? Take heed to the Commentary

Gold seems to be well-positioned for a powerful pump that might carry it to new all-time excessive costs in 2023—and past. As you already know, I’ve been following and writing in regards to the valuable steel marketplace for a really very long time, and I see quite a lot of distinctive catalysts in the intervening time that might contribute to increased gold costs. When you’re underexposed or don’t have any publicity, it might be time to contemplate altering that.

Under are simply three potential catalysts.

Emergence of a Multipolar World and Speedy Dedollarization

I’ll start with what I imagine to be the most important danger that could possibly be helpful for gold costs: dedollarization. In final week’s commentary, I wrote in regards to the finish of the petrodollar and the attainable emergence of a multipolar world, with U.S. on one facet and China on the opposite.

Check out the chart under. The purple line exhibits the mixed economies of G7 nations (Canada, France, Germany, Italy, Japan, the U.Okay. and the U.S.) as a share of world GDP, in buying parity phrases. The inexperienced line exhibits the identical, however for BRICS nations (Brazil, Russia, India, China and South Africa). As you possibly can see, G7 economies have steadily been shedding their financial dominance to the BRICS—China and India, specifically. At this time, for the primary time ever, the main developed nations contribute much less to world GDP than the main rising nations.

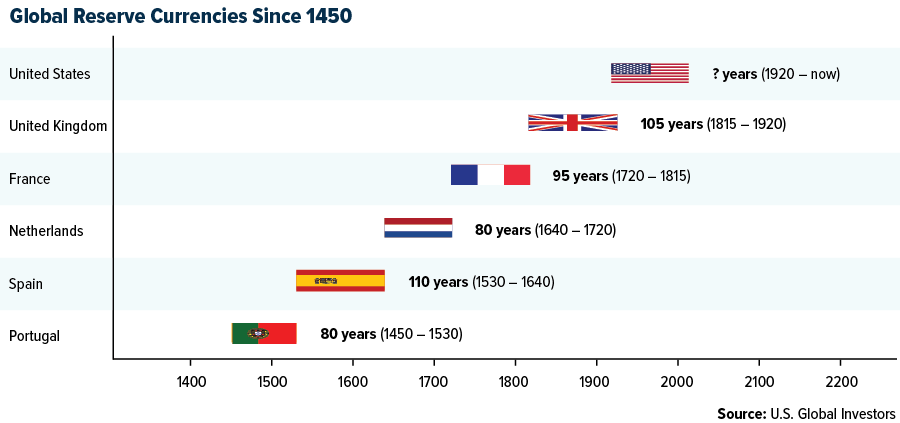

The implications of this could possibly be multi-faceted, however for our functions right here, let’s focus simply on currencies. Because the finish of World Battle I, the U.S. greenback has served because the world’s reserve foreign money, and for the reason that Nineteen Seventies, crude oil and different key commodities—together with gold—have traded globally in bucks.

Which may be set to vary with the rise of a multipolar world by which half of all commodities are traded in U.S. {dollars}, the opposite half in one other foreign money—the Chinese language yuan, maybe, or a BRICS foreign money of some form, or a digital foreign money comparable to Bitcoin.

An growing share of commodities is already being settled in non-dollar currencies. This week, China settled a liquid pure fuel (LNG) commerce with France in yuan for the primary time ever because the Asian big seeks to increase its financial affect world wide. Since Russia’s invasion of Ukraine final 12 months and the worldwide sanctions that adopted, Russia’s de facto reserve foreign money has been the yuan, in keeping with Kitco Information.

Some economists imagine the time is true for a significant competitor to the greenback to step up. Jim O’Neil, the previous Goldman Sachs economist who coined the acronym BRIC, wrote an essay final weekend urging BRICS nations to problem the dollar’s dominance, saying that shifts in U.S. financial coverage create dramatic fluctuations within the worth of the greenback that have an effect on the remainder of the world.

Gold can be a direct beneficiary of dedollarization because it’s priced within the dollar. Gold is buying and selling at or close to all-time highs in quite a lot of currencies proper now, together with the British pound, Japanese yen, Indian rupee and Australian greenback, and it will doubtless be hitting new highs in USD phrases as nicely have been the greenback to be devalued.

Acceleration of the Liquidity Disaster and Return of Quantitative Easing (QE)

The subsequent potential catalyst has to do with the continuing shakiness of sure segments of the normal monetary sector. Pressured underneath an estimated $620 billion in unrealized losses, the U.S. banking business has seen the failure of two giant companies this 12 months—Silicon Valley Financial institution (SVB) and Signature Financial institution—and a major erosion in depositors’ confidence.

