Gold and silver costs have risen sharply over the past month in response to the banking issues, a decrease greenback and the expectation that central financial institution coverage will ease in coming months. And the most recent from the IMF suggests that there’s extra to return. If the IMF (Worldwide Financial Fund) forecasts are proper, gold and silver costs will soar larger within the subsequent a number of quarters.

The IMF launched two of their flagship reviews on Tuesday April 11 – the International Monetary Stability Report and the World Financial Outlook replace.

The opening chapters of the International Monetary Stability Report deal with the “fault strains” which have been uncovered by the speedy financial coverage tightening by central banks. The underside line of the report is that the speedy enhance in charges has uncovered the monetary vulnerabilities considerably over the previous a number of months.

Main Monetary Stress Forward

The report factors out that monetary crises typically are preceded by financial tightening. The chart under from the IMF web site maps the US fed funds charge with main monetary stress intervals highlighted.

The report does attempt to say that the present monetary issues are totally different than the earlier intervals of monetary stress:

Monetary crises have typically been preceded by financial tightening, however the newest stress episode differs in vital respects from the 2008 international monetary disaster, the 1997 Asian monetary disaster, and the Nineteen Eighties US financial savings and mortgage disaster. Whereas the present stress is squarely within the banking system, the 2008 disaster shortly unfold from banks to nonbanks and off-balance sheet entities of banks. Moreover, the 2008 disaster was triggered by credit score losses as a consequence of housing market declines, whereas the present turmoil partially stems from unrealized losses in portfolios of protected, however falling-in-value, securities. Lastly, financial institution capital and liquidity guidelines and disaster administration frameworks have been strengthened considerably after the worldwide monetary disaster, serving to stem a broader lack of confidence and underpinning a swifter and higher coordinated coverage response. The present turmoil additionally differs from the Asian monetary disaster, when present account deficits and heavy exterior borrowing uncovered corporates and banks to change charge and funding dangers. And it differs from the Nineteen Eighties financial savings and loans disaster, which occurred outdoors of bigger banks, in entities with considerably much less capital and liquidity.

DON’T MISS

This has been an thrilling week for each gold and silver. We welcomed chart guru Patrick Karim again to the present, to take us via his expectations for the brand new quarter and he was even type sufficient to provide us some tops suggestions for any newbies to technical evaluation.

Nonetheless, the report goes on to ask questions on latest occasions within the banking sector as harbinger of extra systemic stress that can take a look at the resilience of the worldwide monetary system—a canary within the coal mine—or just the remoted manifestation of challenges from tighter financial and monetary situations after greater than a decade of ample liquidity.

And the reply to this query is that there are certainly different vulnerabilities lurking within the monetary system:

Stresses triggered by the tighter stance of financial coverage might end in additional bouts of monetary instability. Actions in riskier segments of capital markets corresponding to leveraged loans and personal credit score markets have slowed. Considerations have additionally been rising about situations in business actual property markets, that are closely depending on smaller banks. Whereas banking shares in superior economies have undergone important repricing, broad fairness indices stay very stretched in lots of nations, having appreciated markedly for the reason that starting of the 12 months. A extra in depth lack of investor confidence or a spreading of the banking sector strains into nonbanks may end in a broader sell-off in international equities. Some mutual funds have skilled outflows in latest weeks. Liquidity backstops and determination mechanisms are much less properly developed for nonbanks …

… Along with banking sector turmoil and fragile investor confidence, macro-financial volatility is also exacerbated by geopolitical fragmentation …

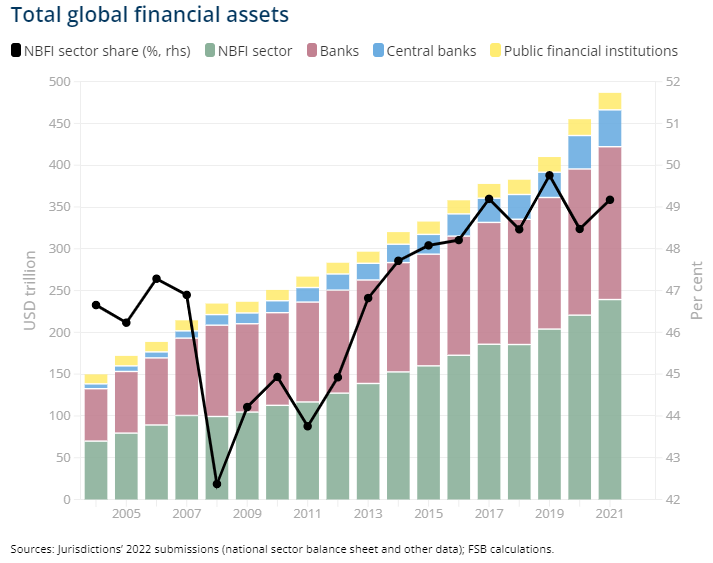

… The affect of tighter financial and monetary situations may very well be amplified due to monetary leverage, mismatches in asset and legal responsibility liquidity, and excessive ranges of interconnectedness throughout the NBFI (non-bank monetary establishments) sector and with conventional banking establishments. For instance, in an effort to extend returns, life insurance coverage corporations have doubled their illiquid investments over the past decade and likewise make rising use of leverage to fund illiquid property.

