Feverpitched

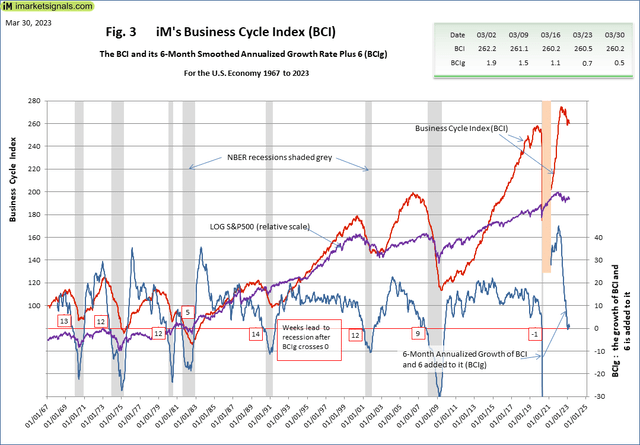

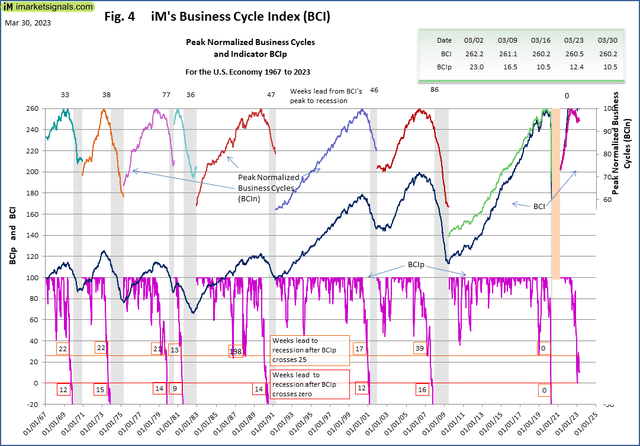

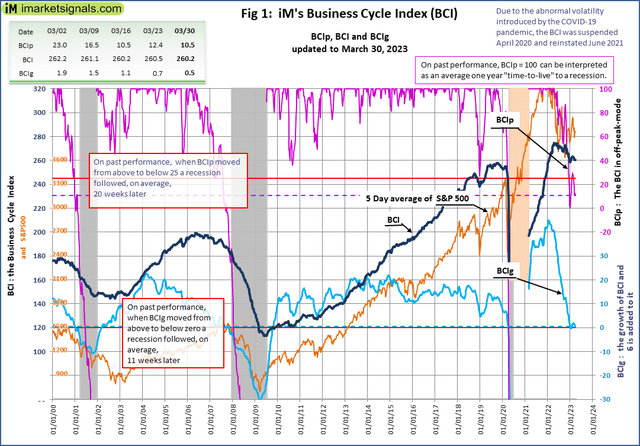

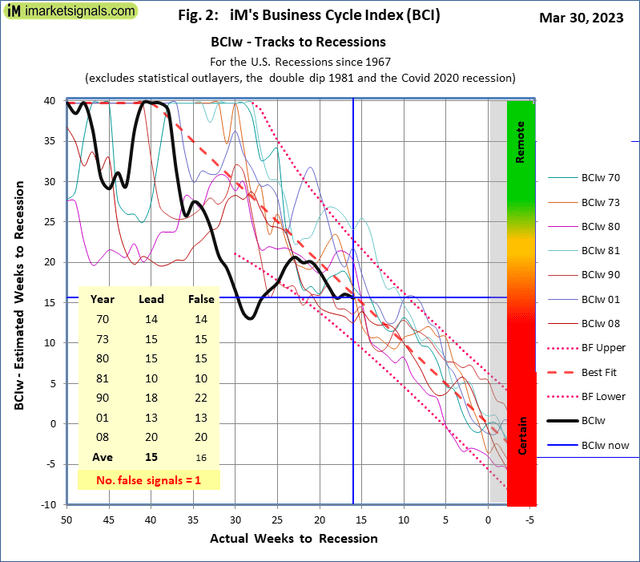

The BCI at 260.2 is close to the earlier week’s stage and equally for BCIp now at 10.5 (see Determine 1, magenta curve) and from previous efficiency a recession is signaled not sooner than 10 weeks however not later than 23 weeks (see Determine 2). BCIg, the six-month smoothed annualized development price of BCI now at 0.5 is beneath the common of the final 4 weeks. (see Determine 1, blue curve). When BCIg crosses zero from the upside, then from previous efficiency, it alerts a recession with a mean lead of 12 weeks.

