There may be plenty of necessary financial knowledge to look ahead to on the finish of this week, together with the discharge of figures on Thursday and the on Friday, together with the and the ultimate studying of the College of Michigan survey for April.

Actual GDP is predicted to extend by 2% within the first quarter, whereas the is predicted to be at 3.7%, indicating a 5.7% nominal GDP development price. The Atlanta Fed GDPNow mannequin predicts a faster-projected development price of roughly 2.2% for the primary quarter, with inflation estimated to be round 4.1%, leading to a nominal GDP development price of 6.25%. Whereas this distinction shouldn’t be important, it’s value noting and contemplating for comparability functions.

Nominal GDP Chart

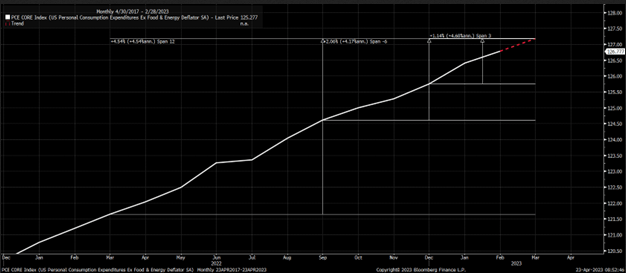

The March is anticipated to rise by 0.1% to 4.1% year-over-year, a lower from the 5.0% reported in February. Moreover, the is predicted to rise by 0.3% month-over-month, leading to a year-over-year improve of 4.5%, down from 4.6% in February.

If the Core PCE does rise by 0.3% for the month, the speed of change for the primary three months of the 12 months could be a 4.7% year-over-year improve. These Core PCE numbers are necessary to the Fed, and primarily based on the info from January by March, it appears that evidently no matter enchancment was seen on the finish of 2022 could also be fading.

Core PCE Chart

I’ve beforehand said that essentially the most difficult facet of the battle towards inflation could be within the 4 to five% vary, which is the present degree we’re experiencing. One other essential determine to be careful for is the CORE PCE Providers much less housing, which has not proven any important enchancment in current months and has been steadily rising, reaching 4.6% year-over-year in February.

PCE Chart

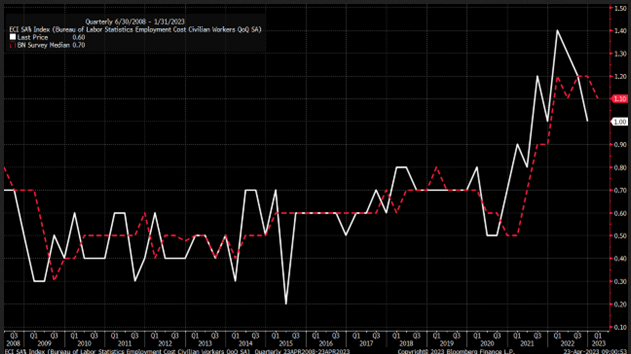

Along with the GDP and PCE knowledge, the Employment price index will likely be launched on Friday morning. It’s anticipated to rise to 1.1% from 1.0% within the fourth quarter.

ECI Chart

Regardless of some individuals believing that inflation is both over or nearing its finish, the estimates for the March PCE recommend that inflation remains to be a difficulty and that a lot work is left to be finished, even when the outcomes are available in as anticipated.

If the figures exceed expectations, it should additional help the case for not solely a price hike in Might but in addition a price hike in June. The likelihood of a price hike in June is presently at 22%, which is a big change from just some weeks in the past when price cuts have been anticipated.

Charge Hikes Chart

1. TLT

It’s potential that the rationale why iShares 20+ 12 months Treasury Bond ETF (NASDAQ:) and bond yields haven’t decreased is because of ongoing inflation issues. That is additionally why the TLT dangers dropping even decrease, presently hovering across the help degree of $104.

If that breaks, it may simply fall to $99.50. Regardless of a number of alternatives to rally past $109 since December, every time it has reached that value, it has stopped rising and reversed path. Due to this fact, it’s possible that the TLT has extra room to fall, which means that yields will proceed to rise.

