JHVEPhoto/iStock Editorial through Getty Pictures

Expensive readers/followers,

I’ve just lately revealed articles on two top quality workplace REITs – Boston Properties (BXP) (article right here) and Highwoods Properties (HIW) (article right here) and advisable each as stable investments. Each articles acquired a lot of feedback relating to work-from-home (WFH) and the risk it presents to places of work. I’ve made it clear that I do not suppose work-from-home is right here to remain, at the very least to not the extent we now have now. At the moment, I needed to take the chance to current further proof that helps this declare and begin protection on Kilroy Realty Company (NYSE:KRC) which I consider may be very nicely positioned to face the WFH pattern.

Work-from-home

So much has been written on the subject, each in articles and feedback. Most individuals’s views are usually based mostly on empirical proof of how their very own or their good friend’s work fashion has modified since Covid. And it’s true that at present extra individuals are working remotely than ever earlier than. As buyers, nonetheless, our job is to look by means of the established order and attempt to guess the place issues will go sooner or later.

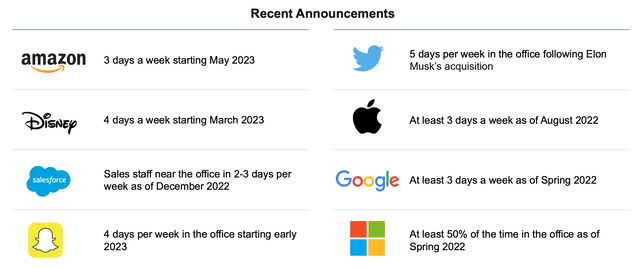

To this point, many of the proof I’ve seen means that corporations are more likely to push again and need folks again within the workplace, at the very least for a pair days per week. That is in line with current bulletins of a number of the greatest corporations on the earth, most of that are pushing for at the very least 3 days per week within the workplace. This is smart, as a result of deep down, I really feel everyone knows that it doesn’t matter what everybody says, individuals are inevitably going to be much less productive when working from house, with no direct oversight of their boss. Furthermore, if absolutely distant work was to persist, do not you suppose corporations would simply outsource it abroad? Why pay an American $120,000 a yr when you’ll be able to rent somebody overseas to do the identical job for half the cash.

KRC Presentation

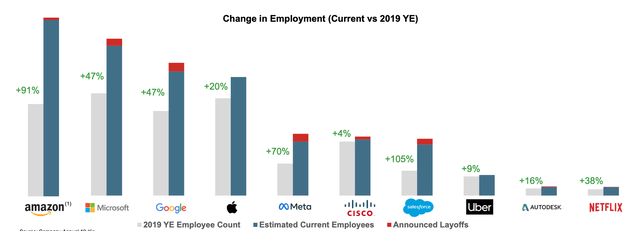

In fact corporations can solely push a lot in a decent labor market, however that would change pretty rapidly. Most huge tech corporations have already minimize some jobs, although frankly not sufficient to make a distinction within the nice scheme of issues. Headcount in most tech corporations remains to be considerably above what it was pre-pandemic (and in some circumstances double!). That is each good and unhealthy for workplace suppliers corresponding to Kilroy. It is good, as a result of in idea extra workers imply an even bigger workplace. Nevertheless it additionally makes for a decent labor market which does not enable executives to push arduous for folks to return to the workplace.

In the long run, it is possible that we’ll attain some form of equilibrium with a hybrid mannequin. In any case places of work aren’t going wherever. It is possible that the entire quantity of leased workplace house will decline as some kinds of work will most likely by no means return (e.g. name facilities). Demand will then shift to the best high quality places of work situated in one of the best areas. These are usually new buildings situated in metropolis facilities and central enterprise districts (CBDs) and these are the kinds of properties we must be on the lookout for.

KRC Presentation

Kilroy Realty

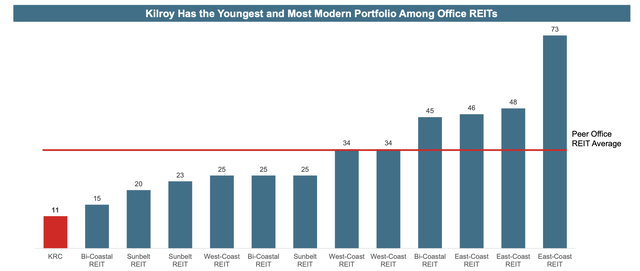

That brings us to Kilroy Realty which has by far the youngest portfolio of all U.S. workplace REITs. On common, their buildings are solely 11 years outdated! That is extraordinarily vital and interprets instantly into one of many highest proportions of funding grade tenants at over 50%. It is also the rationale why I believe the corporate is price a glance regardless of its West Coast publicity.

KRC Presentation

The REIT’s operations are roughly equally cut up between 5 areas – LA, San Diego, San Francisco, the Bay Space and Seattle. The West Coast publicity has scared many buyers away, which makes the contrarian in me wish to leap in. It is true that job development has moved to the Sunbelt and California’s insurance policies have been fairly hostile to enterprise. On the identical time although, these very developments have resulted in drastically decreased ranges of recent provide as many of the development exercise has moved to sooner rising markets. This can possible give Kilroy a substantial benefit as their new buildings are possible going to stay the latest buildings on the town.

