a given time limit. Quite, he pays consideration to off-balance sheet metrics and naturally, free money move.

Scion Asset Administration’s Noteworthy Portfolio Adjustments

Throughout its newest 13F submitting, Scion Asset Administration executed the next notable portfolio changes:

Noteworthy new Stakes:

Signet Jewelers Ltd (SIG)

New York Group Bancorp (NYCB)

Capital One Monetary Corp (COF)

Zoom Video Communications Inc (ZM)

Sibanye Stillwater Ltd (SBSW)

Liberty Latin America Ltd Class C (LILAK)

Cigna Holding Co (CI)

Nov Inc (NOV)

Devon Power Corp. (DVN)

PacWest Bancorp (DE) (PACW)

First Republic Financial institution (FRCB)

Huntington Bancshares, Inc. (HBAN)

RealReal Inc (REAL)

Ovintiv Inc. (OVV)

Noteworthy new Sells:

MGM Resorts Worldwide, Inc. (MGM)

SkyWest Inc (SKYW)

Qurate Retail Group Inc Sequence A (QRTEA)

Wolverine World Broad, Inc. (WWW)

Black Knight Inc (BKI)

Scion Asset Administration’s Portfolio – All 20 Public Fairness Investments

Scion Asset Administration’s public fairness portfolio is closely concentrated. The portfolio numbers solely 20 equities, with JD.com accounting for 9.6% of its holdings. The fund’s prime 5 holdings, which we analyze under, account for 43.9% of its whole public fairness publicity.

Supply: 13F submitting, Creator

JD.com, Inc. (JD)

Chinese language e-commerce big JD.com accounts for 9.6% of Scion Asset’s administration public fairness holdings.

JD.com was based in Beijing, China, in 1998 by Richard Liu Qiangdong. The corporate’s headquarters is situated in Beijing, nevertheless it has a major presence throughout China and operates quite a few success facilities and warehouses all through the nation.

The corporate primarily operates as a business-to-consumer (B2C) on-line retailer, providing a variety of merchandise, together with electronics, dwelling home equipment, clothes, books, cosmetics, and extra. Importantly, JD.com has a complete logistics community and owns and operates its personal warehousing and supply infrastructure, enabling it to supply environment friendly and dependable order success and supply providers.

