Silver, like gold, has returned to the highlight this 12 months with the dear steel not too long ago buying and selling at its highest in a 12 months at just below $26 an oz.

Previously month, silver costs have gone up almost 20%, eclipsing the S&P 500’s approximate 5% achieve over the identical interval, in addition to outpacing different valuable metals, together with gold (9%), platinum (10%) and palladium (12%).

The enhance to silver comes as the worth of the US greenback, an alternate safe-haven asset, has struggled, falling about 2% over the previous month and greater than 9% since a 20-year peak final September.

Assuming the US Federal Reserve proceeds to chop rates of interest, silver may proceed on the present trajectory at the least till the tip of 12 months as the chance value of holding metals will get decrease.

Some are already claiming that is “the 12 months” for silver because it latches onto an inflation-fueled rally to finally surpass the $30-an-ounce mark that was final seen 9 years in the past.

Such projection will not be unwarranted; there’s loads of historic proof to recommend that silver often outperforms gold in years of excessive inflation. Furthering silver’s funding attraction is the final expectation {that a} recession may quickly befall.

However that’s not all. Behind the bullish outlook is an enormous imbalance present in silver’s market fundamentals that’s supporting larger costs.

Largest Provide Deficit

Analysts have lengthy been pointing to a “extreme scarcity” of silver as a result of relentless progress in demand for the steel, which is utilized in many industrial purposes corresponding to automotive and electronics.

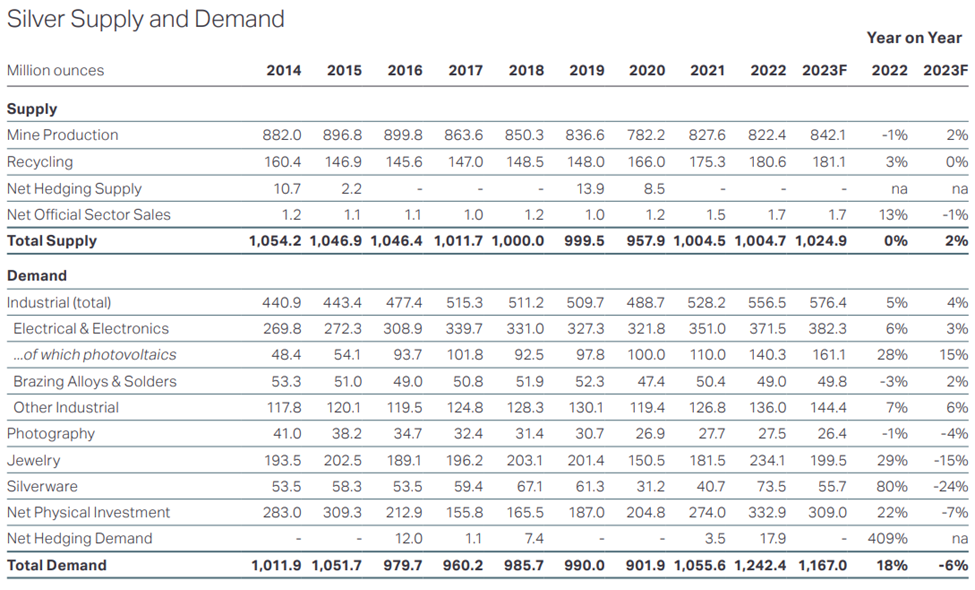

The brand new business figures assist to color a clearer image. Knowledge from the Silver Institute exhibits that international silver demand has elevated by 38% since 2020 as world economies proceed to get well from the Covid-19 pandemic.

Final 12 months, demand for silver surged by 18% to a document excessive 1.24 billion ounces in opposition to a stagnant provide, stretching the market deficit to a second straight 12 months, the Silver Institute mentioned in its newest publication.

In line with the 2023 World Silver Survey, the worldwide silver market was undersupplied by 237.7 million ounces in 2022, which the Institute says is “probably essentially the most vital deficit on document.”