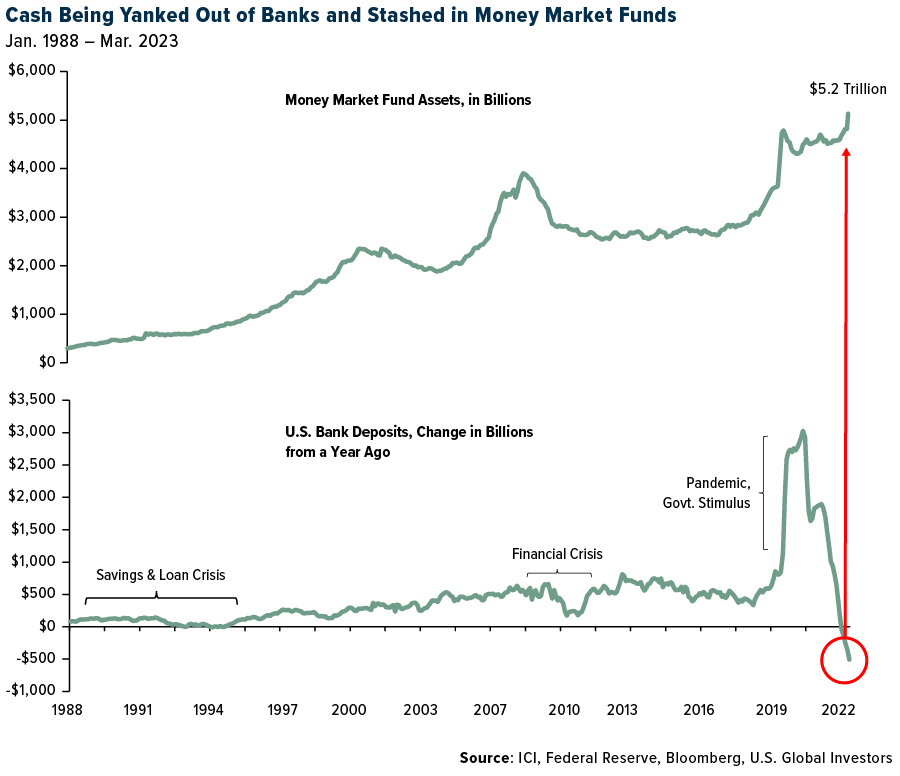

On account of these failures, individuals and firms have withdrawn tens of billions of {dollars} from banks. In March, financial institution deposits have been down greater than $500 billion in comparison with the identical month in 2022, a extra dramatic year-over-year change than the financial savings and mortgage disaster within the Nineteen Eighties and Nineteen Nineties and the monetary disaster.

The place is all this capital going? Cash market funds, that are perceived to be safer and, in lots of circumstances, ship increased yields than financial savings accounts proper now. A report $5.2 trillion now sit in these funds, in keeping with the Funding Firm Institute (ICI), and the stockpile is anticipated to get a lot increased.

Many regional and neighborhood banks have been already going through a liquidity crunch as a result of huge unrealized losses, and the sudden withdrawals will solely amplify issues. As reserves drop, banks will grow to be much less and fewer keen to lend to households and companies, slowing the economic system much more than the Federal Reserve’s price hikes.

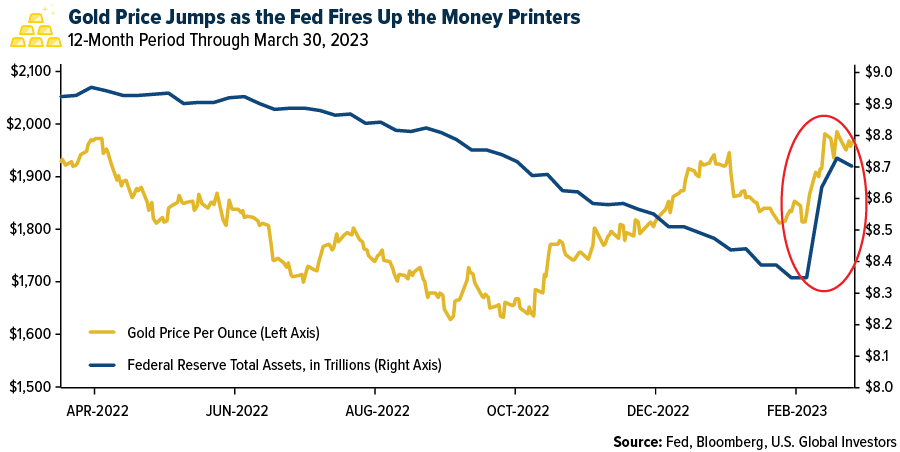

Within the occasion that the liquidity disaster expands right into a full-blown recession, the Fed could have no different selection than to pivot and start one other cycle of quantitative easing (QE). The central financial institution has been attempting to unwind its steadiness sheet, however in an effort to stabilize the banking sector, it added almost $400 billion within the two weeks ended March 22. Over the identical interval, the value of gold jumped 8.6%, reversing its 2023 losses.

Two Chilly Wars

The ultimate catalyst on my listing entails worsening diplomacy between the U.S. and its allies and Russia and China. Relations between the West and the East are about as unhealthy as I bear in mind them ever being, and so they may get manner worse earlier than they get higher.

In latest interviews and webcasts, I’ve been saying that the U.S. is going through two Chilly Wars proper now with Russia and China. I hope that these conflicts stay “chilly,” however there’s at all times the likelihood that they grow to be one thing extra—by which case, I might need to have publicity to gold.

I received’t spend a complete lot of time on this subject, however I need to level you to a latest article that appeared in International Affairs. In keeping with the article’s two contributors, Chinese language Chief Xi Jinping seems to be shoring up his nation’s navy readiness by growing the protection finances and constructing new air-raid shelters in key cities and “Nationwide Protection Mobilization” workplaces. “One thing has modified in Beijing that policymakers and enterprise leaders worldwide can not afford to disregard,” the piece reads.