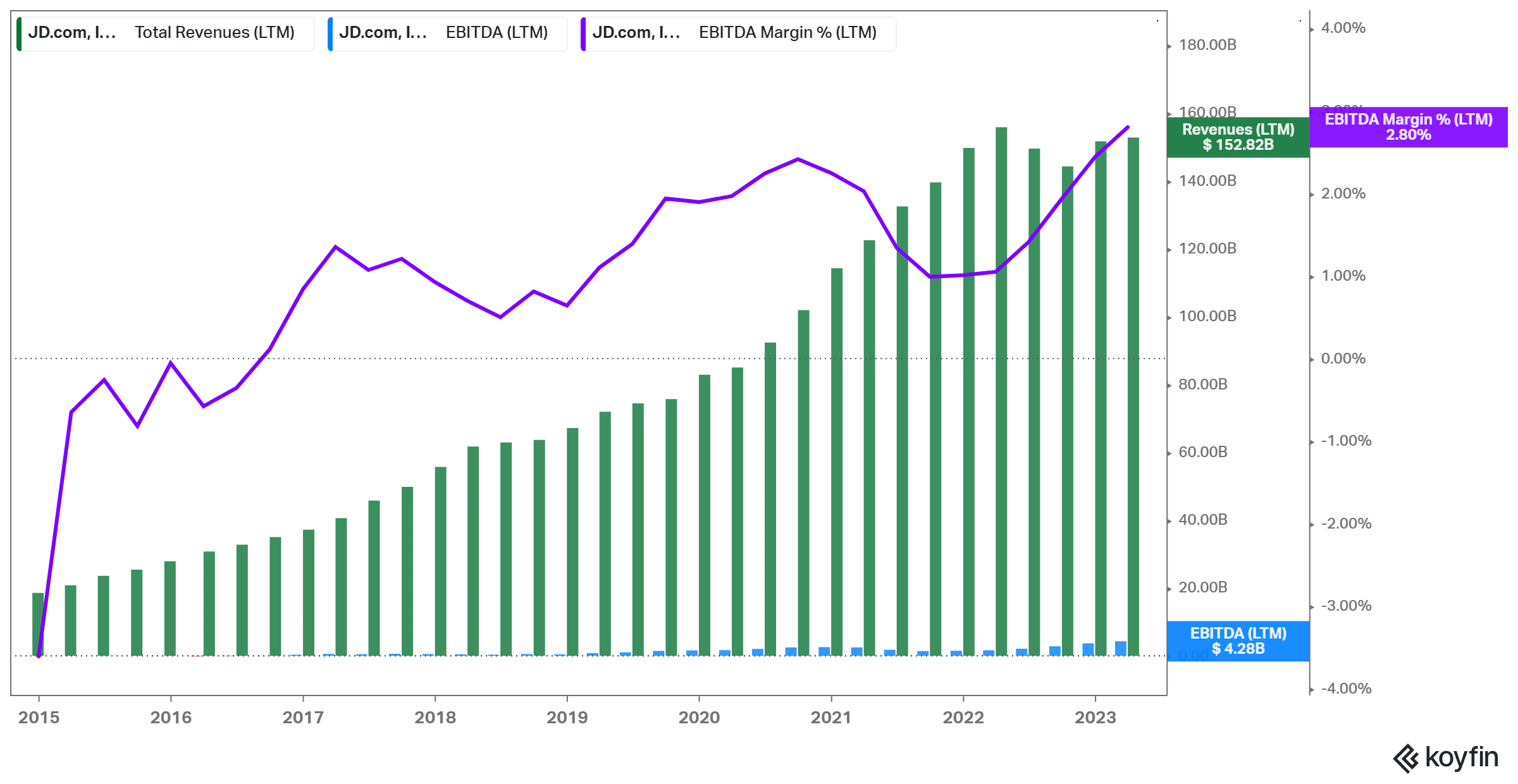

The corporate has been rising its revenues and enhancing profitability quickly as its ever-lasting scaling part persists. That stated, observe that because of its capital-intensive enterprise mannequin, JD.com is a low-margin enterprise with its EBITDA margins remaining under 3%.

Dr. Burry boosted Scion’s place on JD.com by 233% in the course of the earlier quarter. It’s now the fund’s largest holding.

Signet Jewelers Restricted (SIG)

Bermuda-based Signet Jewelers is a famend multinational specialty jewellery retailer with a wealthy historical past spanning over 100 years. The corporate operates a various portfolio of well-known retail manufacturers, making it one of many largest jewellery retailers globally. Signet’s major market is the US, nevertheless it additionally has a major presence in the UK and Canada.

The corporate’s origins might be traced again to 1910 when the primary retailer, known as the “Ratner Group,” was opened in London. Over time, the corporate expanded its presence and made a number of acquisitions, together with the acquisition of the American jewellery retailer Sterling Jewelers Inc. in 1987. The acquisition of Sterling Jewelers propelled Signet’s progress and positioned it as a serious participant within the jewellery business.