What’s extra unsettling is that it took simply two years of undersupply — the 2022 deficit and the 51.1Moz shortfall from 2021 — to wipe out the cumulative surpluses from the earlier decade, and this demand-supply hole is prone to stay for the foreseeable future.

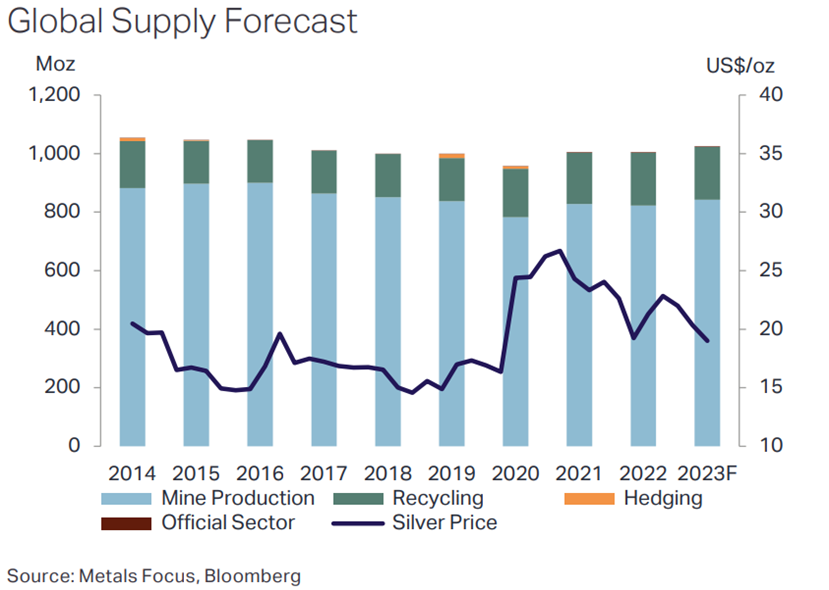

Supply: Metals Focus

“We’re shifting into a special paradigm for the market, certainly one of ongoing deficits,” mentioned Philip Newman at Metals Focus, the analysis agency that ready the Silver Institute’s knowledge.

“Silver demand was unprecedented in 2022, and we don’t say that to attempt to be sensational, that’s the solely technique to describe the market,” Newman acknowledged in an interview with Kitco Information this week.

Supply: The Silver Institute

Supply: The Silver Institute

In 2023, we’re almost certainly going to see a repeat of final 12 months, with strong demand and a slight enhance (2%) in mine manufacturing.

The Silver Institute is forecasting one other 1.17 billion ounces being demanded this 12 months, in opposition to a projected provide of 1.02 billion ounces. Whereas this could shut the hole to 142.1 million ounces, it might nonetheless be the second-largest deficit in over 20 years.

“Even when a number of the markets usually are not as robust in comparison with final 12 months, demand remains to be anticipated to be very strong,” Newton informed Kitco Information.

Supply: The Silver Institute

Supply: The Silver Institute

Document Industrial Demand

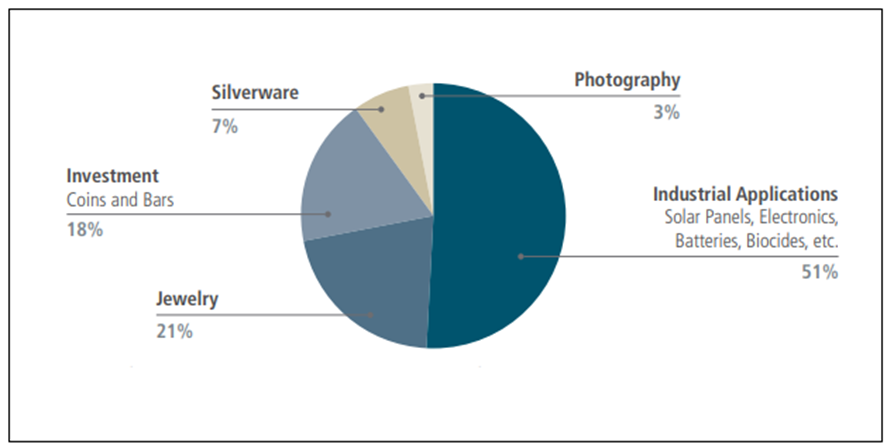

Of all the most important demand classes, arguably the most important driving pressure is silver’s industrial significance.