Whether or not the navy build-up is a precursor to an invasion of Taiwan or one thing else stays to be seen.

What I do know is that traders have put their belief in gold in occasions of geopolitical danger and uncertainty. I’ve at all times advocated for the ten% Golden Rule, with 5% in bodily gold (bars and cash) and the opposite 5% in high-quality gold mining shares, mutual funds and ETFs.

Not everybody is aware of the place to start out, nonetheless, and that’s why we created the ABC Funding Plan. With only a small preliminary funding and an inexpensive month-to-month contribution, you possibly can start investing in our funds. The ABC Funding Plan is an computerized funding plan that makes use of some great benefits of dollar-cost averaging—a way that allows you to make investments a set quantity in a particular funding at common intervals—along with monetary self-discipline that can assist you work towards your monetary objectives.

Index Abstract

The foremost market indices completed up. The Dow Jones Industrial Common gained 3.22%. The S&P 500 Inventory Index rose 3.13%, whereas the Nasdaq Composite climbed 3.37%. The Russell 2000 small capitalization index gained 3.59% this week.

The Cling Seng Composite gained 72% this week; whereas Taiwan was down 0.29% and the KOSPI rose 2.56%.

The ten-year Treasury bond yield rose 0.103 foundation factors to three.48%.

? Take heed to the SWOT

Airways and Transport

Strengths

One of the best performing airline inventory for the week was Hawaiian Air, up 17.4%. Ryanair CEO Michael O’Leary gave feedback to The Telegraph final week that common summer season fares could possibly be up 10-15% year-over-year, given the persevering with restoration in demand and restricted capability progress in Europe. Mr. O’Leary sees “no proof of individuals not spending in any respect. And that isn’t confined to the UK, [it is] throughout Europe.”

Maersk isn’t idling any of its ships but as a result of the corporate expects to have the ability to take care of overcapacity within the container transport market by decreasing vessel pace, so-called gradual steaming, CEO Vincent Clerc says. Maersk has been capable of successfully decrease its capability by 7-8% by gradual steaming up to now and expects to succeed in a discount of 8-9%, Clerc says in a Copenhagen briefing after the AGM. “This implies there’s no must idle ships,” Clerc says, and Maersk “would take a look at among the ships we now have charted as the subsequent step” if the transport line must additional lower capability. Maersk is able to change techniques if market situations change for the more serious, he says.

European airline bookings as a portion of 2019 ranges improved considerably to +3% within the week. Whole internet gross sales have been up +2% this week. Intra-Europe internet gross sales was up 19 factors to -4% versus 2019 (versus -23% in prior week) and have been +4% increased this week. Worldwide internet gross sales improved by 21 factors to +6% versus 2019 (versus -15% within the prior week), and have been up +1% this week. Intra-Europe/worldwide volumes elevated by 12 factors/18 factors to -16%/-10% versus 2019. Pricing stays above 2019 ranges with intra Europe/worldwide costs at +15%/+17% above 2019 ranges respectively.

Weaknesses

The worst performing airline inventory for the week was Turkish Air, down 7.7%. Earlier this week, Fitch Rankings revised GOL’s Lengthy-Time period International and Native Forex Issuer Default Rankings to ‘C,’ following the airline’s debt restructuring plan, which Fitch deems to be indicative of a distressed debt alternate.

Navigator reported 4Q22 persevering with earnings per share (EPS) of $0.08, under consensus of $0.22. FY22 EPS got here in at $0.32 versus $0.35 in FY21. Ethylene throughput on the Marine Export terminal got here in under steering (270,000 tons), totaling 262,835 tons in 4Q22 (+12% YOY); for FY22, complete ethylene throughput volumes have been 987,529 tons, near nameplate capability of 1,000,000 tons per 12 months. The corporate estimates that 1Q23 ethylene export volumes shall be 260,000 tons (above nameplate capability of 250,000 tons), as ethylene exports remained sturdy within the first months of the 12 months.

System internet gross sales fell 3.0% versus 2019 for the week in comparison with -1.2% final week. The decline was pushed by pricing (+9.5% versus 2019 in comparison with +12.3% final week) whereas volumes modestly improved (-11.5% versus 2019 in comparison with -12.0% versus 2019 final week). Final week, the regional banking headlines could possibly be driving a close to time period softening in reserving developments, and the newest information exhibits company channels are softer than leisure channels. Web gross sales by leisure channels have been principally unchanged versus final week whereas internet gross sales in giant company and SME channels decelerated 130 foundation factors and 340 foundation factors, respectively.

Alternatives

India stays one of many fastest-growing aviation markets throughout the globe. The market is considerably under-penetrated. India’s airline seats per capita stand at 0.13 versus 0.49 for China and three.1 for the U.S. Additional, India has 700 plane working at present (versus China at >4,000 plane), and by 2027, demand is more likely to be round 1,100 plane, per the India Model Fairness Basis. Authorities help by constructing new airports (goal of 220 airports by 2025 from 140 at present), improve of current airport infrastructure, Regional Connectivity Schemes and discount of VAT on jet gasoline by state governments is supporting progress within the business.