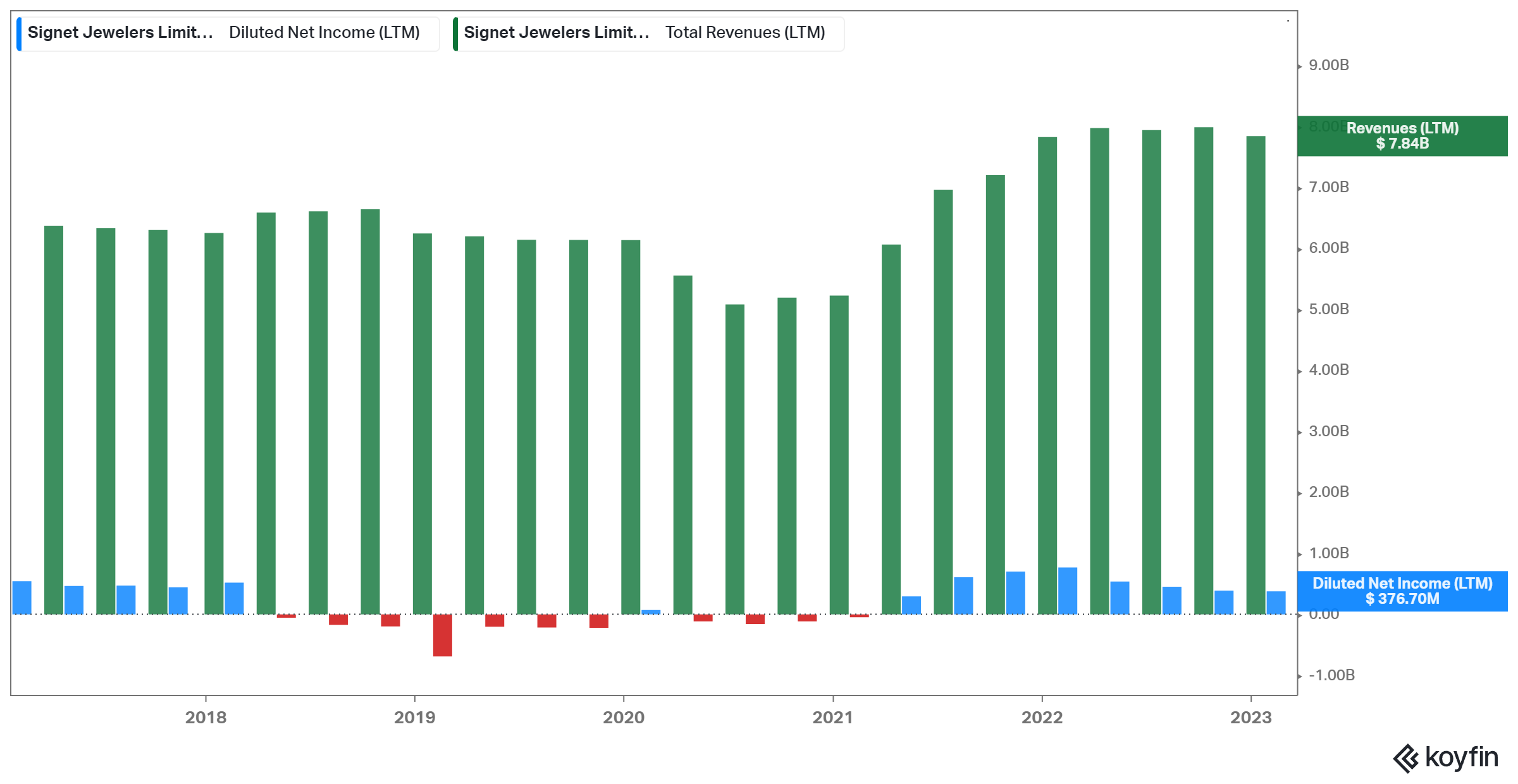

Signet’s cyclical enterprise mannequin can lead to fluctuating profitability prospects. Throughout the pandemic, as an example, when demand for jewellery declined, Signet reported sustained losses. That stated, business situations have now been restored, and Signet’s profitability has resumed. The corporate additionally pays a dividend, which at present yields 1.3%.

Signet Jewelers is a brand new holding for Scion Asset Administration, which initiated a place in its most up-to-date quarterly filings. It’s now the fund’s second-largest holding, accounting for 9.4% of its holdings.

Coherent Corp. (COHR)

Coherent Corp. produces and manufactures, and sells engineered supplies, optoelectronic parts, and units internationally. The corporate’s huge portfolio of merchandise consists of optical and electro-optical parts and supplies, fiber lasers, infrared optical parts, and high-precision optical assemblies, amongst others.

