Individuals stroll close to the Google workplaces on July 04, 2022 in New York Metropolis.

John Smith | View Press | Getty Photographs

Try the businesses making headlines in noon buying and selling.

State Avenue, M&T Financial institution – Shares of State Avenue dropped 11% after the corporate posted disappointing earnings and income. State Avenue posted earnings of $1.52 per share on income of $3.10 billion, whereas analysts referred to as for per-share earnings of $1.64 and income of $3.12 billion, in response to Refinitiv. In the meantime, M&T Financial institution shares popped 5% greater after the financial institution reported beats on the highest and backside strains. Financial institution of New York Mellon, set to submit outcomes on Tuesday, slipped 5%.

Enphase Power, First Photo voltaic, SolarEdge Applied sciences – Photo voltaic power shares climbed throughout the board, with Enphase main the cost with a 7.2% acquire, whereas First Photo voltaic and SolarEdge added 5.4% and 4.3% respectively. Piper Sandler upgraded Enphase Power earlier on Monday from impartial to obese, citing doable 40% high line progress this 12 months.

Netflix — Shares of the streaming big dipped greater than 2%. The streaming big is about to submit its newest quarterly outcomes Tuesday after the bell. Credit score Suisse reiterated its impartial score on Netflix on Monday, saying it is cautious forward of its earnings.

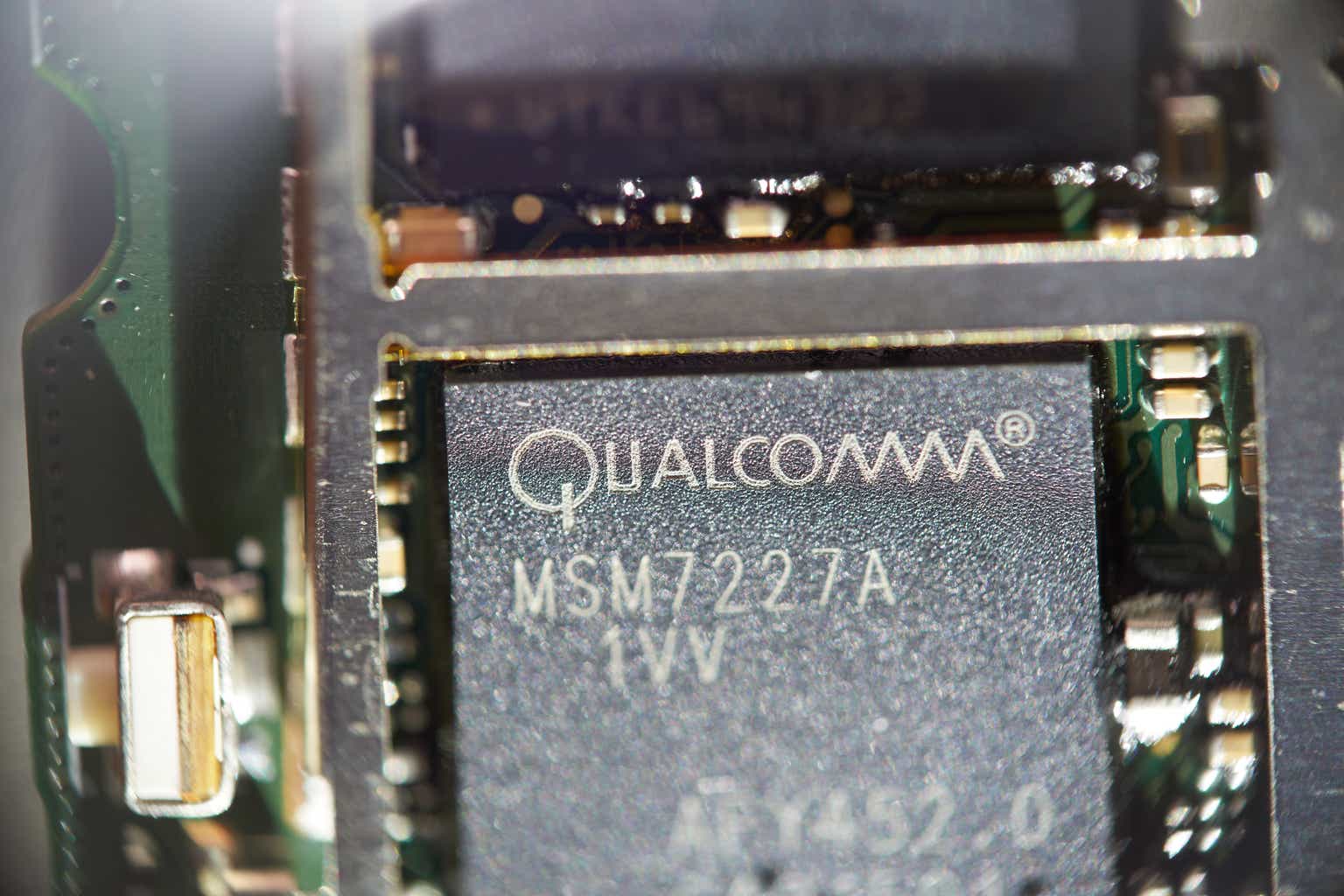

Alphabet – Shares of the Google mother or father slid 3% after The New York Instances reported that Samsung is contemplating ditching Google because the default search engine on its smartphones in favor of Microsoft’s Bing. The report, citing inside messages, stated Alphabet was spooked upon studying in regards to the discussions in March, and that about $3 billion in annual income is at stake.

Charles Schwab — Shares of Charles Schwab rose about 2.5% after the brokerage agency posted better-than-expected earnings on Monday. Schwab posted adjusted earnings of 93 cents per share, beating analysts’ forecast of 90 cents per share, in response to Refinitiv. The corporate’s income of $5.12 billion fell barely in need of analysts’ estimates. Schwab has confronted strain because the collapse of Silicon Valley Financial institution. Schwab, nonetheless, has defended its monetary place, noting its loan-to-deposit ratio is low.

Prometheus Biosciences – Shares of Prometheus Biosciences leapt practically 70%. The motion comes a day after Merck stated it will buy Prometheus for about $10.8 billion. Prometheus is growing a remedy for ulcerative colitis, Crohn’s illness and different autoimmune circumstances. Merck shares have been roughly flat.

Roblox— The gaming firm continued a pointy decline into noon buying and selling, with a lack of 11%. Roblox’s March metrics report disclosed the corporate expects common bookings per day by day consumer, which is the way it refers to income, to fall 12 months over 12 months.

Moderna — Shares of the vaccine maker have been 7% decrease on Monday. The motion follows an encouraging report a day earlier that confirmed early trial outcomes from a vaccine that used Merck’s immunotherapy Keytruda slashed the recurrence of lethal pores and skin most cancers melanoma.

Lumentum — The sunshine and laser firm superior 3.4% after JPMorgan upgraded the inventory to obese. The agency stated the present valuation may very well be pricing in “extra headwinds than practical” regardless of near-term demand challenges.

Okta — The cloud software program agency climbed 3.8% Monday, after UBS initiated protection of the corporate with a purchase score and highlighted the potential advantage of “continued id tailwinds.”

— CNBC’s Tanaya Macheel, Yun Li, Alex Harring, Pia Singh and Sarah Min contributed reporting