The inventory-to-sales ratio (1.23x) stays under the traditional ratio of 1.45x seen throughout 2010-19. Moreover, evaluation of freight charges signifies that present charges are near 2018-19 ranges, which suggests restricted draw back danger of 3-10% throughout main transport routes. The above reaffirmed the angle that the container transport sector is clearly turning the nook following the sharp spot freight price correction, with Chinese language ports witnessing a sequential pickup and poised to achieve additional momentum in 2H23.

American Airways is growing its flights to Europe this summer season by 14% YOY, in keeping with Enterprise Traveler. In keeping with the article, American will provide as much as 64 day by day flights to European locations, and almost half of these will function into London Heathrow airport, which in keeping with administration is an efficient place to be proper now. Administration additionally just lately famous that they count on additional enchancment in demand for long-haul worldwide journey this 12 months as they proceed to develop again their capability.

Threats

In keeping with AEROIN, Colombian authorities have authorised Viva Air’s acquisition by Avianca; nonetheless, the previous indicated that the combination with Viva continues to be unsure, with the situations not reflective of those who have been in place when the unique request for the method was made, signaling a possible discontinuation of the deal. In that sense, Avianca feedback that the diminished capabilities of Viva Air, together with its route community, plane and workforce, as a result of suspension of operations must be completely evaluated to evaluate the viability of the necessities set by Civil Aviation. Lastly, Avianca signifies that the decision is just not remaining as this resolution is topic to enchantment and reintegration not solely by the events concerned, but additionally by third events acknowledged by the authority.

In keeping with Morgan Stanley, the quantity of newly-built container ships up to now in 2023 stands at solely about 11% of their forecast for brand new provide arriving this 12 months. They count on considerations about provide/demand deterioration as a result of stress from provide of latest ships to kick in absolutely sooner or later.

China’s financial rebound is weaker than anticipated as customers emerge “surprised” from pandemic-led disruptions and an actual property meltdown final 12 months, in keeping with the top of Maersk. This suggests the chance that air journey progress could also be stunted sooner or later in China.

? Take heed to the SWOT

Luxurious Items and Worldwide Markets

Strengths

Luxurious shares proceed to maneuver increased, recording a powerful weekly and quarterly efficiency. On the weekly foundation, the S&P Attire & Equipment Composite Index rose as a lot as 7.53%, this week outperforming the broad S&P 1500 Composite Index, which elevated by 4.22%. On a quarterly foundation, the S&P Attire & Equipment Composite Index gained 7.19% whereas the S&P 1500 was little change, gaining solely 0.55%.

Tesla’s January gross sales have been up 34% in comparison with a 12 months in the past, whereas BMW’s have been up simply 2.5%, Mercedes’ 7.3%. Lexus noticed a 6.6% gross sales drop. In keeping with Experian information from January 2023, the electrical carmaker recorded almost 50,000 new registrations within the U.S., which is a large lead over second-place BMW, with round 31,000 registrations.

PVH Company was the best-performing S&P International Luxurious inventory for the week, gaining 20.71%. Shares of the Tommy Hilfiger and Calvin Klein’s guardian firm jumped 19% noon Tuesday after the corporate reported fourth-quarter earnings that considerably beat. Jay Sole from UBS stated the corporate is now ready to spice up earnings per share by a double-digit compounded annual progress price.

Weaknesses

In america, the Convention Board Client Confidence Index was reported at 104.2 in March vs. the anticipated studying of 101.0 and February’s 102.9. Client confidence in Germany, Europe’s largest economic system, improved barely as nicely. The GfK Client Confidence index was reported at a adverse 29.5 vs. an anticipated adverse 30.0, and the prior month’s adverse 30.5.

The Kuwait Funding Authority offered shares price about 1.4 billion euros in Mercedes-Benz Group AG after the carmaker’s fairness quadrupled during the last three years, Bloomberg experiences. The sale, which represents about 1.9% of Mercedes’s share capital, was priced at 69.27 euros. The value was a 3.6% low cost to the inventory’s Tuesday closing value.

Faraday Future Intelligence was the worst-performing S&P International Luxurious inventory for the week, shedding 10.81%. Shares fell sharply regardless of the corporate asserting manufacturing begin for the long-awaited FF 91 Futurist automobile on March 29. This mannequin will compete with high-end luxurious vehicles like Ferrari, Maybach, Rolls Royce and Bentley.

Alternatives

Luxurious model Gucci introduced a multi-year partnership with Yuga Labs to develop Web3 functions. Gucci sees Web3 as a long-term alternative to develop a relationship with younger prospects, drive buyer loyalty and finally generate income. In keeping with a 2021 JPMorgan report, metaverse and non-fungible token (NFT) video games may account for 10% of the posh items market by 2030. This can create a 50 billion euro income alternative with a complete market progress of round 25% every year.

Barclay’s analysis staff tasks that the Center East luxurious items and providers purchaser shall be key to the posh sector’s progress in 2023. Luxurious gross sales within the Center East over the subsequent month ought to profit from a return of Chinese language vacationers and from elevated spending over Ramadan, a key gifting interval. Tourism has already recovered nicely for the reason that pandemic within the United Arab Emirates (UAE), and extra Chinese language vacationers are anticipated after China reopened its economic system. China was the fifth largest supply marketplace for Dubai in 2019, with the town welcoming 989,00 Chinese language vacationers that 12 months – vs 177,000 in 2022 (82% under 2019).