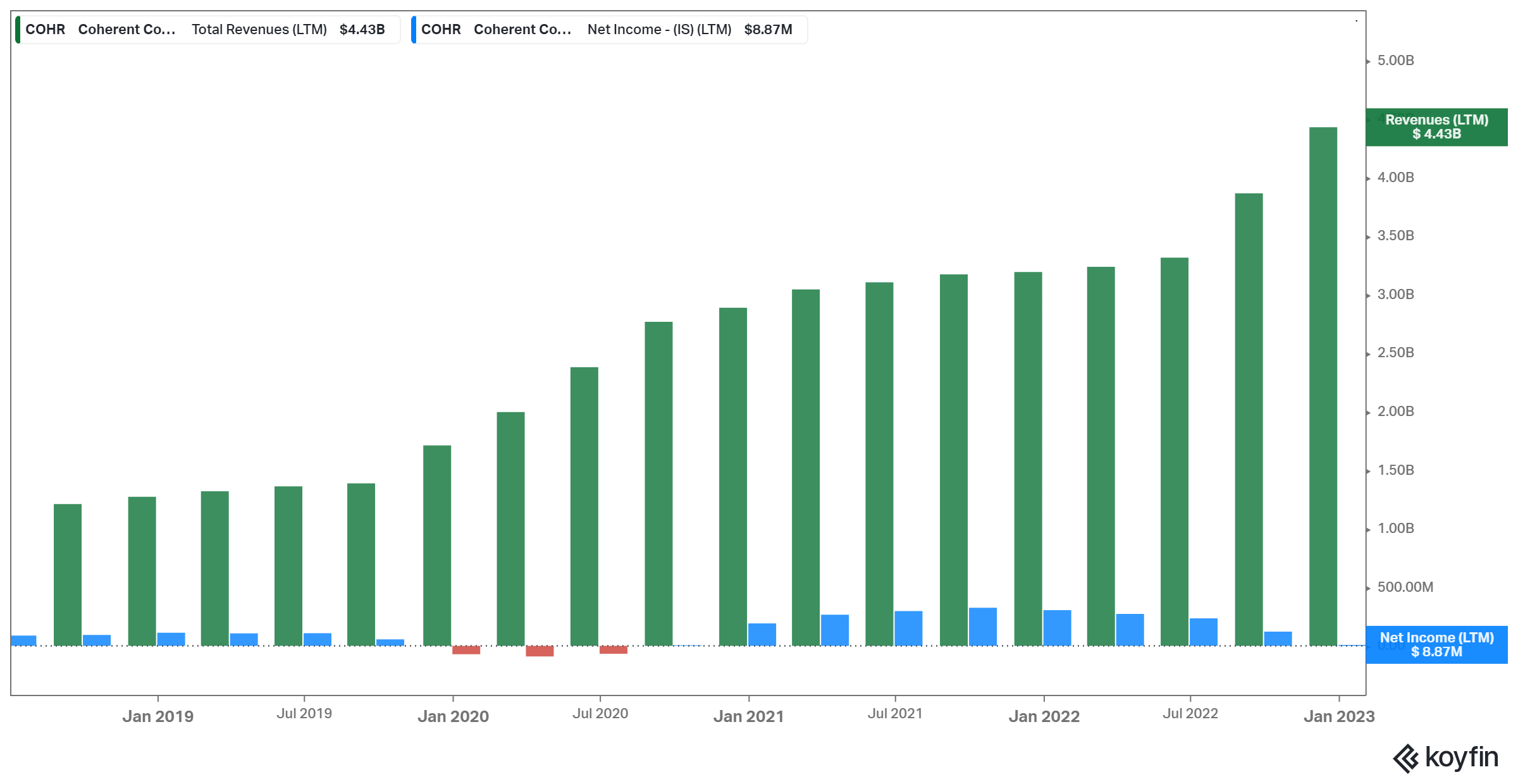

Demand for the corporate’s merchandise has remained sturdy recently, however inflationary pressures on the bills facet of the revenue assertion have suppressed profitability severely. It is a low margin enterprise within the first place, and so regardless of the corporate posting document revenues final 12 months, it noticed a decline in earnings.

Black Knight is a brand new holding for Scion Asset Administration, initiated in its most up-to-date quarterly filings. It’s now the fund’s third-largest holding, accounting for 12.8% of its holdings.

Wolverine World Broad, Inc. (WWW)

Wolverine World Broad designs, produces, and distributes footwear, attire, and different equipment globally. The corporate’s working segments embrace Energetic Group, Work Group, and Life-style Group, which individually focus wherever from informal footwear and attire to industrial work boots and attire.

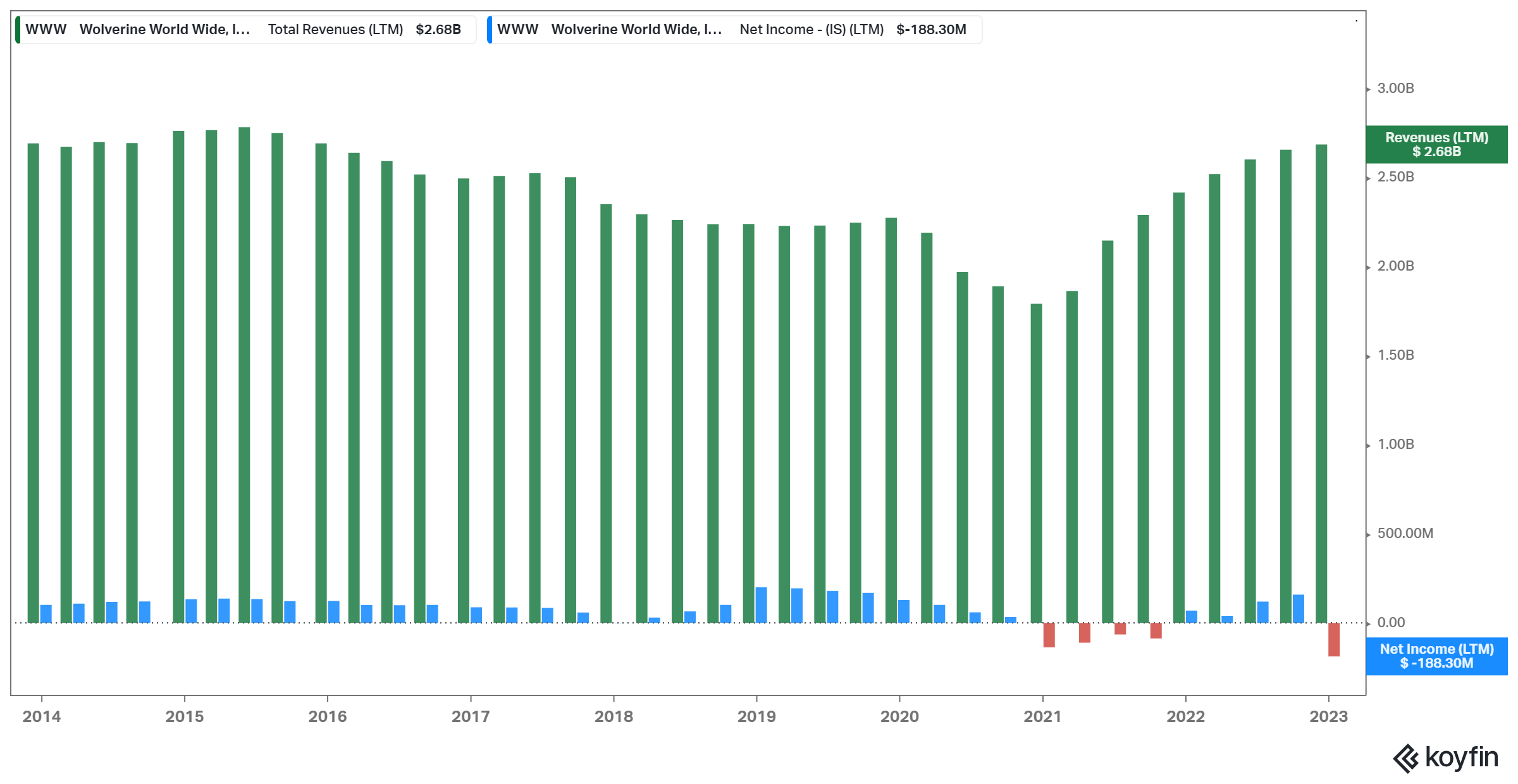

Competitors has been consuming the corporate’s lunch for years, with Wolverine having a tough time sustaining its gross sales over the previous decade, not to mention rising them. Profitability has additionally been weak. Michael Burry is probably going betting on Wolverine as a distressed fairness play, as the corporate’s gross sales are nonetheless greater than twice its present market cap.