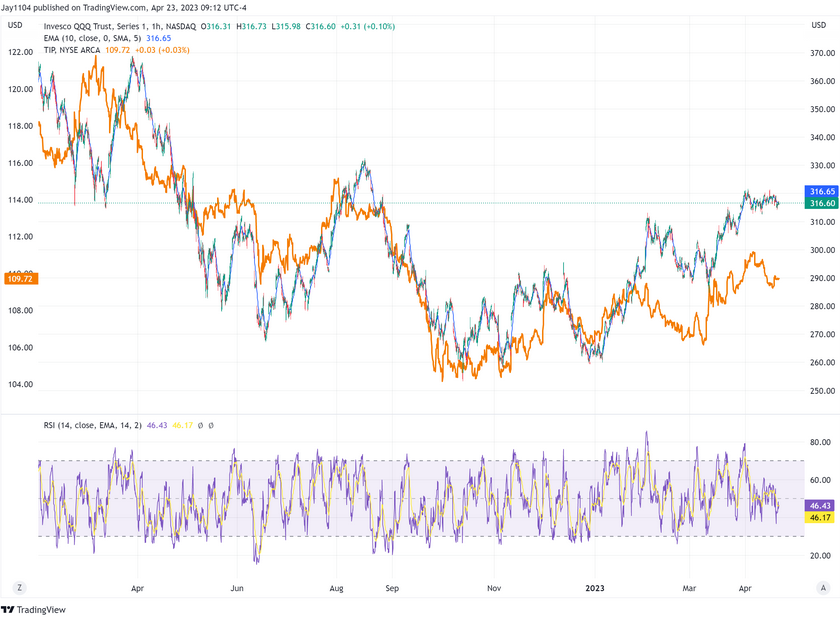

2. TIPS

The iShares TIPS Bond ETF (NYSE:) ETF, which measures actual yields, has skilled an analogous development to the TLT, with a number of alternatives to extend however failing to take action. At the moment, the TIP ETF seems to be forming a head and shoulders sample, which may probably end in a drop beneath the help degree of $108.50, confirming the sample and sending the TIP ETF again to the hole of round $106.

3. Nasdaq

One motive the Invesco QQQ Belief (NASDAQ:) has stopped rising often is the falling TIP ETF, which the QQQ ETF nonetheless intently correlates with. Because the TIP ETF continues to say no, it might damage the and the QQQ ETF.

If the TIP ETF continues to fall, it might damage the QQQ ETF and the , which has struggled to advance and seems to be trending decrease. Nonetheless, till the help degree at 4,080 is damaged, it’s troublesome to say that the bears have taken management. Nonetheless, a help break at 4,080 may end in important losses for the bulls, who could discover themselves trapped.

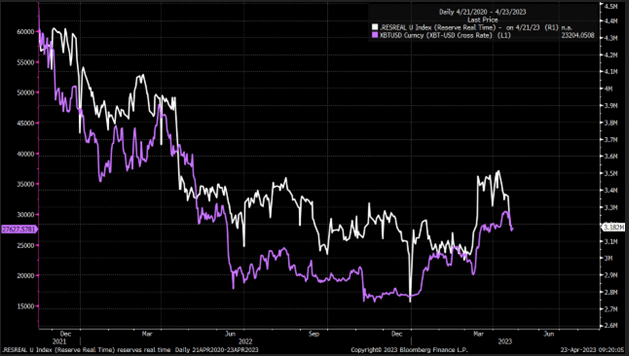

4. Bitcoin

may probably function a number one indicator this week concerning the market’s path, because it tends to be affected by adjustments in liquidity ranges first. With the TGA rising and reverse repo exercise remaining excessive, the liquidity that entered the market in mid-March is shortly leaving. Bitcoin may be very delicate to adjustments in reserve balances held on the Fed, that means it might reply to the altering liquidity ranges earlier than different belongings.

BTC-Reverse Repo Chart

5. Intel

Intel (NASDAQ:) can also be set to report its outcomes on Thursday, and the inventory’s breakout try from a number of weeks in the past is failing. The primary degree of help for the inventory is across the hole fill at $29.30, with a second one at $26.90. Each ranges may probably function help if the breakout try fails.

6. Microsoft

Microsoft (NASDAQ:) can also be set to report its outcomes on Tuesday after the shut. The inventory has been buying and selling in a decent vary since March 31 and seems to be in a distribution sample, simply churning on the highs. The vital degree to observe for Microsoft is $282, as a break of this degree might be a unfavorable signal and recommend a drop to $275 and probably again to $263.

Get All of the Info You Want on InvestingPro!

7. Roku

Roku (NASDAQ:) is reporting on Wednesday, and I’ve by no means seen the purpose of this inventory; for instance, my youngsters, who was once Roku customers, infrequently use it anymore. They’ll discover YouTube rather more simply from the Samsung app menu on our good TV. Help at $58 should maintain for Roku, or this inventory is going through a giant drop, maybe again to the lows, primarily based on the technical setup

8. Visa

Visa (NYSE:) will report on Tuesday after the shut, and this, together with Mastercard (NYSE:), and each have been the final word hedge towards inflation. In spite of everything, if costs, and their charge revenue rise, very straightforward and clear to understand. That’s in all probability why VISA may be very near breaking out at this level and heading to an all-time excessive.

This week’s FREE YouTube Video:

Authentic Submit