Will Central Financial institution Assist Ever Come to an Finish?

This ties into the query we requested in our March 30 submit The Fed is now in a tug-of-war between combating inflation and saving the banking system however the place does the assist from central banks finish? Solely with the banks? What in regards to the pension funds and life insurance coverage corporations that are dealing with the identical issues because the banks with declining values of longer-term authorities debt, which was deemed to be protected.

The NBFI sector is important, in truth the Monetary Stability Board estimates that the NBFI sector accounted for US$239.3 trillion (49.2%) of the $486.6 trillion in complete international monetary property in 2021.

The International Stability report additionally factors out that that is all taking place at lightning velocity over social media:

The latest banking turmoil additionally demonstrated the rising affect of cellular apps and social media in spreading sudden monetary asset allocations. Phrase of deposit withdrawals unfold globally at lightning velocity, doubtlessly signaling that future banking stress might unfold quicker and be much less predictable.

As well as, the report factors on the market are additionally vulnerabilities within the family sector:

Trying past monetary establishments, households gathered important financial savings in the course of the pandemic thanks partially to the fiscal assist and financial easing rolled out in the course of the pandemic. Nonetheless, they’re dealing with heavier debt-servicing burdens, eroding their financial savings and leaving them extra susceptible to default. The steep enhance of residential mortgage charges has cooled international housing demand. Common home costs fell in 60 p.c of the rising markets within the second half of 2022, whereas in superior economies worth will increase have slowed.

Geopolitical Tensions Put Strain on Monetary Dangers

The ultimate level from the International Stability report we need to spotlight is that the geopolitical tensions are additionally including to the monetary dangers:

Rising geopolitical tensions amongst main economies may increase monetary stability dangers by rising international financial and monetary fragmentation and adversely have an effect on the cross-border allocation of capital. This might trigger capital flows to abruptly reverse and will threaten macro-financial stability by rising banks’ funding prices. These results are more likely to be extra pronounced for rising markets and for banks with decrease capitalization ratios.