Wolverine World Broad is a brand new holding for Scion Asset Administration, initiated in its most up-to-date quarterly filings. It’s now the fund’s fourth-largest holding, accounting for 10.7% of its holdings.

Alibaba Group Holding Restricted (BABA)

China-based Alibaba Group is one other Chinese language holding of Scion administration’s portfolio following JD.com.

Alibaba is a multinational conglomerate and one of many world’s largest e-commerce corporations. It was based in 1999 by Jack Ma. As we speak, it operates varied on-line platforms that facilitate business-to-business (B2B), business-to-consumer (B2C), and consumer-to-consumer (C2C) gross sales.

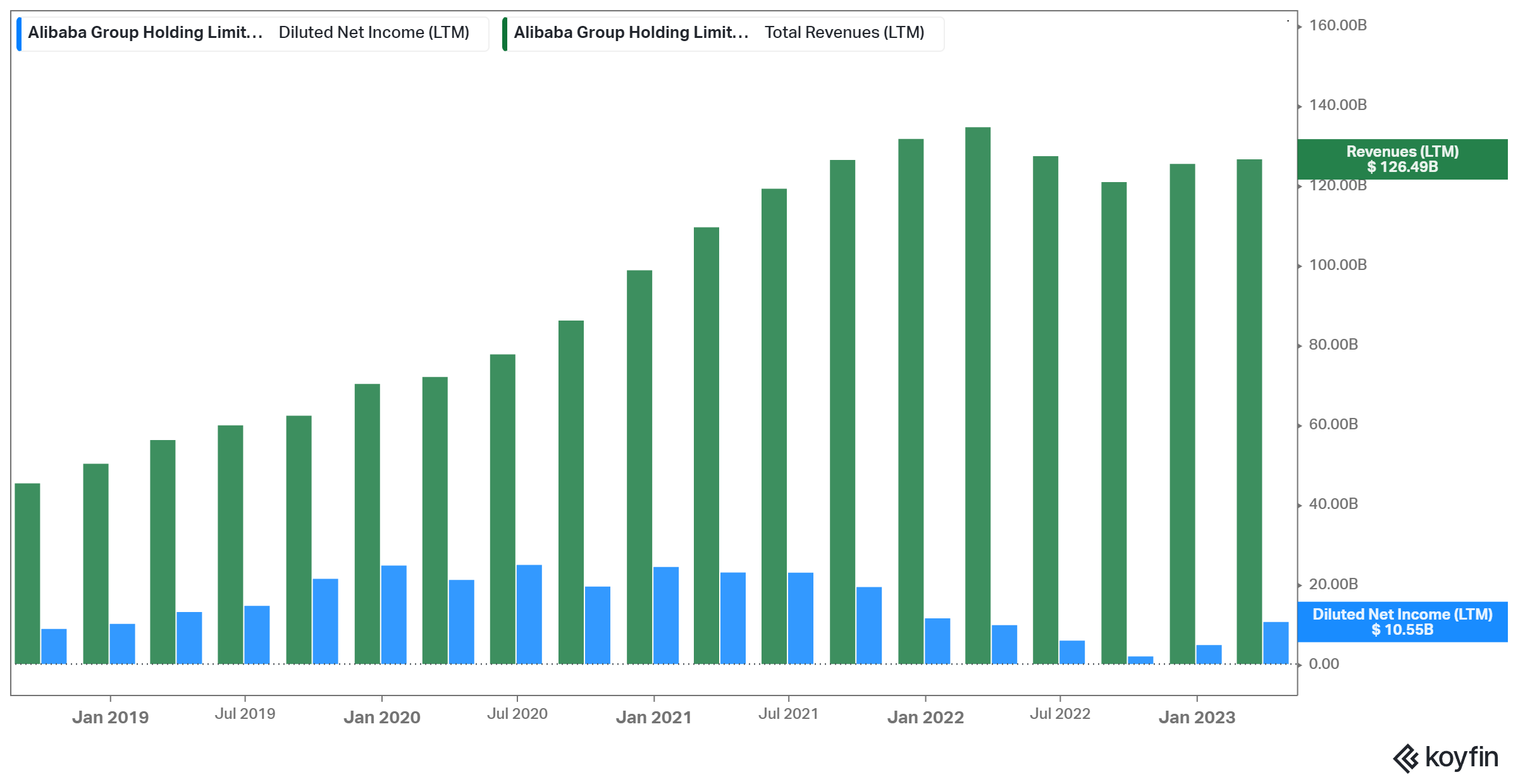

Sadly, shares of the Chinese language e-commerce behemoth have remained underneath strain regardless of the corporate producing slightly sturdy revenues, given the continuing buying and selling atmosphere. The underside line has softened recently because of inflationary pressures and provide chain inefficiencies, however income are nonetheless substantial.