The European Union (EU) will enable gross sales of latest inside combustion engine (ICE) vehicles on e-fuel past 2035. Beforehand, the EU Parliament voted to ban gross sales of carbon-emitting automobiles, however in a remaining resolution, vehicles that run on e-fuel shall be permitted. Ferrari and Porsche will profit from plans to exempt vehicles that run on e-fuels from the European Union’s deliberate 2035 phase-out of combustion engine automobiles. Porsche, which is a part of the VW Group, has been creating e-fuel in Chile for a few years, intending to combine it with common gasoline.

Threats

Luxurious shares had a very good begin this 12 months, recording a achieve of greater than 17% year-to-date (as measured by the S&P International Luxurious Index). Quick-term correction could observe. Buyers could grow to be cautious if inflation doesn’t begin to ease additional, as is anticipated. Eurozone March preliminary inflation eased this week, however the underlying inflation (core CPI) posted the best studying on report, suggesting the ECB should still must hike charges.

The luxurious market may even see consolidation within the coming months. In keeping with a Bloomberg survey of 17 M&A desks, fund managers and analysts, the sector seems ripe for a mergers & acquisitions wave. Hugo Boss and Burberry have been talked about as potential takeover candidates within the survey, alongside Italy’s Tod’s SpA. Many shares doubled in worth for the reason that early days of the pandemic and bidders will doubtless have to supply high costs.

The Chinese language state oil and fuel firm, CNOOC, and French TotalEnergies traded 65,000 tons of liquefied pure fuel (LNG) this week, settling the transaction in yuan, the Shanghai Petroleum and Pure Gasoline Trade stated on Tuesday. France is likely one of the world’s high LNG trades and it was the primary transaction that was accomplished in Chinese language foreign money, difficult america greenback.

? Take heed to the SWOT

Vitality and Pure Assets

Strengths

One of the best performing commodity for the week was West Texas Intermediate (WTI) crude oil, rising 9.02%, largely on disruptions to Iraqi exports of 400,000 barrel a day over a battle with the Kurdistan area. At costs close to the present strip ($70 WTI), free money move (FCF) yields common almost 10% in 2023 for a lot of oil producers. Whereas that is decrease than final 12 months, it’s nonetheless two occasions the S&P 500. At $80 per barrel WTI, yields would common 12%, whereas at $90 per barrel they’d develop to 16%. Robust steadiness sheets and low break-evens additionally bolster the sector’s resilience at decrease costs, particularly relative to prior cycles. At $60, FCF yields would fall to six%, whereas at $50 they’d be 4%.

Air Merchandise introduced $130 million in hydrogen contract gross sales to NASA overlaying a number of services. Some contracts/gross sales seem already in place, however are nonetheless an incremental optimistic. Assuming a 30% incremental margin, gross sales may add $0.15 to earnings per share (EPS), or 1% to FY23. The press launch signifies a goal to speculate at the very least $15 billion in clear vitality mega-projects globally.

Regardless of the receding lithium carbonate costs in China, lithium Big Albemarle made a $3.7 billion money provide for Liontown Assets, which was instantly rejected by the Australian developer, sending shares within the goal up virtually 70% and fueling expectations of wider consolidation. U.S.-based Albemarle is in search of progress to fulfill future demand, as reported by Bloomberg. Liontown owns some of the promising early-stage lithium tasks in Australia, the world’s high exporter of the battery steel, and has provide agreements with main automakers together with Tesla and Ford Motor.

Weaknesses

The worst performing commodity for the week was molybdenum, dropping 18.50%, persevering with its pullback that began within the first week of March with a 20% decline from costs that had risen to a 17-year excessive. Pure fuel costs stay subdued near-term, however ahead pricing stays constructive at $3 per million cubic toes (Mcf) and $4 per Mcf for the 12-month interval. The Nationwide oceanic and Atmospheric Administration (NOAA) just lately launched its spring climate outlook that features above common temperatures within the Southern and Jap U.S. and under common temperatures within the northern Midwest.

Pulp shipments have been down 3.6% year-over-year (hardwood -4.3%; softwood -2.7%) in February. Shipments have been additionally down 0.2% month-over-month (however have been up 0.3% after adjusting for seasonality), with decrease softwood shipments (-3.1%) partially offset by elevated hardwood shipments (+1.3%).

Spot lithium costs in China have been breaking down for the higher a part of 5 months. Carbonate costs have outpaced hydroxide to the draw back, although each are underneath stress. There has not been weak point prolong exterior of China, although given cross border purchases, world markets will quickly be underneath stress as nicely.

Alternatives

Bloomberg experiences that enormous wind generators are poised to get even greater, in keeping with Ming Yang Sensible Vitality Group, a producer that already gives tools fitted with huge 140-meter-long blades. Deploying bigger tools can cut back the variety of generators wanted at every wind farm website, reducing challenge prices. Big-sized merchandise are additionally seen as more likely to be in elevated demand because the world builds increasingly offshore challenge, and to be used in huge clean-energy hubs like these deliberate by President Xi Jinping for China’s huge inside.