Not like gold, which is principally purchased as an funding or for jewellery, silver is extra of an industrial steel. It’s estimated that roughly 60% of immediately’s silver is used for industrial functions corresponding to electronics, photo voltaic cells, automotive and soldering, with the remaining 40% obtainable for funding.

Supply: Supply: GFMS Definitive, Metals Focus, The Silver Institute, UBS

Supply: Supply: GFMS Definitive, Metals Focus, The Silver Institute, UBS

As such, silver’s worth is primarily pushed by demand from the commercial sectors, which the Silver Institute tasks to achieve an all-time excessive this 12 months at 576.4 million ounces, a 4% rise over 2022 after a 5% enhance the 12 months earlier than.

What’s extra, demand for silver within the subsequent few years is anticipated to carry “broadly regular” even with downward swings from the funding and jewellery classes, the Silver Institute says, as the worldwide shift to wash vitality means extra of the steel will probably be wanted for photo voltaic photovoltaic (PV) cells and electrical automobiles on prime of the traditional industrial wants.

This structural change in silver demand additionally builds on promising cyclical elements corresponding to GDP progress, and specifics corresponding to features for client electronics, an extra rise in automobile output and progress for the development business.

“Some new (or newer) makes use of (corresponding to PV) will see additional thrifting and/or substitution in silver use however thrifting general is anticipated to stay slight as, for many purposes, silver use is already working on the naked minimal,” the Silver Institute wrote in its report.

“All this explains why we count on industrial demand to outpace general GDP progress, marking a turnaround from the final decade’s scenario,” it added.

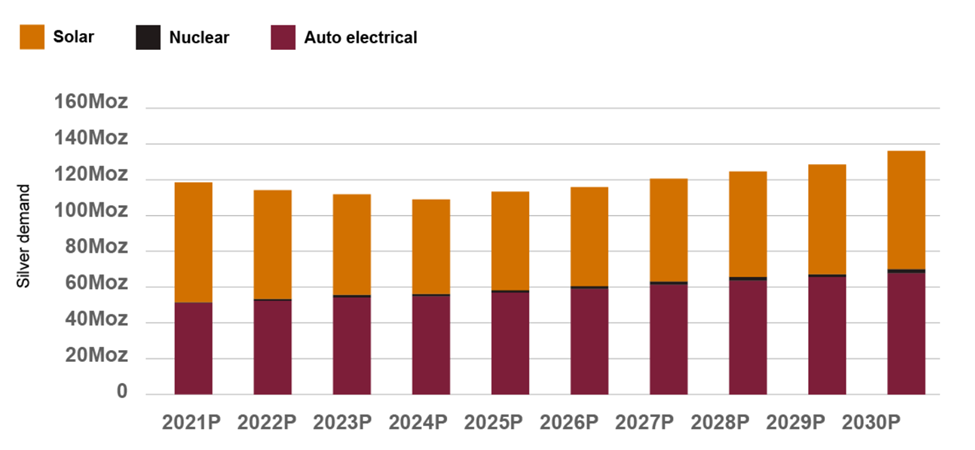

Wanting into the following decade, the Silver Institute expects appreciable curiosity in silver as the worldwide transition to renewable vitality intensifies.

Because the steel with the very best electrical and thermal conductivity, silver is ideally suited to photo voltaic panels. A 2020 Saxo Financial institution report acknowledged that “potential substitute metals can’t match silver when it comes to vitality output per photo voltaic panel.

Utilizing silver as conductive ink, photovoltaic cells rework daylight into electrical energy. Silver paste throughout the photo voltaic cells ensures the electrons transfer into storage or in the direction of consumption, relying on the necessity. It’s estimated that roughly 100 million ounces of silver are consumed per 12 months for this function alone.