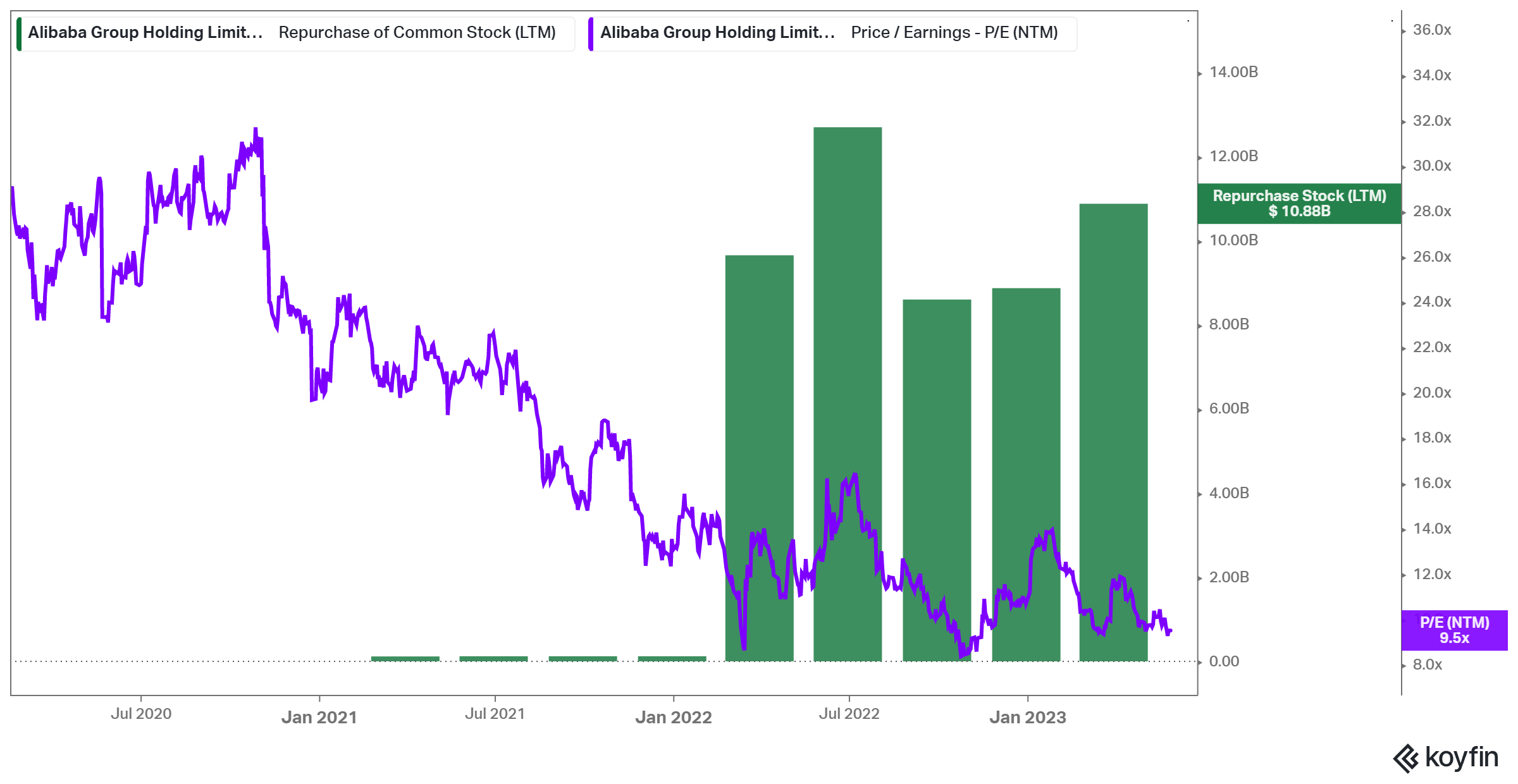

The inventory’s valuation has been compressed to a really low ahead P/E ratio of about 9.5X, primarily as a result of buyers have been ditching Chinese language equities because of the ongoing geopolitical dangers concerned. In response, Alibaba has been repurchasing inventory in bulk. Particularly, the corporate repurchased almost $10.9 billion price of inventory over the previous 4 quarters. Michael Burry is probably going betting on the inventory’s valuation ranges normalizing as we advance, which feels like an affordable funding case given Alibaba’s wonderful financials.

Alibaba is a comparatively new holding for Scion Asset Administration, initiated in This fall-2022. It’s now the fund’s third-largest holding, accounting for 9.1% of its holdings.

New York Group Bancorp, Inc. (NYCB)

New York Group Bancorp was based in 1859 as Queens County Financial savings Financial institution. Over time, it has grown via mergers and acquisitions to change into one of many largest banks within the New York space.

The corporate gives a spread of banking services and products to people, companies, and municipalities. Its choices embrace private and enterprise banking, residential and business actual property loans, multi-family and mixed-use loans, development and improvement loans, and varied deposit merchandise.