This week, the Monetary Instances highlighted Trafigura’s bullish view on copper. They see copper costs surging to a report excessive this 12 months as a rebound in Chinese language demand dangers depleting already low stockpiles, the world’s largest non-public metals dealer has forecast. International inventories of the steel utilized in the whole lot from energy cables and electrical vehicles to buildings have dropped quickly in latest weeks to their lowest seasonal degree since 2008, leaving little buffer if demand in China continues to tempo forward. The benchmark three-month copper contract is buying and selling at $9,000 a ton, having gained 30% since falling sharply within the three months after Russia’s invasion of Ukraine when traders fretted that hovering vitality costs would dent metals demand.

The Division of Vitality (DOE) tasks inexperienced hydrogen manufacturing within the U.S. will improve to 10 million metric tons per 12 months by 2030, 20 million metric tons per 12 months by 2040 and 50 million metric tons per 12 months by 2050. The World Financial institution believes hydrogen is a key a part of a carbon-free world resolution and can account for 12-22% of ultimate vitality demand in 2050. To not be left behind, Bloomberg experiences China’s capability to fabricate electrolyzers – the tools used to make inexperienced hydrogen – may develop about 20 occasions by 2028 as prices of the clear vitality supply plunge, in keeping with the China Worldwide Capital Company (CICC). Native electrolyzer demand could possibly be 40 gigawatts by 2028. The zero-emissions gasoline, produced through the use of renewable vitality to extract hydrogen from water, is on monitor to realize value parity with different strategies fueled by pure fuel or coal as quickly as the tip of this decade, which can drive speedy deployments, CICC analysts wrote in a word.

Threats

A bunch of institutional traders who collectively oversee $11 trillion in property is putting new limits on fossil-fuel spending it would tolerate as reported by Bloomberg. The Web-Zero Asset Proprietor Alliance, whose signatories embrace Allianz SE and the California Public Workers’ Retirement System, is advising members to halt direct funding of any new investments in fields, pipelines or energy crops which can be fueled by oil or fuel, in keeping with a report on Wednesday. In addition they stated oil and fuel corporations should set science-based targets to incorporate so-called Scope 3 emissions, observe science-based pathways and cease lobbying towards motion on local weather.

The U.S. is unlikely to start out shopping for crude for the U.S. Particular Petroleum Reserve (SPR) this 12 months regardless of decrease costs as a result of a pending drawdown, Argus Media reported Vitality secretary Jennifer Granholm stated at the moment. Granholm added that one other problem is that two SPR services — the Bayou Choctaw website in Louisiana and Bryan Mound storage website in Texas — are underneath upkeep. Crude within the SPR at present stands at 371.6 million barrels at 4 storage websites, the bottom degree in 40 years.

Provide will increase from the U.S. shale producers, historically probably the most aware of altering market situations, are anticipated to greater than halve from 0.9 million barrels/day this 12 months to 0.4 million barrels/day in 2024 with crude and condensate manufacturing growing solely 300 kbd and NGLs contributing solely 144 kbd. Present drilling stock steering suggests U.S. public shale producers have 8-15+ years of financial drilling remaining at present charges.

? Take heed to the SWOT

Bitcoin and Digital Property

Strengths

Of the cryptocurrencies tracked by CoinMarketCap, the perfect performer for the week was XRP, rising 25.81%.

Crypto Trade Kraken signed a multi-year world pact with System One staff William Racing, marking the buying and selling platform’s first main sponsorship deal whilst sports activities tie-ups with digital asset companies grow to be more and more unpopular. Kraken’s emblem shall be positioned on the halo and rear wing of William’s automobile for the remainder of the 2023 season, writes Bloomberg.

Bitcoin renewed its climb towards $30,000 with danger urge for food rising throughout world markets and concern in regards to the fallout from Binance’s authorized woes waning. Bitcoin rose as a lot as 4.9% to $28,638 on Wednesday, writes Bloomberg.

Weaknesses

Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Stacks, down 15.48%.

Galaxy Digital, the corporate based by Michael Novogratz, posted a fourth-quarter loss however stated that the corporate’s liquidity place stays intact after the latest turmoil within the banking sector. The web loss was $2.8 billion, in contrast with internet revenue of $521.3 million within the year-earlier interval. The loss was primarily attributed to unrealized losses on investments in its funding portfolio through the droop in token costs, writes Bloomberg.

Sushi Swap CEO Jared Gray is now not feeling “impressed” after a wave of regulatory crackdowns on crypto exchanges, together with the DEX that he manages, has put immense stress on the crypto business.

Alternatives

Michael Novogratz, the founding father of crypto monetary providers agency Galaxy Digital Holdings, stated crypto markets “really feel sturdy” this 12 months, as a result of sellers’ exhaustion and the easing of restrictions in China, with Hong Kong warming as much as the digital-asset sector. Though buying and selling crypto has been banned in mainland China, the town of Hong Kong final 12 months unveiled a plan to make itself as a middle for digital property and so-called Web3 companies, writes Bloomberg.

A brand new Hong Kong-based fund plans to lift $100 million this 12 months to put money into digital asset startups, as the town seeks to grow to be a regional fintech hub. The fund shall be led by Ben Ng, a enterprise associate on the Asian non-public fairness agency SAIF Companions, and longtime tech investor Curt Shi. The 2 have secured at the very least $30 million in funding commitments, writes Bloomberg.