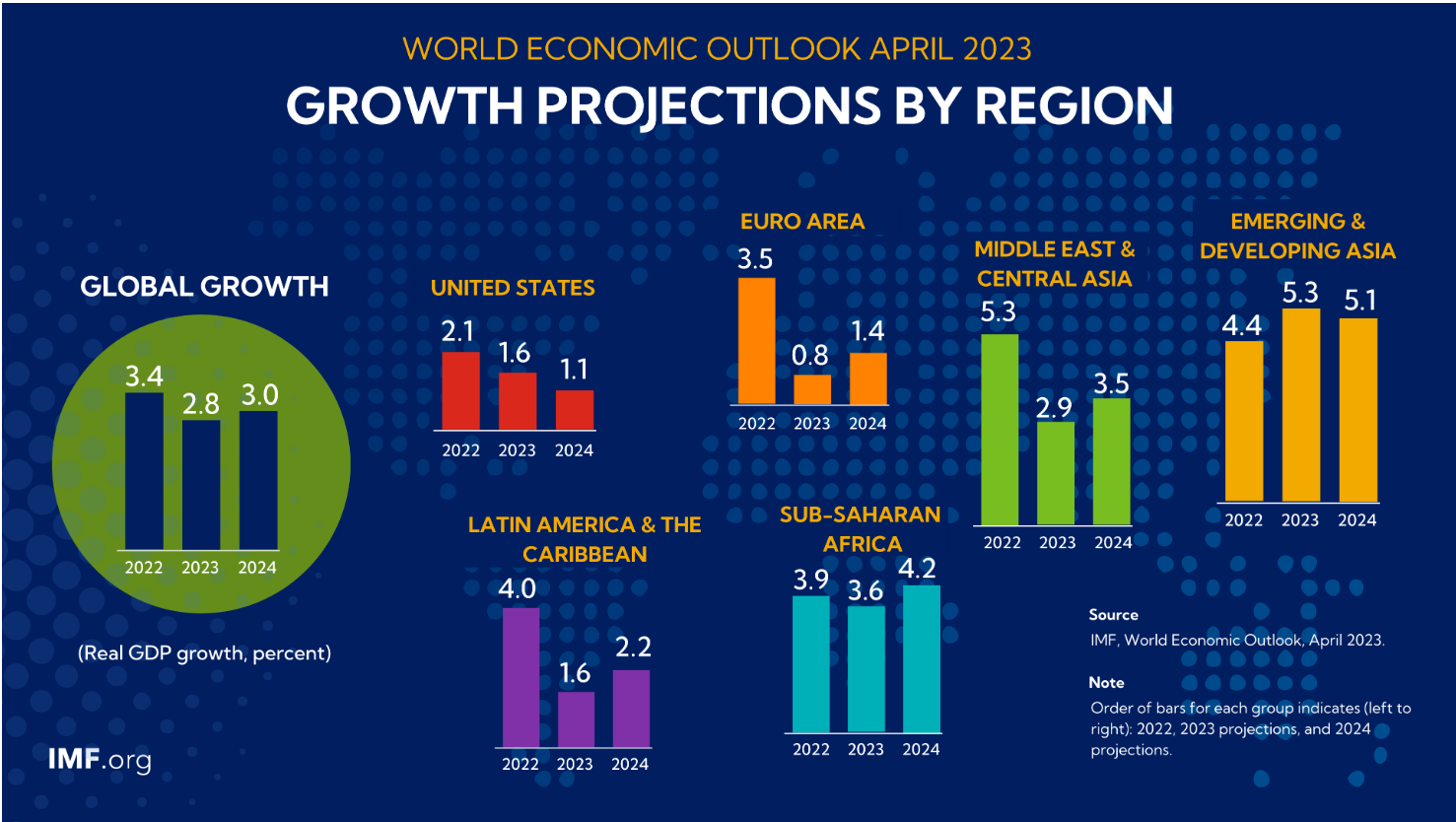

The results of larger rates of interest, tightening credit score from the banking sector issues, the struggle in Ukraine and geo-economic fragmentation is slower progress in accordance with the World Financial Outlook report.

International financial exercise is experiencing a broad-based and sharper-than-expected slowdown, with inflation larger than seen in a number of a long time. The associated fee-of-living disaster, tightening monetary situations in most areas, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh closely on the outlook. International progress is forecast to sluggish from 6.0 p.c in 2021 to three.2 p.c in 2022 and a couple of.7 p.c in 2023. That is the weakest progress profile since 2001 apart from the worldwide monetary disaster and the acute section of the COVID-19 pandemic.

Being ready for turbulent occasions forward is vital. With geopolitical and monetary dangers brewing, international progress slowing, US greenback weakening and actual rates of interest declining, it’s a good suggestion to construct up some portfolio safety within the type of bodily gold and silver bullion.

From The Buying and selling Desk

Gold worth has moved up once more this morning to settle slightly below $2030. Decrease inflation numbers out of the US yesterday and a weaker USD has supported the worth transfer above the vital and now close to time period assist stage at $2,000. Gold is inside 3% of its all time highs. Silver too has joined in, comfortably over its close to time period new assist stage at $25.

Fed minutes launched yesterday, present the fallout from the latest banking disaster within the US will probably tilt the economic system right into a recession later this 12 months. Nonetheless, Vice chair for Supervision Michael Barr went on at present the banking sector ‘is sound and resilient’ ! We’ll greater than probably get one closing charge hike of 25bp in Could however the market is pricing in decrease charges for later within the 12 months.

Strategist at Blackrock put a notice out yesterday that they count on the Fed will cease its rate-hike cycle with out getting inflation to its 2% goal. They went on to say ‘We predict the politics of inflation narrative is on the cusp of fixing, which means People should stay with excessive costs for years to return’. All bullish for Gold and Silver!

Inventory Replace

Silver Britannia’s

– We have now a restricted variety of Silver Britannia’s from the from the Royal Mint, with the bottom premium out there at Spot plus 40% for EU storage/supply and for UK storage/supply. Please name our buying and selling desk. Inventory is restricted at this decreased premium.

Gold Kangaroo’s can be found for EU purchasers, beginning at 4.5% over Spot and Gold 1oz Bars begin at 4.2% over Spot.

GoldCore have wonderful inventory and availability on all Gold Cash and bars. Please contact our buying and selling desk with any questions you might have.

Purchase Gold Cash

GOLD PRICES ( AM/ PM LBMA FIX– USD, GBP & EUR )

USD $

AM

USD $

PM

GBP £

AM

GBP £

PM

EUR €

AM

EUR €

PM

12-04-2023

2008.90

2008.20

1618.37

1610.17

1839.15

1827.86

11-04-2023

2001.50

2002.70

1608.41

1610.97

1833.17

1833.47

06-04-2023

2017.25

2001.90

1619.04

1611.73

1851.23

1837.54

05-04-2023

2022.30

2030.85

1622.29

1625.90

1847.78

1853.15

04-04-2023

1982.25

2009.60

1585.60

1607.28

1814.16

1837.18

03-04-2023

1963.10

1983.30

1591.09

1598.94

1810.17

1820.47

31-03-2023

1978.80

1979.70

1599.46

1598.21

1618.93

1818.16

30-03-2023

1968.10

1965.80

1593.96

1588.17

1811.64

1800.08

29-03-2023

1965.85

1965.00

1593.91

1593.22

1812.91

1811.34

28-03-2023

1949.85

1962.85

1587.37

1595.21

1803.03

1813.87

Purchase gold cash and bars and retailer them within the most secure vaults in Switzerland, London or Singapore with GoldCore.

Be taught why Switzerland stays a safe-haven jurisdiction for proudly owning treasured metals. Entry Our Most Fashionable Information, the Important Information to Storing Gold in Switzerland right here