Whereas quite a few regional banks have confronted important challenges amid the continuing banking disaster, New York Group Bancorp has demonstrated outstanding resilience. That is evident within the outstanding efficiency of its share worth, which has remained steadfast compared to its counterparts within the business. This doubtless explains Dr. Burry’s determination to go lengthy on this banking participant.

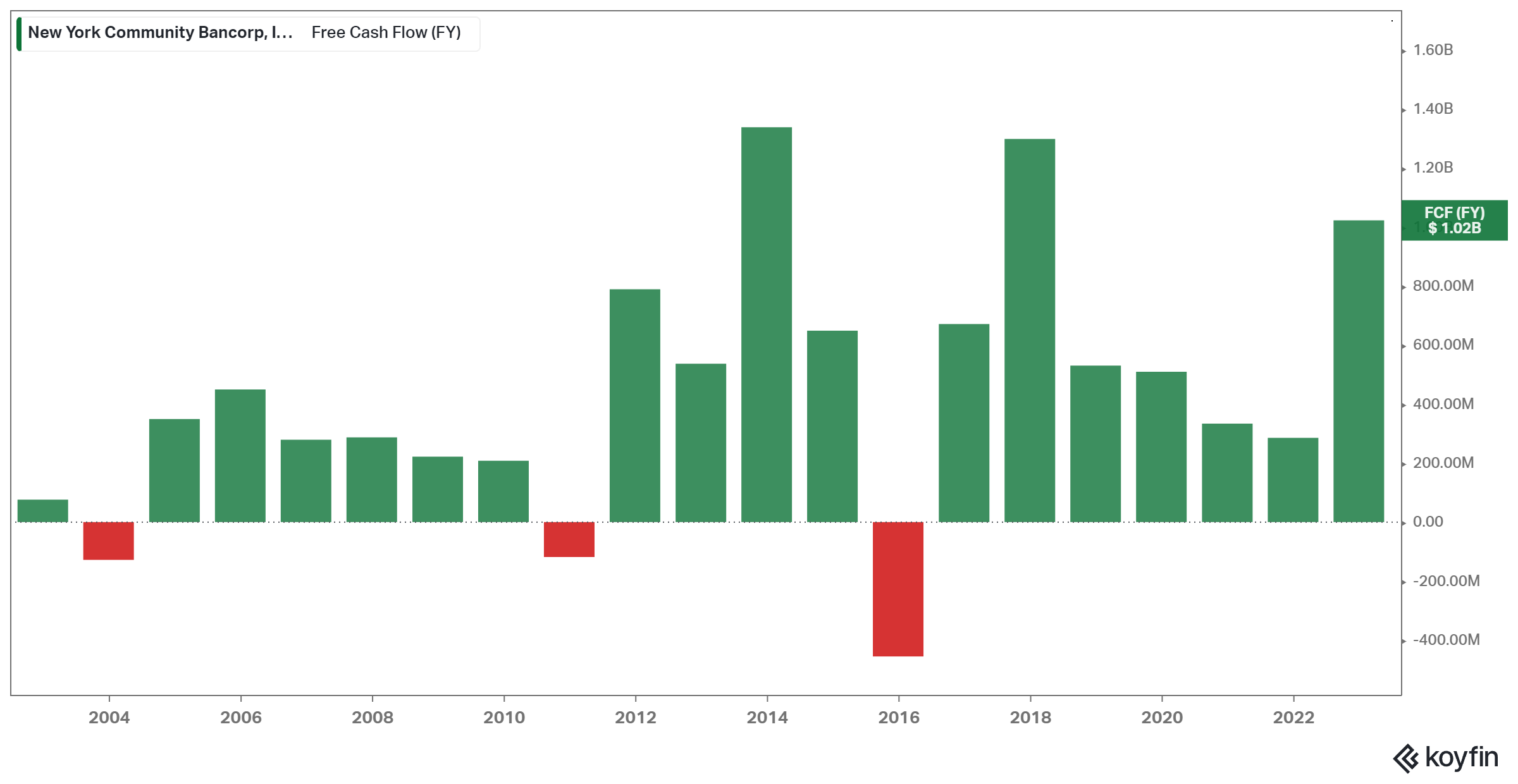

New York Group Bancorp generated about $1.0 billion in free money move final 12 months, implying a double-digit free money move yield on the inventory’s present worth ranges.

The inventory is Scion Asset Administration’s fourth largest holding, making up round 9% of its fairness portfolio.

Capital One Monetary Company (COF)

Capital One Monetary Company is a number one American financial institution holding firm specializing in bank cards, auto loans, banking, and financial savings accounts. With headquarters in McLean, Virginia, the corporate operates primarily in the US, though it has expanded its providers globally. Capital One is well known for its various vary of monetary services and products, cutting-edge expertise, and robust buyer focus.