As a lot as $5 trillion could transition to new types of cash comparable to central financial institution digital currencies and stablecoins by 2030, of which roughly half could possibly be linked to blockchain applied sciences, in keeping with a Citigroup analysis examine.

Threats

The U.S. took its most forceful transfer but on Monday to crack down on crypto alternate Binance Holdings and its CEO, Changpeng Zhao. The CFTC alleged in federal court docket in Chicago that Binance and its CEO routinely broke American derivatives guidelines because the agency grew to be the world’s largest buying and selling platform. Binance ought to have registered with the company years in the past and continues to violate the CFTC’s guidelines, writes Bloomberg.

Sam Bankman-Fried was charged with bribing Chinese language officers, including a brand new dimension to the U.S. authorities’s case towards the FTX co-founder. The brand new cost was unsealed Tuesday in a revised indictment by federal prosecutors in Manhattan. Bankman-Fried is accused of authorizing the fee of $40 million to a number of Chinese language authorities officers to be able to get them to unfreeze accounts at Alameda Analysis, writes Bloomberg.

U.S. banks already hesitant to work with crypto prospects are actually even warier of offering providers to the business after a string of regional-lender collapses. The closure of crypto pleasant Silvergate and seizure of Signature Financial institution has left crypto companies struggling to search out new banks for depository and fee providers, Bloomberg says.

? Take heed to the SWOT

Gold Market

This week gold futures closed the week at $1,987.70, down $14.00 per ounce, or 0.70%. Gold shares, as measured by the NYSE Arca Gold Miners Index, ended the week increased by 2.66%. The S&P/TSX Enterprise Index got here in up 3.68%. The U.S. Commerce-Weighted Greenback fell 0.54%.

Strengths

Every thing is enjoying in gold’s favor: A banking disaster, falling charges, excessive inflation, stress on the greenback, scorching Asian demand and technical momentum because it flirts with breaching the $2,000 an oz. degree for the primary time in over a 12 months.

Weaknesses

The worst performing valuable steel for the week was gold, down 0.70%. Gold costs in India, the second largest client, are up 15% from the prior 12 months and that has led to a pullback in demand going into subsequent month which is a key demand interval. The money marketplace for gold is at present buying and selling at a reduction.

Galiano Gold reported This fall/22 monetary outcomes with adjusted earnings per share (EPS) of -$0.03 (versus the consensus estimate of $0.01) on a decrease realized gold value and better finance prices from manufacturing of 34,100 ounces gold with an all-in sustaining value (AISC) of $1,191 an oz..

General, inflation pressures have been considerably underestimated in 2022 with solely 30% of producers reaching unique steering and common AISC coming in +$100 an oz. increased than expectations. For 2023, corporations have rebased prices increased, outlining a further +3% improve in guided prices versus 2022.

Alternatives

With traders shifting to build up gold over the previous two weeks as evidenced by internet inflows into bodily gold ETFs, the chief economist and world strategist at Euro Pacific Capital believes traders could also be operating out of time to buy gold under $2,000 per ounce. Banking stress, a weaker greenback, and falling bond yields are driving traders to observe the lead of many central banks world wide that purchased report quantities of gold.

Gold is close to its highest value in almost a 12 months, with the copper/gold ratio declining by 4% year-to-date. Traditionally, this ratio has exhibited an in depth correlation with the cyclical/defensive ratio; nonetheless, the latter is +12% YTD. Gold equities ought to proceed to learn at this level within the cycle.

Barrick Gold and the Papua New Guinea authorities and companions have agreed to renew operations on the Porgera gold mine on the earliest alternative in keeping with Bloomberg. Upon operational restart, the plant and operations have been on care and upkeep since 2020, the mine is anticipated to ramp as much as round 700,000 ounces per 12 months. This must be a optimistic because it brings a second working gold mine to the Papua New Guinea exterior of the presently established operations of K92 Mining. Barrick has the boldness to return to this jurisdiction.

Threats

Analysts are taking down their platinum group metals (PGM) basket value forecasts by 20% on common between 2023-2030 to replicate a faster-than-expected decline in ICE automobile gross sales by 2030 and a rising perpetual palladium/rhodium surplus that emerges by 2025. Recalling ICE automobiles are one of many major demand drivers for platinum/palladium/rhodium (given use in ICE automobile catalytic converters), and rising penetration of EV’s poses a powerful demand-side menace to PGMs.

Solely 33% of operations have been capable of execute on mine website value steering in 2022 with common miss of $50 per ounce gold. Firm-wide, producers noticed common AISC of +$100/oz above unique steering, with solely 30% of producers capable of obtain steering, representing a report low versus the prior five-year common of 75%.

CoinDesk information exhibits that the highest cryptocurrency by market worth rose virtually 72% to $28,500 this 12 months, its greatest quarterly achieve in two years. The cryptocurrency’s market worth is $542 billion after the rally. After falling 76% since November 2021, some consultants predicted Bitcoin may fall to $12,000 this quarter three months in the past. The rebound has put Bitcoin forward of Ether, the second-largest cryptocurrency by market worth, which is on monitor for a 50% quarterly achieve. Gold has uneventfully solely gained 8% this 12 months, reflecting it hasn’t seen a significant soar in value as a result of present stress, however persons are noticing.

