Alibaba Group, China’s largest e-commerce firm (with a market capitalisation of over US$270 billion) based by Jack Ma in 1999, provides a wide range of e-commerce providers to fulfill on-line purchasing wants by its on-line platforms Taobao (C2C), Alibaba (B2B) and Tmall (B2C). The corporate has additionally expanded its worldwide presence by international AliExpress and Lazada. The corporate is scheduled to report its third quarter 2022 outcomes earlier than the market opens on Thursday, 23 February.

Home business retail generated probably the most income for the corporate. In Q3 2022, 66% of income got here from Chinese language business retail, whereas 5% got here from worldwide business retail.

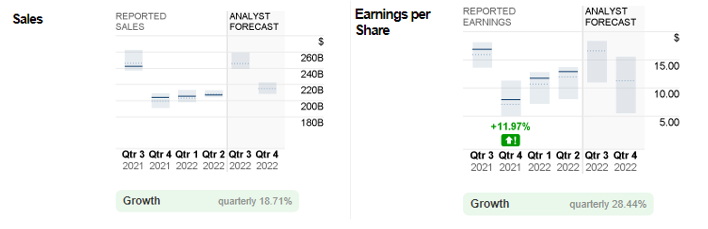

General, Alibaba’s reported gross sales for the primary half of 2022 have been flat (Q1 – $205.6 billion, Q2 – $207.2 billion), dragged down by a large state embargo, strict regulatory insurance policies and the general downturn within the Chinese language economic system. Within the upcoming earnings report, market individuals are optimistic because the Chinese language authorities eases its zero Covid coverage, and so they anticipate the corporate to report gross sales of $245.9 billion, up over 18% YoY and 1.36% QoQ.

Alternatively, EPS was recorded at $11.73 and $12.92 within the first and second quarters respectively. The final expectation for EPS within the subsequent quarter is $16.59, up greater than 28% from the earlier quarter, however down barely by -1.66% from the identical quarter final 12 months.

Trying forward, China’s official approval of Ant Group’s capital growth plan (from RMB8 billion to RMB18.5 billion) is being interpreted by the general public as an indication that the federal government is displaying indicators of easing the regulatory surroundings. This transfer may be useful for different native know-how shares. As well as, the launch of the primary blockchain node service in Q1 2023 might proceed to enhance AliCloud’s competitiveness out there. Within the final quarter, AliCloud’s income grew by 4% in comparison with the identical quarter in 2021. Its Non-Web Business (NII) clients grew by 20% year-on-year and accounted for 58% of its complete cloud income. This reveals that AliCloud is anticipated to develop steadily regardless of having solely a small market share (solely 5%).

Technical Evaluation:

#Alibaba (BABA.s) soared in January this 12 months after a sequence of optimistic information releases, hitting a yearly excessive of $121.15, its highest stage since July 2022. The corporate’s shares have since fallen right into a technical correction and are presently buying and selling 23.6% beneath FR at $106.25. The closest help stage is at $97 (38.2% FR). A profitable break above this stage might encourage extra promoting stress to the 100-day SMA, which intersects FR 50.0% at $89.60. Alternatively, if earnings outcomes are in step with or above market expectations, a rally to resistance at $106.25 after which to the $119.70 – $121.20 space is probably going.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Evaluation

Disclaimer: This materials is supplied as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.