By way of leasing, the REIT has a stable occupancy of 92.9% and comparatively few lease expirations in 2023 and 2024 (solely about 8% of complete house every year). Leasing in 2022 has slowed considerably in comparison with the prior yr as evident by the massive distinction between leases commenced (1.8 Million sft) and leases signed (900 ths. sft) all year long. Traditionally the driving pressure behind their leasing has been their life science publicity which presently accounts for 17% of all current house (22% if we embody house beneath development). Administration plans to extend the proportion of life sciences to 30% over the subsequent 5 years. Frankly, their portfolio remains to be closely concentrated in direction of solely a few tech corporations, with the highest 15 corporations accounting for 45% of complete hire. Notable tenants embody Adobe (ADBE), Salesforce (CRM), Amazon (AMZN), Netflix (NFLX) and Stripe and though none of those ought to wrestle to pay hire, it is best to keep watch over their efficiency.

I additionally wish to level out that administration is being fairly cautious with their steering for 2023 forecasting a fabric drop in occupancy to 86.5-88%. That is fairly worrisome particularly after we take into account the truth that their lease expirations in 2023 are comparatively low at 1.5 Million sft and there are basically no anticipated new completions this yr. Because of declining occupancy and flat NOI development for the yr, FFO is anticipated to drop by about 4% to $4.50 per share.

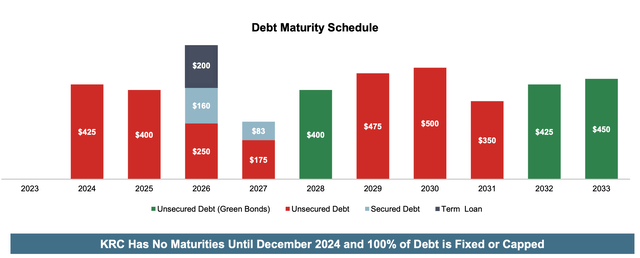

On the brilliant aspect, Kilroy has a BBB-rated steadiness sheet with 95% of the debt mounted and has no debt maturities till December 2024. That along with $1.8 Billion in obtainable liquidity will give them a lot of flexibility and will enable them to get by means of the present financial uncertainty. It additionally eliminates the danger (at the very least for now) that many different workplace REIT face and that’s the threat that lenders would possibly refuse to refinance their debt.

KRC Presentation

The dividend presently stands at $2.12 per share which interprets to a pleasant yield of 6.8% and may be very nicely coated with a ahead payout ratio of simply 47%. That implies that the dividend is protected even when occupancy declines considerably, however possible is not going to develop very a lot for so long as FFO stays flat.

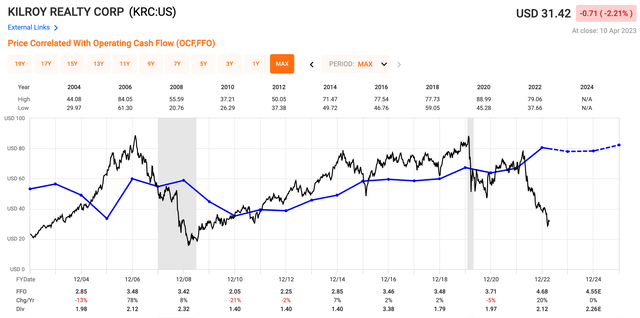

As far valuation, it ought to come as no shock that the REIT is reasonable, very low-cost.

REIT P/FFO implied cap charge KRC 6.8x 10.1% BXP 7.4x 8.6% HIW 5.3x 8.6% Click on to enlarge

It presently trades at a P/FFO of 6.8x and an implied cap charge of 10.1%. And whereas I do not anticipate it to return to the 17x a number of it has traded at traditionally, I anticipate it to shut at the very least a part of that hole. Even with flat FFO going ahead it isn’t tough to see the inventory buying and selling at 10x FFO which might suggest a 50% upside from right here.

Quick graphs

So what do I anticipate from KRC?

6.8% dividend yield (protected however no development) no FFO development 50% upside from a number of enlargement (anticipated over 3 years) complete annual return of 20% (dangerous however stable alpha)

Some analysts have targets as excessive as $60 per share, however I wish to be conservative in my forecasts. With flat FFO and a conservative 10x a number of I’ve a PT of $45 per share. That is a goal I really feel snug with as a result of it permits for a big drop in occupancy and I’ll proceed to obtain a juicy nicely coated dividend whereas I look forward to the insanity to cross. I charge KRC as a “BUY” right here at $31.4 per share with a PT of $45 per share. As soon as once more, the inventory is more likely to be risky and I am not calling a backside right here. The very best technique will possible be to common into the inventory over the subsequent 3-6 months and that is precisely what I plan to do. KRC will turn into one in every of my 4 workplace REITs holdings alongside BXP, HIW and Brandywine Realty Belief (BDN).