Evaluation by BMO Capital Markets has annual silver consumption by the photo voltaic business rising even larger at 85% to about 185 million ounces inside a decade.

The position of silver within the inexperienced vitality revolution. Supply: Bloomberg

The position of silver within the inexperienced vitality revolution. Supply: Bloomberg

Within the Silver Institute’s report, demand from photovoltaics climbed 15% final 12 months to 140.3 million ounces, and is anticipated to surge one other 28% to 161.1 million ounces in 2023, by which demand would’ve been about 3 times that of 2015.

Long term, demand from the photo voltaic market is anticipated to maintain up this tempo. The institute, which references a World Financial institution projection for the vitality expertise phase as a foundation for its predictions, forecasts that consumption may finally hit 500 million ounces by 2050.

And with no sudden, massive injection of provide, it received’t be stunning to see the present silver deficit lengthen past the tip of this decade whereas setting new data alongside the best way.

Constructive Outlook

Whereas there could be no such factor as “protected bets” with regards to commodities, silver might be the closest factor due to its strong fundamentals, appearing as a help for the steel’s long-term pricing.

Over the previous three months, it has even outperformed gold “primarily because of actual or perceived future demand for silver because of industrial utilization elements,” says Michael Cuggino, president and portfolio supervisor of the Everlasting Portfolio Household of Funds.

As Metals Focus factors out, the worldwide silver market is getting into a brand new period the place sizable deficits could possibly be the frequent theme 12 months to 12 months, fueling a constructive outlook for silver.

Nicky Shiels, head of metals technique at valuable metals firm MKS PAMP, predicts that silver is anticipated to publish deficits of greater than 100 million ounces over the following 5 years, with industrial demand spurring the tight provide.

That demand, in keeping with Shiels, is anticipated to develop greater than 15% over that interval, hinging on accelerated industrial demand from automotive and electronics purposes.

“The biggest phase of silver demand is industrial, [which equates] to virtually 50% of whole demand,” she informed CNBC earlier this 12 months, calling for a base case of silver costs to climb to $28, with a bullish case of $30 or extra.

With the correct mix of things, silver may go loads larger, “simply into the $30s,” Cuggino seconded.

Again in February 2022, David Morgan of the Morgan Report informed Investing Information there was potential for silver to hit US$50 within the quick time period, as “excessive ranges of inventory market volatility may make the white steel extra enticing to buyers.”

Silver mining executives, too, are optimistic. Randy Smallwood of Wheaton Treasured Metals mentioned that “I’m very bullish on gold, however I’m much more bullish on silver.”

“We hit peak silver provide again about 5, six years in the past. Silver manufacturing on a worldwide foundation has truly been dropping, and we’re not seeing as a lot silver produced from the mines,” he acknowledged in a CNBC interview.

Peak silver

Peak mined silver reached

The case for peak gold, silver and copper

Keith Neumeyer of First Majestic Silver even believes that the steel’s value may hit triple digits, partly as a result of the present market cycle could be in comparison with the 12 months 2000, when buyers have been crusing excessive on the dot-com bubble and the mining sector was down.

“It’s solely a matter of time earlier than the market corrects, prefer it did in 2001 and 2002, and commodities see a giant rebound in pricing,” he acknowledged in an interview with Wall Avenue Silver in August.

Doable Headwinds

Nonetheless, some analysts desire to be cautious about silver’s outlook within the short-term, as the worth has already damaged the important thing $20 per ounce stage and rates of interest are rising.

The World Financial institution’s October 2022 Commodity Markets Outlook noticed the silver value averaging $21 all year long, after which staying fixed on the identical stage all through 2024.

In its annual survey, the Silver Institute says costs ought to common $21.30 an oz this 12 months, which is 2% decrease than final 12 months’s common of $21.73, owing to a decline in funding demand.

“We expect that institutional funding will finally run out of steam, as we consider that the present market consensus that the Fed will probably be pressured to chop charges in H2 will probably be confirmed flawed,” the institute mentioned.