U.S. International Buyers, Inc. is an funding adviser registered with the Securities and Trade Fee (“SEC”). This doesn’t imply that we’re sponsored, really helpful, or authorised by the SEC, or that our talents or {qualifications} the least bit have been handed upon by the SEC or any officer of the SEC.

This commentary shouldn’t be thought of a solicitation or providing of any funding product. Sure supplies on this commentary could include dated data. The knowledge supplied was present on the time of publication. Some hyperlinks above could also be directed to third-party web sites. U.S. International Buyers doesn’t endorse all data equipped by these web sites and isn’t chargeable for their content material. All opinions expressed and information supplied are topic to vary with out discover. A few of these opinions might not be acceptable to each investor.

Holdings could change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. International Buyers as of (12/30/22):

Tesla Inc.

Bayerische Motoren Werke AG

Mercedes-Benz Group Inc.

Ferrari NV

Volkswagen AG

Hugo Boss AG

Burberry Group PLC

Northern Star Assets Ltd.

Barrick Gold Corp.

K92 Mining Inc.

Hawaiian Holdings Inc.

Ryanair Holdings PLC

AP Moller-Maersk A/S

American Airways Group Inc.

*The above-mentioned indices usually are not complete returns. These returns replicate easy appreciation solely and don’t replicate dividend reinvestment.

The Dow Jones Industrial Common is a price-weighted common of 30 blue chip shares which can be typically leaders of their business. The S&P 500 Inventory Index is a widely known capitalization-weighted index of 500 frequent inventory costs in U.S. corporations. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq Nationwide Market and SmallCap shares. The Russell 2000 Index® is a U.S. fairness index measuring the efficiency of the two,000 smallest corporations within the Russell 3000®, a widely known small-cap index.

The Cling Seng Composite Index is a market capitalization-weighted index that includes the highest 200 corporations listed on Inventory Trade of Hong Kong, based mostly on common market cap for the 12 months. The Taiwan Inventory Trade Index is a capitalization-weighted index of all listed frequent shares traded on the Taiwan Inventory Trade. The Korea Inventory Worth Index is a capitalization-weighted index of all frequent shares and most popular shares on the Korean Inventory Exchanges.

The Philadelphia Inventory Trade Gold and Silver Index (XAU) is a capitalization-weighted index that features the main corporations concerned within the mining of gold and silver. The U.S. Commerce Weighted Greenback Index gives a basic indication of the worldwide worth of the U.S. greenback. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose fairness weights are capped 25 p.c and index constituents are derived from a subset inventory pool of S&P/TSX Composite Index shares. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded corporations concerned primarily within the mining for gold and silver. The S&P/TSX Enterprise Composite Index is a broad market indicator for the Canadian enterprise capital market. The index is market capitalization weighted and, at its inception, included 531 corporations. A quarterly revision course of is used to take away corporations that comprise lower than 0.05% of the burden of the index, and add corporations whose weight, when included, shall be higher than 0.05% of the index.

The S&P 500 Vitality Index is a capitalization-weighted index that tracks the businesses within the vitality sector as a subset of the S&P 500. The S&P 500 Supplies Index is a capitalization-weighted index that tracks the businesses within the materials sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base degree of 10 for the 1941-43 base interval. The S&P 500 Industrials Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the industrial sector as a subset of the S&P 500. The S&P 500 Client Discretionary Index is a capitalization-weighted index that tracks the businesses within the client discretionary sector as a subset of the S&P 500. The S&P 500 Data Expertise Index is a capitalization-weighted index that tracks the businesses within the data expertise sector as a subset of the S&P 500. The S&P 500 Client Staples Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the client staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the businesses within the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the businesses within the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the telecom sector as a subset of the S&P 500.

The Client Worth Index (CPI) is likely one of the most widely known value measures for monitoring the value of a market basket of products and providers bought by people. The weights of parts are based mostly on client spending patterns. The Buying Supervisor’s Index is an indicator of the financial well being of the manufacturing sector. The PMI index relies on 5 main indicators: new orders, stock ranges, manufacturing, provider deliveries and the employment setting. Gross home product (GDP) is the financial worth of all of the completed items and providers produced inside a rustic’s borders in a particular time interval, although GDP is often calculated on an annual foundation. It contains all non-public and public consumption, authorities outlays, investments and exports much less imports that happen inside an outlined territory.

The S&P International Luxurious Index is comprised of 80 of the biggest publicly traded corporations engaged within the manufacturing or distribution of luxurious items or the availability of luxurious providers that meet particular investibility necessities.

Normal and Poor’s 500 Attire & Equipment Index is capitalization-weighted index.

The Client Confidence Index experiences how customers really feel in regards to the present scenario of the economic system and about the place they really feel it’s headed. Carried out by the Convention Board, the survey consists of 5 questions in regards to the current scenario and three questions on their expectations for the economic system sooner or later.

GfK’s Client Confidence Index (carried out on behalf of the European Fee) measures a variety of client attitudes, together with ahead expectations of the final financial scenario and households’ monetary positions, and views on making main family purchases.