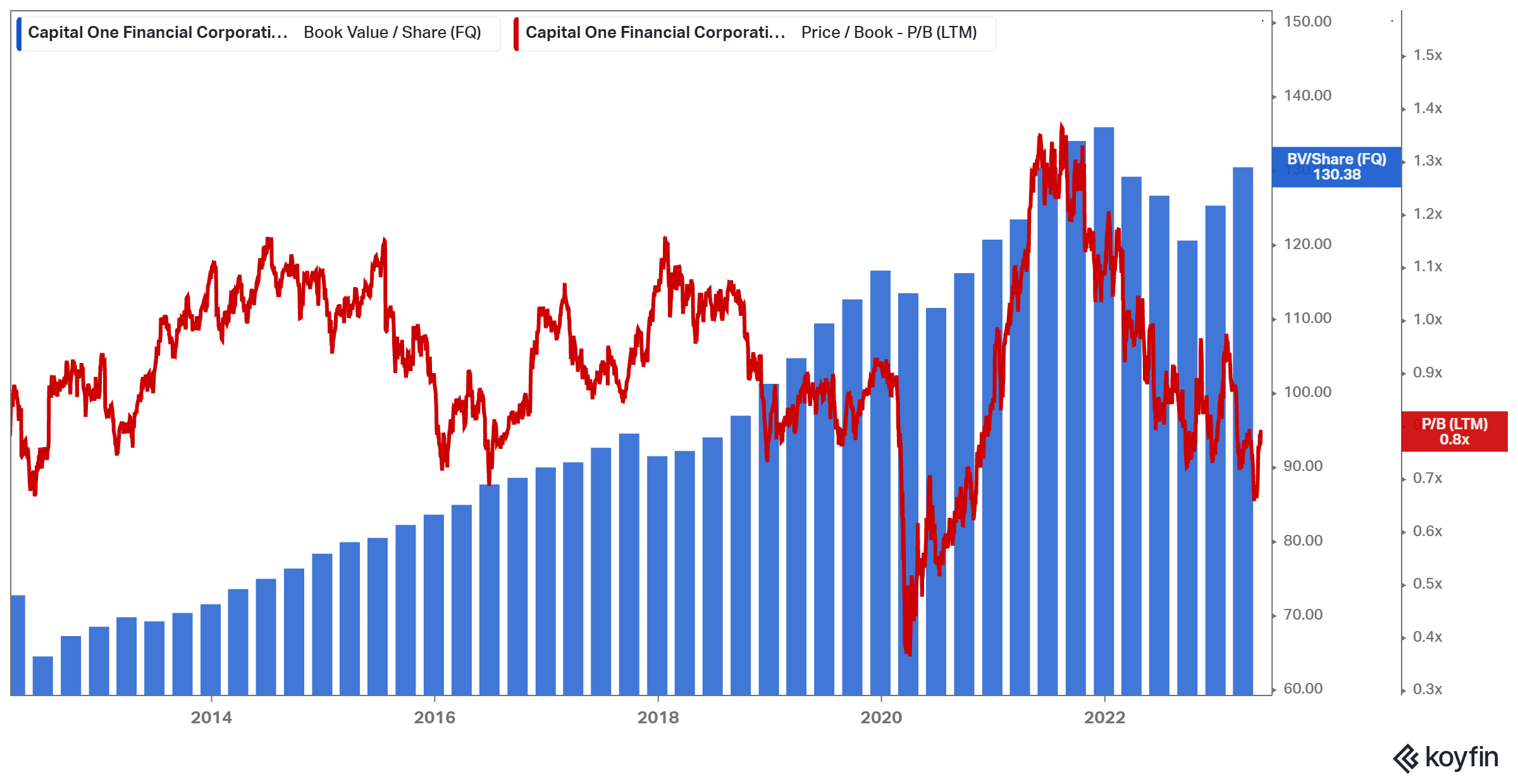

Shares of Capital One have plummeted in current months because of an ongoing disaster regional banks have been experiencing. The disaster emerged as a consequence of assorted parts, encompassing the swift surge in rates of interest that led to important drops available in the market price of Treasury bonds and government-backed mortgage securities held by regional banks. Moreover, excessive ranges of uninsured deposits, regulatory rollbacks, and inadequate oversight by the US Federal Reserve additional contributed to the turmoil.

Dr. Burry’s determination to put money into Capital One following this occasion is probably going a vote of confidence for the corporate, suggesting he believes the market could have oversold the inventory in current months. The inventory seems to be buying and selling under its ebook worth as effectively.

Capital One is Scion Asset Administration’s fifth-largest holding, making up round 6.8% of the fund’s fairness portfolio.

Last Ideas

Following the huge triumph he skilled by efficiently predicting the subprime mortgage disaster of 2007-2008, Dr. Michael Burry has grown right into a dwelling legend on the earth of finance. His solemn investing philosophy has resulted in outsized market returns over the previous few years, beating the S&P 500 by a large margin.

Whereas Scion Asset Administration’s portfolio lacks diversification, its holdings include traits that mirror Dr. Burry’s rules. However, most shares within the fund appear to be bearing their fair proportion of dangers. Thus, be aware and conduct your individual analysis earlier than allocating your hard-earned cash to any of those names.

Further Assets

See the articles under for evaluation on different main funding companies/asset managers/gurus:

In case you are fascinated with discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases will likely be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].