Determine 1 plots BCIp, BCI, BCIg and the S&P 500 along with the thresholds (crimson strains) that have to be crossed to have the ability to name a recession. Right here we word that BCIp has crossed the 25 threshold firmly to the draw back. Historic knowledge of the previous recession exhibits that at this worth, the financial system by no means recovered to keep away from a recession. (iMarketSignals) Determine 2 plots the BCIw tracks to the previous recession along with the present worth of BCIw with its endpoint on the very best match common worth of the previous recessions (iMarketSignals)

iM’s Enterprise Cycle Index Description

In 2013, we developed our Enterprise Cycle Index from the next fundamental financial knowledge:

10-year treasury yield (each day) 3-month treasury invoice yield (each day) S&P 500 (each day) Continues Claims Seasonally Adjusted (weekly) All Workers: Complete Personal Industries (month-to-month) New homes on the market (month-to-month) New homes offered (month-to-month)

The entire data-set is out there on FRED from 1967 onwards. When combining the parts for the index the “real-time” facet was thought of, i.e., the info was solely included into the index at its publication date and never on the date proven within the sequence.

The BCI by itself doesn’t present recession alerts, however after additional manipulation of the sequence two indicators are extracted that reliably sign looming recessions:

The six-month smoothed annualized development price of an financial sequence is a well-established technique to extract an indicator from the sequence. We use this technique to acquire BCIg (development). Right here BCIg is the calculated development price with 6.0 added to it, which generates, on previous efficiency, a mean 11-week main recession sign when BCIg falls beneath zero. We additionally discovered that the BCI retreats in a well-defined method from its cyclical peak previous to recessions. This allowed the extraction of the choice indicator BCIp (deviation from earlier peak of BCI). Previous efficiency exhibits that on common 20 weeks previous to a recession, the BCIp worth crossed 25 to the draw back. In our 2014 article, iM’s BCIw: A Weeks to Recession Indicator, we present how the BCIp (deviation from earlier peak of BCI) indicator might be remodeled to a BCIw (weeks to subsequent recession) derived from the earlier BCIp tracks to the NBER outlined recession.

The 2 indicators BCIg and BCIp could possibly be used as a promote sign for ETFs that monitor the inventory markets, like SPY, IWV, VTI, and so on., or shares on the whole.

In Desk 1, we report for every recession the pre-recession peak of the S&P 500, the worth on the day of the BCIg sign, and the following lowest worth of the inter-recession trough. From these, we calculate the loss prevented by exiting the market on the day of the BCIg sign.

Desk 1: Loss avoidance in SPY when exiting on BCIg recession warning.

Be aware

1

2

3

4

5

6

7

8

Recession

Peak

Sign

Trough

(P-T)/P

(S-T)/S

(P-T)

(S-T)

(S-T)/(P-T)

Jan-70

106.16

93.24

69.29

36.1%

25.7%

36.87

23.95

65.0%

Dec-73

120.24

103.36

62.28

48.2%

39.7%

57.96

41.08

70.9%

Feb-80

115.2

100.3

98.22

17.1%

2.1%

16.98

2.08

12.2%

Aug-81

140.52

128.64

102.42

27.1%

20.5%

38.1

26.22

68.8%

Aug-90

368.95

332.92

295.46

19.9%

11.3%

73.49

37.46

51.0%

Apr-01

1520.77

1326.82

965.8

36.8%

27.2%

554.97

361.02

65.1%

Jan-08

1565.15

1508.44

676.53

56.8%

55.2%

888.62

831.91

93.6%

Common all recessions

34.6%

25.9%

60.9%

Column Notes:

S&P 500 peak throughout 1-yr interval earlier than recession S&P 500 at iM-BClg sign date S&P 500 trough throughout recession %-Loss from Peak to Trough %-Loss prevented from Sign to Trough Absolute loss from Peak to Trough Absolute loss from Sign to Trough prevented % of loss from Peak to Trough prevented Click on to enlarge

Following the BCIg alerts from our recession indicator, one would have prevented on common about 61% of the full market decline from pre-recession peaks to inter-recession troughs, as indicated within the final column of Desk 2. One can see in column 5 that exiting the market on the sign dates would have prevented losses averaging about 26%. Had one identified the market peak, one might have prevented the 35% common decline as proven in column 4. Previous to the 2008 recession, the exit sign from BCIg occurred virtually when the market peaked.

Determine 3 plots the historical past of BCI, BCIg and the LOG (S&P 500) since July 1967, and Determine 4 plots the historical past of BCIp, i.e., 56 years of historical past, which incorporates eight recessions, every of which the BCIg and BCIp managed to point well timed; the weeks resulting in a recession are indicated on the plots.

iMarketSignals iMarketSignals