Moreover, recession fears may result in softer industrial demand, which can trigger silver costs to drop as little as $18 per ounce, in keeping with MKS PAMP. The Silver Institute additionally sees silver costs falling to this stage earlier than year-end.

The largest danger to silver costs is that if inflation falls away quicker than anticipated, Janie Simpson, managing director at ABC Bullion, elaborated.

“If the Fed continues to tighten, and if inflation falls away extra quickly than the market expects, that will probably be a headwind for silver,” she defined, “particularly if the economic system heads right into a recession, given the massive share of silver demand tied to industrial output.”

5 causes gold and silver may rally quickly

Capitalize on junior’s delta

Conclusion

Lengthy story quick, silver’s short-term outlook is all the way down to a matter of the impacts of a recession on industrial demand weighing in opposition to its “protected haven” standing throughout unsure occasions. However over an extended horizon, there are causes to be bullish.

A more in-depth take a look at the silver value dynamics during the last 5 years signifies {that a} bullish pattern has been established since round mid-2020. The primary hurdle to a breakout was the Fed’s rate of interest hikes, which in flip strengthened the US greenback, however a brand new enterprise cycle of decrease charges and weaker greenback would take away that.

After which there’s the vitality transition, which presents an excellent situation for silver costs to rise.

As Wells Fargo described beforehand: “Commodities have been in a supercycle since 2020, with silver seeking to play a particular position, particularly contemplating how low cost it’s relative to different commodities.”

Richard (Rick) Mills

aheadoftheherd.com

Authorized Discover / Disclaimer

Forward of the Herd publication, aheadoftheherd.com, hereafter often called AOTH.

Please learn the complete Disclaimer fastidiously earlier than you employ this web site or learn the publication. If you don’t comply with all of the AOTH/Richard Mills Disclaimer, don’t entry/learn this web site/publication/article, or any of its pages. By studying/utilizing this AOTH/Richard Mills web site/publication/article, and whether or not you truly learn this Disclaimer, you might be deemed to have accepted it.

Any AOTH/Richard Mills doc will not be, and shouldn’t be, construed as a suggestion to promote or the solicitation of a suggestion to buy or subscribe for any funding.

AOTH/Richard Mills has primarily based this doc on data obtained from sources he believes to be dependable, however which has not been independently verified.

AOTH/Richard Mills makes no assure, illustration or guarantee and accepts no duty or legal responsibility as to its accuracy or completeness.

Expressions of opinion are these of AOTH/Richard Mills solely and are topic to vary with out discover.

AOTH/Richard Mills assumes no guarantee, legal responsibility or assure for the present relevance, correctness or completeness of any data supplied inside this Report and won’t be held answerable for the consequence of reliance upon any opinion or assertion contained herein or any omission.

Moreover, AOTH/Richard Mills assumes no legal responsibility for any direct or oblique loss or harm for misplaced revenue, which you’ll incur because of the use and existence of the knowledge supplied inside this AOTH/Richard Mills Report.

You agree that by studying AOTH/Richard Mills articles, you might be appearing at your OWN RISK. In no occasion ought to AOTH/Richard Mills answerable for any direct or oblique buying and selling losses attributable to any data contained in AOTH/Richard Mills articles. Info in AOTH/Richard Mills articles will not be a suggestion to promote or a solicitation of a suggestion to purchase any safety. AOTH/Richard Mills will not be suggesting the transacting of any monetary devices.

Our publications usually are not a suggestion to purchase or promote a safety – no data posted on this web site is to be thought of funding recommendation or a suggestion to do something involving finance or cash apart from performing your individual due diligence and consulting together with your private registered dealer/monetary advisor.

AOTH/Richard Mills recommends that earlier than investing in any securities, you seek the advice of with an expert monetary planner or advisor, and that it’s best to conduct a whole and impartial investigation earlier than investing in any safety after prudent consideration of all pertinent dangers. Forward of the Herd will not be a registered dealer, vendor, analyst, or advisor. We maintain no funding licenses and will not promote, supply to promote, or supply to purchase any safety.